During the latest shareholder meeting Tim Cook revealed that Apple TV sales were above $1 billion in the last fiscal year (ending September 2013). The company later clarified that this figure includes device and content sales.

This poses a problem. In previous statements the company cited device (unit) shipments rather than value. The statements made to date suggested that cumulative volume of 3rd (current) generation Apple TV totaled 6 million units as of January 1, 2013.

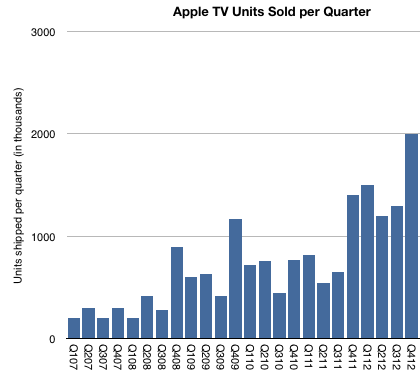

The following graph includes an estimate of quarterly Apple TV sales based on comments made to date.

As there were no additional comments during 2013, the “Billion Dollar” quote is all we have to go with for the year. The problem with trying to separate content from hardware is complicated by several factors:

- How are we to attach content revenues to Apple TV? For example, what if I purchase a series of shows on iTunes or an iPhone and decide to watch them on my Apple TV. Do these purchases count as being “attached” to Apple TV? Do we attach the full transaction value or do we attach the portion that Apple keeps (as in agency accounting)?

- How does Apple account for channel placement on Apple TV? Do the channels prominently displayed on its user interface pay for this access (even though the user needs a cable subscription?) Is this the primary source of content revenue that is attributed to Apple TV?

- What about Netflix, YouTube, etc? What is the content licensing deal with these channels? Does the Netflix channel actually cause an Apple TV purchase or does the Apple TV purchase cause a Netflix subscription?

- Without content, one might think that the $1 billion revenue would yield total device shipments approximately 10 million units in fiscal 2013 (assuming $99 unit pricing). This is not quite right however as Apple’s revenue per unit is unlikely to be $99 unless all units are sold through its own retail stores (including online). Sales through other retailers probably allow for some retailer margin so Apple’s average selling price will be below $99.

- Another question is the fiscal year accounting. We have visibility into the fourth quarter of 2012 (about 2 million units est.) so we only need to fill in the first three calendar quarters of 2013 to understand the Billion Dollar volume.

- Finally, I already estimate separately the overall video market (in my iTunes Business Report) which, based on historic data and other inferences suggests a total video content gross (contributing to iTunes revenues) of $1.8 billion for the fiscal quarter. If a significant portion (50%) of this were allocated to Apple TV it would imply that the hardware business contracted sharply in 2013. Put another way, if I add what we know about C2012 units (6 million and an ASP of $89) to what I estimate video content revenues to have been in 2012 ($1.6 billion) I get a $2.1 billion business. This would be a “two billion dollar” business in 2012.

All this makes the Billion Dollar Hobby a puzzle. The way I can make it square with existing assumptions is by saying that “Apple TV content revenues” are mostly, if not entirely, distribution revenues from channel placement rather than iTunes purchases.1 As a result, my best guess now is that there were about 7.6 million Apple TVs sold in fiscal 2013, with a bit over 8 million for calendar 2013.

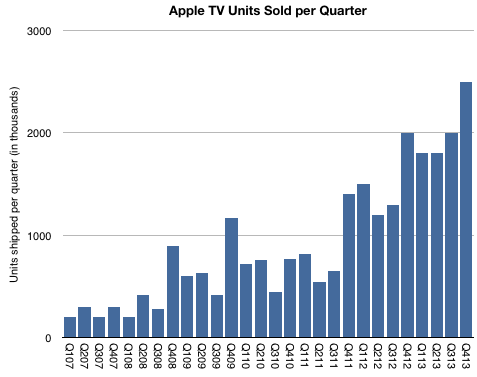

If I’m right, the complete history of the shipments would be similar to this graph:

By Apple standards this is indeed a modest story. The total units sold would add up to more than 25 million units with healthy growth. But it would not be in the same magnitude as other iOS devices which have so far sold 800 million units.

More important than this picture however, or the Billion Dollar Business threshold, would be a better understanding of how Apple sees Apple TV as a business. We already knew that it was a low value hardware business. I even suggested that it’s “Apple’s equivalent of the Kindle”: Hardware sold at low margins as a gateway for a high volume content business (iTunes). The problem with that model is that selling other people’s content is never a good margin business. If it were to be sustained, Kindle may ultimately have to become an Amazon Prime salesman.

So that leaves the Apple TV as a product without a satisfactory business model. Unsatisfactory, at least, to Apple’s standards; hence the hobby label. But what if the model is turning out to be a platform for discovery of content and therefore the equivalent of (dare I say it?) a portal!2 The TV UI certainly limits search or traditional browsing interaction but it enables eye candy for a few choice placed offers. It is a low interaction model. Think of how the prevailing UI for TV for decades has been that of pressing one button repeatedly, also known as channel surfing.

If so , the business of Apple TV may be the auctioning of the real estate on the landing page. In some ways this is how iTunes is already behaving by “featuring” exclusive music content.

There are all sorts of implications, which I will leave as an exercise to the reader.

- This revenue will end up in licensing/other revenues in iTunes/Software/Services segment and separate from Apple TV (which is a part of Accessories). [↩]

- Exclamation point. [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.