Thanks to all those who contributed to the big Mac index there is a substantial amount of pricing data available in one location.

The analysis that I hoped to perform on the data was to see if Apple was pricing specific products differently in international markets. It was prompted by some apparently anomalous pricing of the iPhone 4S in Brazil.

To summarize, the idea is to calculate the “expected” price of an Apple product by taking the untaxed US price and adding duties and tariffs and taxes to determine what that product “should” cost in another country. Then taking the difference between this “expected” price and the actual price to determine if Apple is using pricing to signal in a particular market.

The analysis basically eliminates the effect of government on price and leaves currency and actual pricing signals from Apple as variables.

The analysis is not simple because there are many obscure tax rules. Some products are taxed differently in the same country. I have not completed the country-level analysis but have been able to see some averages over the countries reported (total of 45 reports.)

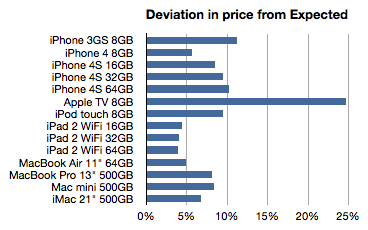

The following chart shows the average deviation from “Expected” as a percent:

Here are some potential interpretations of this data:

- The more a product deviates from expectation (e.g. the Apple TV) the more it’s likely to be targeted to the US or potentially has advantages of scale in the US

- The less of a deviation (nearer to zero, e.g. iPads) the more the international market is interesting to Apple. They are essentially signaling that those products are targeted at wide distribution.

If we take this train of thought it takes us to these conclusions:

- The Apple TV is being “subsidized” in the US. The price is so low there probably because it is benefiting from content sales. This is a compelling argument and it might suggest a strategy for Apple TV closer to that of Amazon’s Kindle than to any of the telecom or computing products Apple sells. This may have significant implications in the pricing of any future “TV” product from Apple.

- The iPhone 3GS seems to be a US-targeted product. Anecdotal evidence shows that the product is not particularly strong selling in international markets. Apple is seemingly not trying to stoke demand with discounting.

- The iPhone as a brand is not tuned to compete on price globally. Indeed, the iPhone 4S is the most “overpriced” product and seems to be premium priced vs. iPhone 4. The iPod touch is also something of a prima donna when it comes to pricing.

- In contrast to the iPhone, the iPad is being positioned through pricing for broad global distribution. This is undoubtedly due to their unlocked nature but there might be some other penetration tactics at play here.

- Macs in general are not priced aggressively internationally. However the Air does seem to be positioned for volume growth (while the mini is not.)

Admittedly, these are quite aggressive conclusions given the limited data. What gives me some confidence in these conclusions is additional circumstantial data. The demand for some products is clearly higher outside the US than others. I believe and this data seems to support the notion that the overall strategy for the iPhone, iPad, Mac and iPod is being tuned for the international markets with some precision.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.