Last week I made an attempt to measure the iPhone’s manufacturing cost given new data points from the Foxconn field trip. The post generated a great amount of new knowledge and the feedback was very valuable.

The main value to me came from stepping back and looking at the entire cost and value structure for the iPhone. Putting costs into perspective is as valuable as knowing what they are.

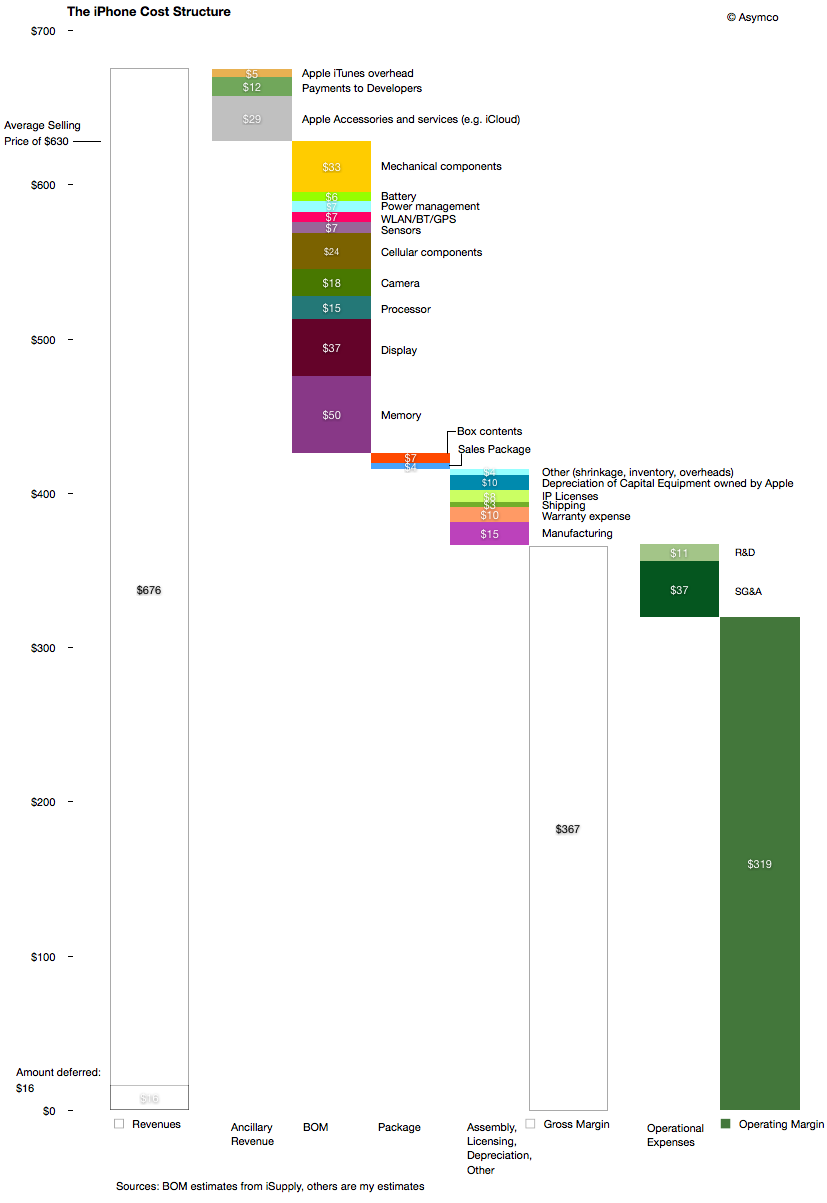

The following diagram shows my estimates for this cost structure for the fourth quarter given both bill of materials estimates and the other parts of the cost of goods sold and operational expenses and even ancillary sources of revenue.

Source for BOM estimate: iSupply.

There are several observations easily made from this view:

- The manufacturing cost ($15 may be very generous i.e. high) but it still amounts to a tiny fraction of the device cost and hence value-add. The direct labor part of that cost is tinier still.

- Depreciation on capital equipment (Apple owned) amounts to $10 per device, probably higher than the direct labor cost.

- External developers as a group receive more app income than the salaries and costs associated with Apple’s own developers working on the product.

- The gross margin percent is 58%.

- The operating margin is estimated at 51%

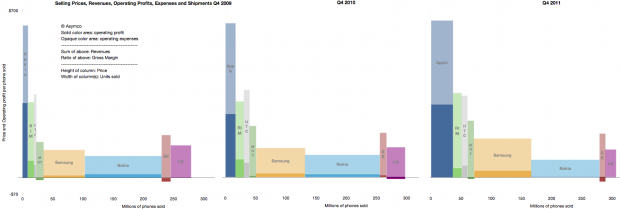

The high margin that the product generates is even more surprising given the industry average as seen in this summary view of the industry’s performance over three years’ fourth quarters.

The operating margin is the ratio of solid colors to the entire bar.

As someone pointed out on twitter: one of these is not like the others.

The question should be: How is this possible? What does this product have that gives it such a pricing advantage? Note the the ratio was preserved through the three years shown and has persisted for nearly five years.

The answer to this paradox is in data that is not visible in any of the diagrams above: The largest revenue attached to the iPhone comes into the mobile network operators. We don’t have global averages but the revenue the iPhone generates over its lifetime is probably two to three times the revenues that Apple directly receives. The ARPU iPhones are attached to allows for a substantial subsidy, but more importantly, loyalty (or churn)

As seen in the small but clearly visible US market, being an operator having iPhone exclusivity generates above-average growth and being the only operator to be excluded from the product generates above average subscriber losses.

It quickly becomes obvious that ranging the iPhone has moved from being an advantage to not doing so becoming a serious disadvantage. The product and its high up-front costs are “hygiene factors” for operators. The sine qua non status means that it can still be priced with the extraordinary built-in margin shown above.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.