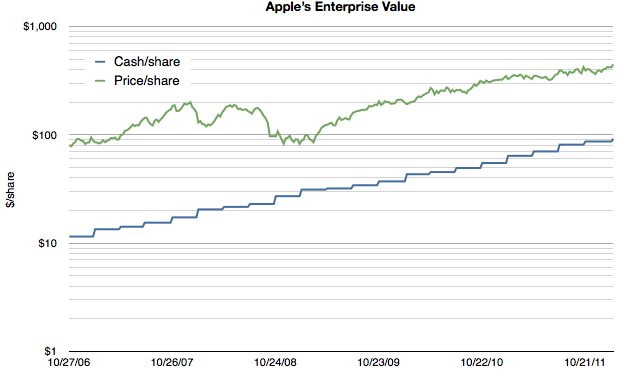

As Apple’s extraordinarily low valuation is being more widely noted, explanatory hypotheses are proliferating. Everyone seems to have an opinion. Some explanations come in and out of fashion. Others are reliable old clichés. We’ve seen liquidity issues with large funds forced to sell, “too much cash”, management transitions, an impending loss of mojo, share price too high to afford, “law of large numbers”, and that old chestnut, competition. None of these satisfy. They don’t explain why reliable growth is not valuable. And reliability is indeed what Apple offers in spades. Consider the following chart:

Note that the scale is logarithmic so that the growth patterns can be seen clearly.

It shows Apple’s cash/share vs its price per share. First, it should be noted that the company’s cash has been growing reliably on a log scale, increasing by a factor of 10 in five years. As a proxy for retained earnings, the cash trajectory shows exceptionally predictable earnings.

Second, although the share price has grown it has not grown either as reliably or as quickly. It’s as if the reward for reliable earnings is a significant dissent.

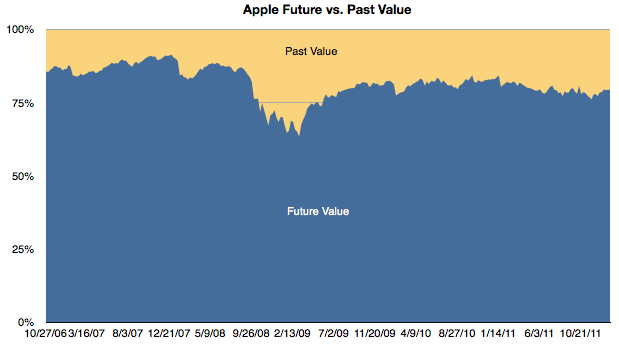

Third, if we subtract the cash/share from the price/share we obtain the enterprise value (EV) per share. The EV reflects the future value built into the price. It reflects the expectation of more earnings. In the chart above one can see the shrinking of the gap as a multiple of the cash value. To bring that gap into focus, I prepared this chart showing the percent of the share price allocated to past value (cash) and future value (EV).

One can see the gradual erosion of emphasis of future value. With the exception of the credit crisis induced equities crash, future value as a percent of total value is at a new low. In late 2006 the future was was about 86% of the share price. At the end of last week it had dropped to 79%.

Another way to interpret this is that in 2007 when the iPhone was born nearly 90% of the business value was thought to be in its future. Today only 80% is future value.

To clarify further, if a company reaches a price where 100% of its value is cash then it’s seen as having no future value. Having any significant portion of the price attached to the past is extremely rare for a growing company and I would say unheard of in a company growing as rapidly as Apple is.

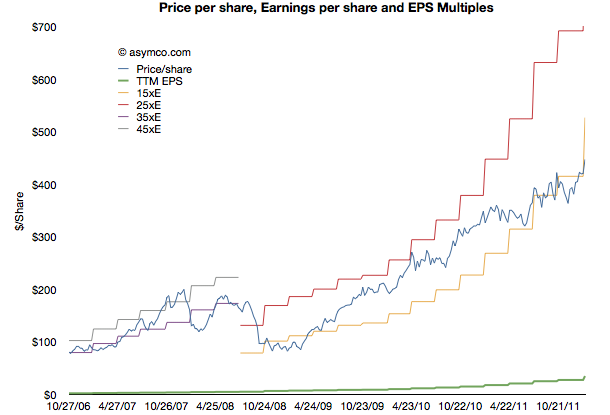

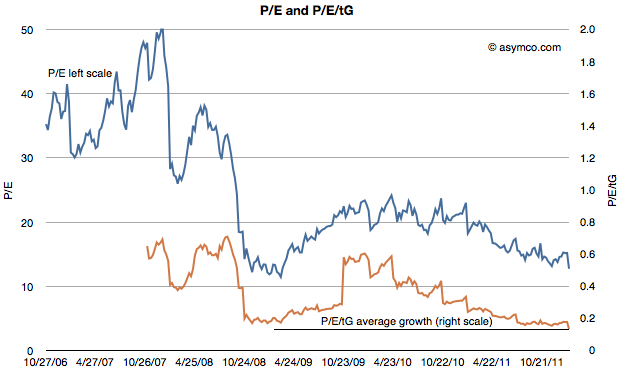

This preoccupation with the past and discomfort with the future is, I believe, the key to understanding the valuation paradox for Apple. I have gone over the conventional metrics of P/E and P/E/G(trailing) that illustrate absurd pricing (updated below). But they don’t help explain the mis-pricing.

A disruptive company is inherently unpredictable. Success and growth are unrewarded because there no understanding of the underlying causes of these phenomena and therefore there is no expectation of repetition.

In other words, a five year dead-straight line of logarithmic growth is not a sign of anything resembling reliability if the underlying causes are not understood. Today Apple is still a mystery wrapped in an enigma and without a causal understanding of its suceess its pricing will remain paradoxical.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.