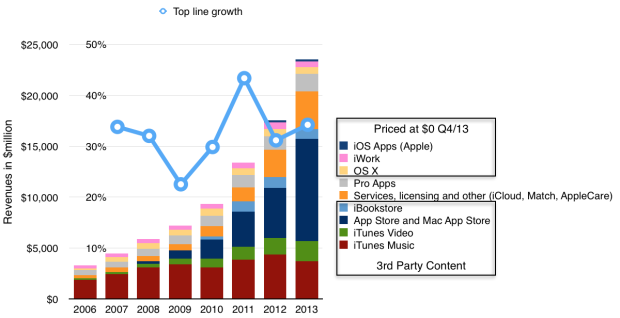

The increase in net sales of iTunes, Software and Services in the first quarter of 2014 compared to the first quarter of 2013 was due to growth in net sales from the iTunes Store, AppleCare and licensing. The iTunes Store generated a total of $2.4 billion in net sales during the first quarter of 2014 versus $2.1 billion during the first quarter of 2013. Growth in the iTunes Store, which includes the App Store, the Mac App Store and the iBooks Store, was driven by increases in revenue from App sales reflecting continued growth in the installed base of iOS devices and the expansion in the number of third-party iOS Apps available. Net sales of digital content, including music, movies, TV shows and books, from the iTunes Store was relatively flat in the first quarter of 2014 compared to the first quarter of 2013.

Apple Inc. Form 10-Q.

During the last quarter Apple changed the pricing for iWork and OS X to zero1.

I estimate the net effect to have been a reduction in revenues from those software titles of about $350 million for the quarter. Nevertheless, increases in services and app revenues means that the iTunes total reported revenues increased to a new record.

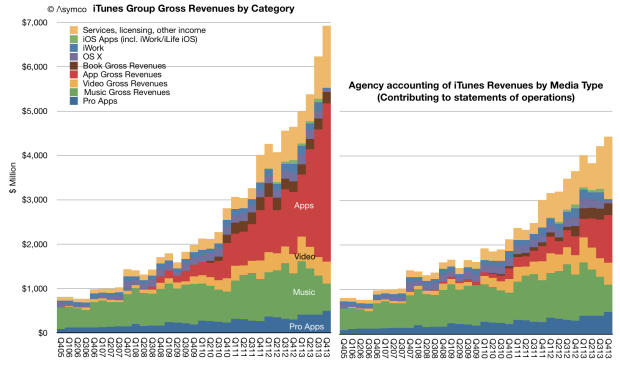

The total with estimated contributions by media and service components is shown below right.

Note that revenues do not reflect total billings. As Apple reports only the 30% of App transaction values, the full iTunes/Software/Services transaction values are shown in the above graph on the left.

The “gross” revenues are now nearly $7 billion per quarter. On a yearly basis the iTunes/Software/Services group had gross revenues of $23.5 billion with growth of 34% y/y.

Other estimates for full year 2013 growth are:

- Third party content +46.6%.

- Music downloads -14%

- Video +19%

- Apps +105%

- Books -9%

- Services +37%

- Pro apps +29%

- OS X -8%

- iWork and iLife -8%

Although iTunes/Software/Services are not usually included in a “sum-of-the-parts” total contributing to Apple’s overall enterprise value, the scale of volume and value of transactions is becoming harder to ignore.

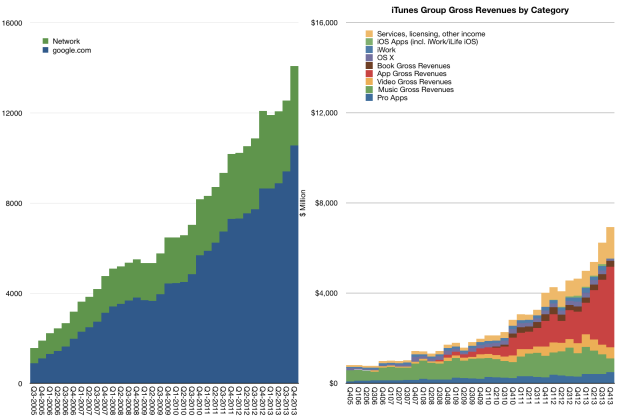

To illustrate this, I plotted the history of gross iTunes revenues vs. Google’s search business2

On a yearly basis iTunes/Software/Services is nearly half of Google’s core business and growing slightly faster.

The iTunes “empire” of content and services would be ranked as number 130 in the Fortune 500 ranking of companies (slightly below Alcoa and above Eli Lilly).

- OS X server is still priced at $20 and iWork for previously unlicensed devices and computers is still priced above $0 [↩]

- Excludes Motorola and “Other” segments as reported by Google [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.