With the launch of the Wii console, Nintendo averted disaster. When the Wii launched in late 2006 Nintendo had been facing the simultaneous attack from the “seventh generation” Xbox 360 which launched a year earlier as well as the PlayStation 3, both of which set as their bases of competition 3D graphics at HD resolutions. Many wrote off the company and called the console market a two horse race.

Then, in what seemed a desperate downward leap, the Wii was launched into a different trajectory. It addressed non-consumers with a new, more intuitive controller and standard resolution rather than competing for hardcore gamers with more power and richer graphics.

Because the Wii was asymmetric and addressed non-consumption rather than trying to be a “better” console in what was becoming a horsepower race, Nintendo expanded the console market. Its innovation was interesting enough that many hard core gamers used the console in addition to a PS3 or Xbox and many non-gamers bought it as their first console.

The result is that 95 million Wii’s have been sold vs. 66 million Xbox 360’s and 62 million PS3’s.

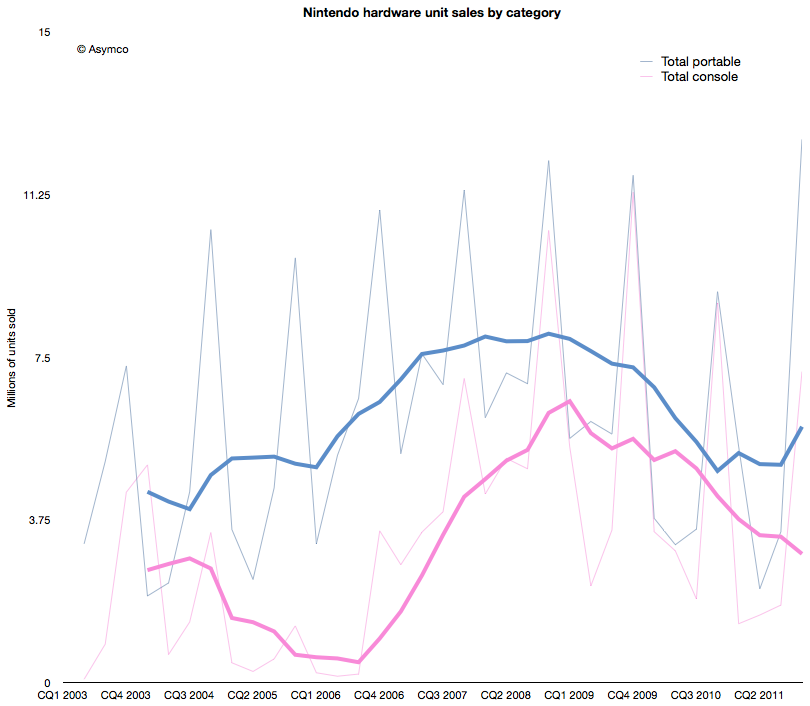

The effect of the Wii introduction on Nintendo’s console unit sales is shown below (pink line).

The graph above shows that the growth from Wii has stopped. In fact, the console has been in decline since early 2009. Fortunately for Nintendo, the company also developed a mobile strategy. Learning from its Game Boy device, its DS series of portable game consoles allowed the company to diversify its portfolio. The graph also shows the total portable units sold in blue.

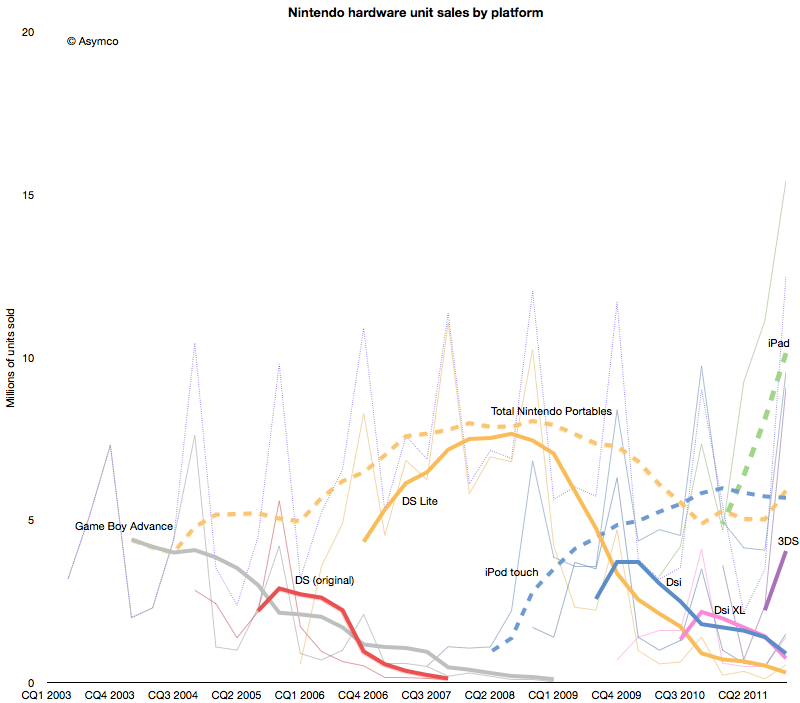

However, this strategy has not been enough to protect the company from the disruptive effect of mobile computing. As the following chart shows, each new generation of portable from Nintendo has failed to break out of a general pattern of overall decline.

Contrast the DS product patterns with the iPod touch and iPad–multi-purpose products whose game functionality is “good enough” but whose communications and general-purpose app catalogs are re-defining the basis of competition yet again.

Nintendo bet on the 3DS to reboot the franchise. The 3DS product does show the characteristic initial spike in adoption but the level it launched at is far lower than the level of the iPad. Nintendo has a big hill to climb to even recover the volumes it held in 2009. In contrast, the usurper Apple’s volumes are doubling each year.

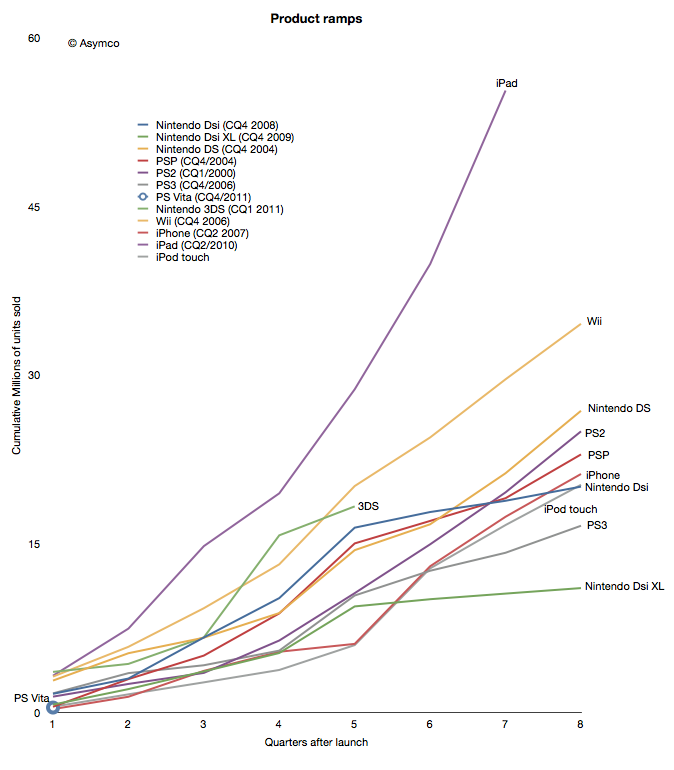

When products are compared as “ramps” in terms of growth post-launch the story becomes even clearer.

Although the iPhone and iPod touch ramped in similar ways[1] to the gaming platforms, iPad took an entirely different path. The 3DS benefited temporarily from a price cut but it seems to be returning to a well-worn trajectory.

The data points a bleak picture for Nintendo. The Wii was a success due to its competitiveness vs. non-consumption of gaming. But another low end disruption took hold in 2007. Good enough games on phones and mobile computers are taking consumption away from dedicated consoles, both fixed and mobile.

In addition, the rate at which game experiences are improving on iOS imply that they will overtake the “quality” of consoles in the not too distant future. Differences in distribution models also guarantee lower pricing for software for end users and enabling a far larger catalog of titles.[2]

This may sound like another story of fortune gained and fortune lost. The inevitable “what goes up must come down” aphorism. We become used to this pattern and assume it to be axiomatic. But there are causes for each success and causes for each failure.

The lesson here is that a company that disrupts does not necessarily survive. Long term survival depends on the ability for serial disruption. Serial disruption is an uncomfortable state for an organization to exist in. As the story above shows, disruptions are usually enabled by “desperate” necessity. Desperation is not something management is trained to aspire for.

What management strives for is steady state satisfaction and predictability from intelligent planning.

—

Notes:

- Though the iPhone ramp matched the consoles, the growth for the iPhone is persisting at 100% y/y five years into the product. This means it is outstripping all console installed bases by at least a factor of 2.

- The catalog is not only broad but deep in the sense that there are many new game concepts and experiments being tried. The app store is a vast testbed for game and entertainment ideas.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.