During the fourth quarter 2012 Apple’s margin fell to about 38%, a level not seen since two years earlier and down from a peak of 47% in Q1 2012. Does this lower margin foretell lower prices or a loss of competitiveness?

Obviously not.

Gross margin is a function of Sales (aka revenues) and Cost of Sales. Gross margin as a percent is calculated with the following formula: (Sales-Cost of Sales)/Sales. If dealing with a single product, Sales itself is the product of shipments and price/unit but since cost of sales is also a product of shipments and cost per unit, the shipments numbers cancel each other out and the gross margin reduces to the ratio of (Price-Cost)/Price.

So a margin drop can only be caused if one of three things happened:

- Prices dropped

- Costs increased

- Both prices dropped and costs increased.

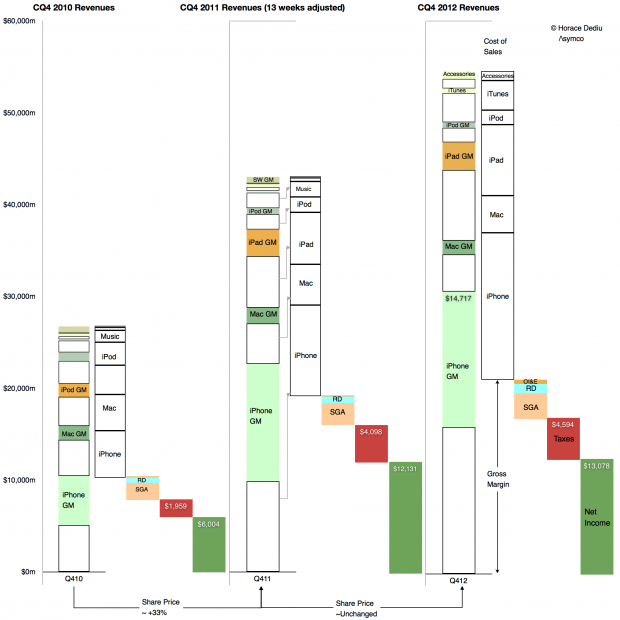

We can easily find out which of these was the cause in the fourth quarter because we have volumes and prices for all of Apple’s products. We can also derive total costs based a total gross margin. These are illustrated in the following retina-friendly diagram.

The diagram shows Revenues, cost of Sales, Operating expenses, Taxes and Net Income relative to each other for the fourth quarters of 2010, 2011 and 2012. Of interest is the difference between 2011 and 2012. Note how the 2012 Gross Margin (absolute, not as a percent, identified with the arrow) did not change much from the year before. As Taxes and Operating Expenses did not change much either, the earnings were quite flat y/y.

However note also that total sales increased quite a bit. As the gross margin (absolute) remained steady and sales increased the margin as a percent fell. But the cause is that cost of sales also increased. They increased faster than sales increased.

Relative to adjusted 4th quarter 2011 Sales increased by 27% while Cost of Sales increased by 30.5%. Margins shrank in late 2012 because the products were more expensive to make.

It’s simple arithmetic.

We can at a glance see that the cost of sales increased as a proportion of sales. Therefore the margin decreased as a percent of sales. The cause is higher costs, not lower pricing.

In fact, pricing analysis was already performed and showed that they largely held steady (iPad being the only decline). If pricing is unchanged then competitive issues are not to blame. The supposed link between lower margins and some mythical loss of competitiveness can be easily disproved.

But there’s more.

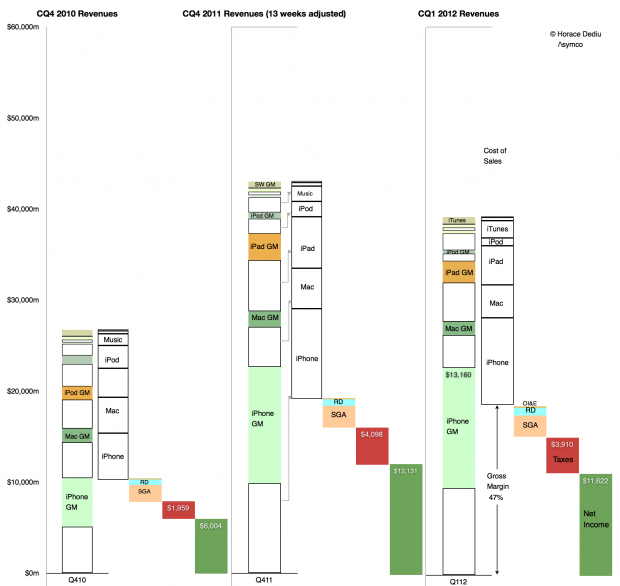

There is an easily observed cause to changes in production costs. Consider the opposite effect in the sequential change from the fourth quarter of 2011 to the first quarter of 2012:

Here we can see how sequentially sales fell but gross margins rose. Again, the change in absolute Gross Margin was slight but the reduction in cost of sales was out of proportion of the reduction in sales. Cost of sales fell by 13% while sales fell by 9%. The result was an increase in gross margin from 45% to 47%. The cause was that the cost of production fell.

Obviously. Because, as everyone knows, costs of production fall as output increases. It’s due to something called the learning curve. It’s something that has happened for all of Apple’s (or anyone else’s) product launches forever.

What is not obvious is the effect this has on the share price whose changes are shown at the bottom of the first diagram. It’s a case where one margin’s fall has caused quite a few margin calls.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.