Ever since the iPhone launched four years ago (to the day), the question on everyone’s mind has been: When will Apple expand the portfolio to reach into all market segments? I remember thinking in 2007 whether it would be in six months or a year that they would create a “mini”, “nano” and “classic” line-up which served them so well with the iPod.

Apple however took a different approach. To their credit, they focused on the platform and built a consistent experience around a fixed screen size to nurture an ecosystem. They also improved the power of the device so that experience would improve to be better and more robust. In other words, they treated every iPhone as not being good enough, needful of every megahertz of power, every pixel of screen and every minute of battery life. They polished the OS constantly and added APIs by the thousands.

In other words, they acted like a computer software company, not like a “device vendor” or like a handset manufacturer which was everyone’s (including mine) frame of reference.

Having expanded from iPhone to iOS and built the platform into non-cellular centric computers like iPad and iPod touch, they clearly showed a nonchalance about the operator channel and the amplification power it offers (an amplification which comes with a hefty price of dependency and strategic illusion.)

But the mind always wonders back to the question of portfolio. Now that the product is maturing, the hardware is getting nearly “good enough”. Perhaps even Apple might now consider letting go of the “frontier” of what’s technologically possible and consider expanding its reach to the broader audiences it has willfully kept out of reach.

And broad they are.

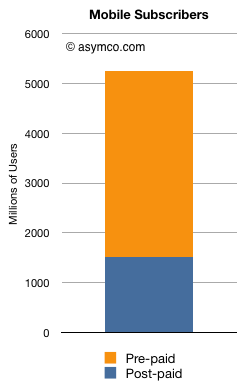

Based on data published by Deutsche Bank and the ITU, we can calculate roughly how many customers Apple’s current iPhone positioning has left unserved. I chose to use pre-paid/post-paid split as a proxy for unaddressed/addressed. This is an imperfect proxy but a pretty good one as most pre-paid subs see a full price for the iPhone (retail around $700 to $1000) vs. post-paid customers seeing a price of $200 or below. The $200 happens to be an important psychological price inflection point where volumes increase dramatically.

The first chart shows the global split between pre-/post-paid subscribers as of 2010. Roughly 1.5 billion are post-paid and 3.7 billion are pre-paid. That means that nearly 70% of the world is not being addressed by the iPhone as it currently stands. Put another way, a shift in positioning might result in a 250% increase in addressable market.

Tim Cook alluded to this in the last conference call when he said pre-paid markets, especially in China, are huge with share figures “starting with a nine“. He also said separately that they would not be ceding any market–a hint if there ever was one, given the broadening of Android into previously feature-phone price bands.[1]

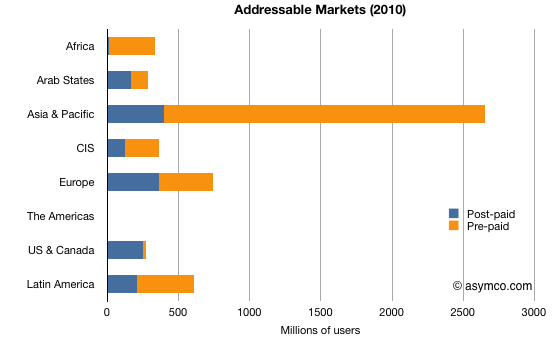

We can even see the situation more clearly on a regional scale. The following chart shows the same pre-/post-paid split by region.

You can visualize the iPhone having spent the last four years penetrating into the blue areas of the chart through the expansion of carrier agreements. With half the US & Canada area being finally filled in this year, most of the blue is now more-or-less within reach.

Given the constraints on production, and given the improvements in the product and the improvements in the hardware (learning curves and price points) it may mean that Apple could finally be turning its attention to those orange areas.

The time may be soon at hand that maturity coupled with limits of organic growth are leading the four-year-old iPhone to finally be re-defined as more than a post-paid skimming entrant. It may be time for the iPhone to more than just grow. It may be time for it to grow up and take on the whole market. Five billion people are waiting.

—

Notes:

- Contrary to a commonly held belief, Apple does not shy away from market share. In the case of the iPod and even the original Apple 2, the company sought and obtained the top share ranking. In fact, the decision to pursue share vs profit is “context sensitive”. Steve Jobs, at least, thinks so.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.