New market disruptions take root in non-consuming contexts. For instance, mobile phone photography began not because early phone cameras were good. They weren’t good at all but good enough when a camera was not within reach. The quality was poor but the photo taken would not have otherwise been taken, making a lousy photo better than no photo.

The result is that the total number of photos taken this year will be ten times higher than the total number of photos taken before the advent of mobile phone cameras.1

This rush to use the phone as a camera has meant that phone makers are keen to improve their product (so as to compete effectively with it against each other) and as a consequence they overtake the incumbent camera makers in quality as well as quantity.

The same phenomenon was experienced by fixed component “Hi-Fi” audio products. The quality of mobile music was poor but it was convenient and convenience translated into consumption and consumption translated into quality improvement and eventually the evaporation of usage of the traditional category.

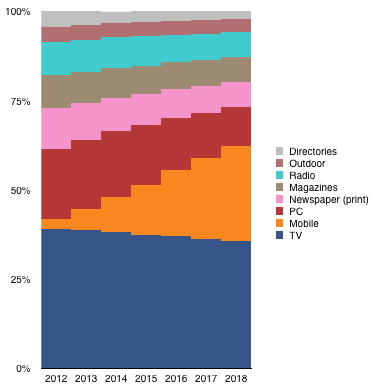

Now consider how ad dollars are getting spent. The following chart shows the eMarketer forecast for ad spending mix across different media in the US.

It would appear that the “Mobile” media is competing effectively against the other media types, especially the non-Mobile digital (i.e. PC-based experiences).

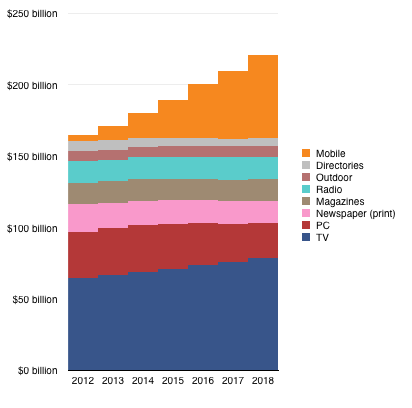

However, if we look at the absolute spending forecast the picture shows that Mobile is responsible for most of the growth in the overall spending.

In other words, Mobile is creating new consumption of ad spending. If the forecast is correct, it suggests that if Mobile was not an option, ad spending would probably remain flat.

Mobile is capturing all the growth but it’s also the creator of this growth. The reason for this is that people are consuming mobile (i.e. looking at their device screens) more without necessarily looking at other media much less. Mobile is effectively creating consumption and therefore competing effectively against non-consumption.

Nielsen data backs this up by also citing that user “app time” on devices increased from 18 hours and 18 minutes per month in late 2011 to 30 hours and 15 minutes in late 2013.

That’s a lot of screen time which results in a lot more “inventory” of valuable ad space becoming available. Of course the ad buyers will buy the inventory. The value it provides is clear and they will increase their budgets to accommodate it.2

Note that mobile phone makers did not set out to punish newsprint manufacturers. They did not set out to cause suffering for Canon or Nikon. They did not build devices to crush JVC and Pioneer or the myriad of music, photo, and print industry participants. They just wanted to make better phones.

Because they focused on a job to be done that was not done well by alternative products they created consumption. They then used that additional consumption to expand into obvious adjacent use cases. The result was disruptive.

There was no escape for the incumbents. The approach of making a camera into a phone would be doomed as would making an amplifier into an iPod. The outside entrant approach was the only way to “pivot” if such a pivot was even thought desirable.

This is why non-consumption is such a difficult competitor to those in the business of serving consumers and a pushover for those in the business of doing something else altogether.

- The total number of photos taken in 2014 is likely to be around 880 billion. Prior to 2000 the total number of photos ever taken is estimated at 85 billion. [↩]

- Note that the PC does suffer a decline in ad spending but it’s not nearly as much ($8.5 billion drop) as Mobile’s gain ($54 billion gain) [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.