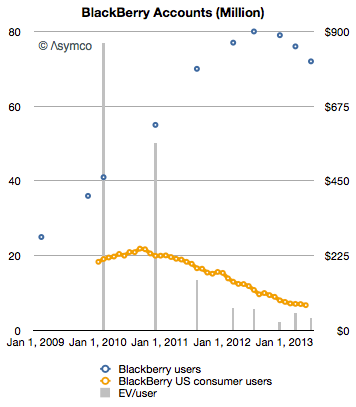

Last week BlackBerry announced that it had 72 million subscriber accounts. The current market capitalization is $5.4 billion and enterprise value (i.e. excluding net cash) is about $2.8 billion.

That implies a net present value of about $40 for each account. This is quite a drop from early 2010 when the value was $866.

The graph of BlackBerry subscriber accounts and EV/account is shown below:

I’ve also added a graph showing a derived value of US consumer BlackBerry users (derived from comScore’s survey data).

There are several patterns which intrigue me:

First, the peak in US consumption seems to have happened about two years prior to global peak (lending credence to the notion that the US is a smartphone market “crucible”.)

Second, that the collapse in value per user occurred in advance to the peak in users. This is, of course, linked to other user base leading indicators such as device sales momentum. But the drop indicates that there was no perceived value in the BlackBerry install base to begin with. As devices went, so did the company.

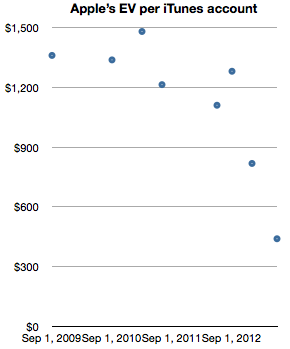

Third, this same lack of perceived value seems to be present within the Apple ecosystem (see below), where user value was cut to a third within a few months

.

In the case of RIM/BlackBerry, the drop in value per user accurately foretold the drop in user base. Does the drop in value per user for Apple foretell a reduction in users?

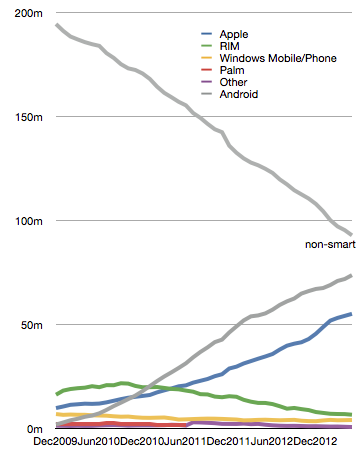

So far, iOS user base (as proxied by iTunes accounts) continues to expand, even in the US.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.