Steve Ballmer stated and Andy Lees confirmed that Microsoft views iPad and other tablets as “just PCs”. From a market measurement point of view Canalys agrees. IDC and Gartner don’t, calling the new devices “media tablets.”

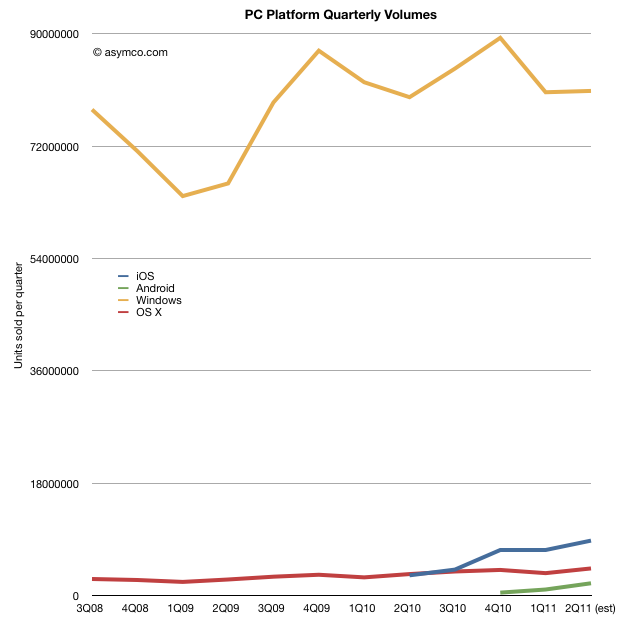

Before deciding whether tablets belong with PCs in market metrics, it would be interesting to look at what the data shows. When seen as a combined market, the focus should be on platforms. The following chart shows the four main PC+tablet platform volumes since late 2008 [1].

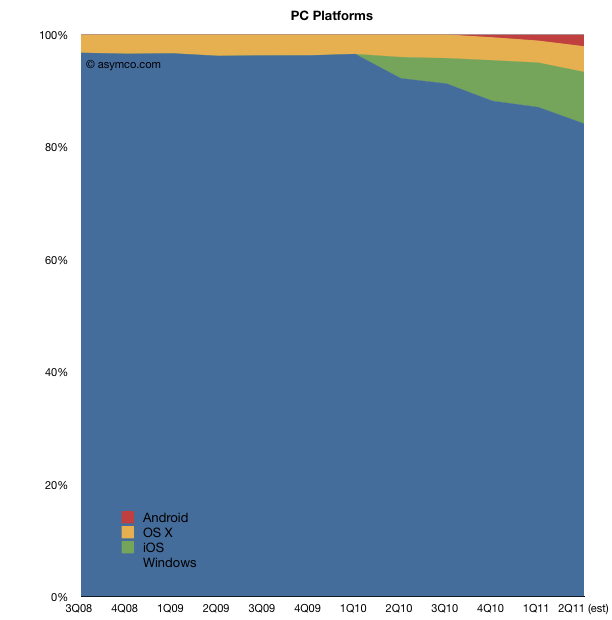

The second chart shows the same data as share of total market:

This comparison allows for some fresh observations:

- Excluding iPads, Apple is very close to being 5th largest global PC vendor. Global share likely to be above 5%. Including iPads, Apple would be 2nd.

- Platform year-on-year growth was Windows: +1.3%, OS X: +26%, iOS: +170%. Android growth cannot yet be measured since Android tablets have not been on the market for more than 1 year.

- In Q2 2011 one million more Windows PCs were sold than in Q2 2010. In same time, 903k more OS X PCs and 5.5 million more iPads.

- Excluding tablets, nearly 50% of the global PC growth was due to the Mac. Including iPad, Apple was responsible for ~70% of the growth in the PC market in Q2.

The picture that emerges is that while Windows continues to be dominant with 84% of units sold in the last quarter, the growth belongs to tablets which captured about 90% of it. If Windows remains marginal on tablets, the “PC market” will likely tip away from Microsoft in two years (depending on how quickly Apple can build iPads.)

Microsoft is making the commitment to move Windows to a tablet form factor but they are doing it while retaining the user interaction model of a desktop. This may or may not work but they are also conceding that a separate experience is also necessary. By rejecting the notion that a mobile OS alone can do the job, they are essentially building a “hybrid” tablet/laptop/desktop product which may be challenging to use but preserve their presence in the form factor.

Whether Microsoft succeeds or not will depend on whether the new form factor is disruptive in more than user experience. In other words whether this is just a “new PC” or a “post-PC”. The argument comes down to business model changes. For example the new model comes with different cycle time of product development (deep, integrated, yearly changes), different ecosystem (apps), different cost structures (high R&D in hardware), vast scale (device economics, components, ramps), and potentially new distribution (operators in the channel mix.)

Summed up, the real challenge for Microsoft is whether they can keep their business model (selling OS licenses to hardware vendors) as PCs become more device-like. Not only is iOS setting the benchmark for performance but Android is potentially ready to take share if the market turns slightly more modular. Microsoft’s differentiation looks to be primarily its legacy of PC software.

It may also seem that much remains to be discovered in this market but I think the main bets have already been made. The PC market as we know it is in the end game.

—

Notes:

- I used Gartner data for overall world-wide PC market and merged it with Mac and iPad data from Apple. Android data is estimated.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.