Did I get anything right in last forecast?

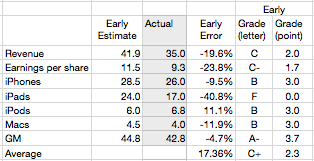

The table below shows the scores for my various estimates[1]

Last quarter I managed a B+ overall but this quarter was a C+. The iPad estimate was a complete failure mitigated slightly by a, directionally at least, correct call on the iPhone. The failure on iPad dragged down revenue and EPS while the accuracy on iPhone improved the gross margin. iPod and Mac estimates were consistent with recent performance.

The error on iPad is a harsh lesson which shows how the category is still unpredictable. With only four quarters where we could measure y/y growth, and with those quarters showing 183%, 166%, 111% and 151% growth, I assumed that the 150% growth was sustainable.

That turned out not to be the case. The iPad slowed to 84% unit growth and 51% revenue growth. It’s perhaps unrealistic to expect 150% growth for more than one year. This is the main learning for the quarter and I will adjust my expectations accordingly. Overall, the product has sold 84 million units since launching in early 2010. I now expect it will sell approximately 80 million this year and 150 million units in 2013.

—

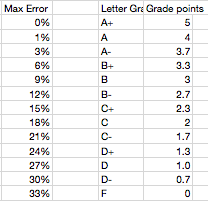

Note: Grading algorithm is based on this table:

Discover more from Asymco

Subscribe to get the latest posts sent to your email.