On July 3rd, Elon Musk handed over the first 30 Model 3s and tweeted

“Production grows exponentially, so Aug should be 100 cars and Sept above 1500.”

He added,

“Looks like we can reach 20,000 Model 3 cars per month in Dec”.

In 2016 he stated

“So as a rough guess, I would say we would aim to produce 100,000 to 200,000 Model 3s in the second half of [2017]. That’s my expectation right now.”

He confirmed this estimate early in 2017

“Our Model 3 program is on track to start limited vehicle production in July and to steadily ramp production to exceed 5,000 vehicles per week at some point in the fourth quarter and 10,000 vehicles per week at some point in 2018.”

Overall 2018 production guidance has been 500,000 units and 1,000,000 units in 2020.

The company shipped 220 Model 3s in the July, August and September months. This is well below the expectation of 75,000 that the 2016 guidance would suggest1 or the 1,630 that might be suggested by the “production grows exponentially” July proclamation.

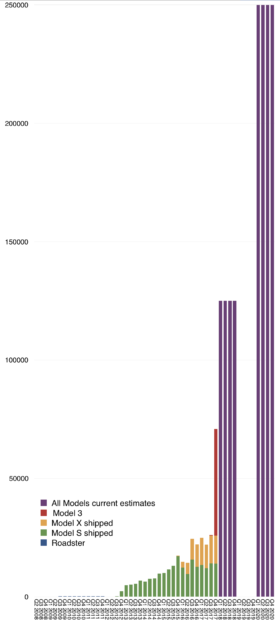

I entered the Q3 production data and kept the previous run rate predictions for Q4 and 2018 and 2020 in the following graph.

Note that the graph includes all previous shipments of Tesla cars throughout its history.

The red bar represents an estimate consisting of the sum of 10,000 Model 3 in October, 15,000 in November and 20,000 in December. This is consistent with reaching the target production of 20,000 in December.

The purple bars are distributing the planned production evenly throughout the 2018 and 2020 calendar years.

Before asking whether these predictions can be relied upon, I’d like to focus on the history of Model S and X production/shipments. Specifically the last five quarters.

- Q3 2016: 24,500

- Q4 2016: 22,200

- Q1 2017: 25,000

- Q2 2017: 22,900

- Q3 2017: 25,930

- Q4 2017: 25,8452

Growth in this total figure has been remarkably low. Only about 4% y/y in the last quarter and sequentially the total has bounced in a narrow range.

This level (about 24,000 units/quarter on average) is a distinct plateau but it’s also well above the average of the previous 4 quarters of about 15,000 units/quarter. It suggests that there was a “quantum leap” in production at the end of 2016, to a new plateau.

So the question is why, with so much pressure to produce cars to meet presumed unlimited demand, is output so limited?

To see just how limited, consider the rate of output. For the past 15 months and near future, the output is equivalent to 264 cars per day. If the Fremont factory is running three shifts, 11 cars are produced every hour. This is equivalent to a cycle time or takt time of 5.5 minutes.

This would be an tragic cycle time. Most car lines aim for run times between 1 and 2 minutes per station. For example BMW’s Spartanburg plant produces 1400 units per day which yields a cycle time of 1 min.3

This measure of performance is so important that it drives the depreciation and capitalization schedule for tooling and the very lifeblood of the company: capital expenditures. An underutilized factory is a giant hole in a financial statement and destroys value as much as inventory does. Every manufacturer strives for maximum utilization and is sunk if it does not achieve a minimum threshold.

So why, after a few years of Model S production, is Tesla running at one fifth the speed of a BMW or Toyota plant? One obvious answer is that the company is not running 3 shifts but perhaps 2 or even 1. But why would they shut down the line when demand is infinite? If it is finite, is it really only 25k at most per quarter? That’s a paltry number considering the size of the market they operate in. BMW alone ships 2 million vehicles a year. Tesla X/S topping out at 100k a year suggests a serious limit to their opportunity.

Another possible explanation is that there aren’t sufficient battery deliveries for continuous production. We hear about issues with battery throughput as transients that slow production. But the production data we have spans an 18 month period during which the speed has hardly budged. During this time additional battery capacity in the form of a Gigafactory has been announced.

If this giant new factory can’t reliably deliver batteries for 25k cars/quarter then how are we to believe that it can deliver for 125k units in a few months? If it’s not batteries, then what? I don’t know of other subsystems that are chronically constrained that we can point a finger at. Almost all other parts in a Tesla are sourced from existing supply chains.

The most likely suspect is that Tesla’s S/X line is not fully operational. When you study production lines, generally they either work at a decent clip or they don’t work at all. They are not designed to be dialed down to be as slow as 5 min for every 10 feet of car. It’s much more likely that the line is idle for long periods of time. Perhaps even 2/3 of the time.

This is what is so mystifying about Tesla’s exuberant predictions for the Model 3. The X/S line is bogged down and inefficient five years after production start but we are to believe that the Model 3 line will come to operate at >5x speed within weeks, on a new product? Maybe the X/S line is a failed experiment. Maybe the company is moving to “Version 2” and leaving the cruft in Version 1 without fixing it.

Maybe.

Tesla’s asymmetric approach to automobile product development and distribution and ownership experience are key advantages but their asymmetry to functioning best practice production systems is a key disadvantage. The big competitive question is will incumbents get good at intelligent EV experiences faster than Tesla gets good at production.

Outsiders might ask “How hard can car building be?” and vote for Tesla winning this race.

There is no data on how fast an incumbent learns the EV experience delivery process, as it’s never been tried before, but there is data on how fast a manufacturing company learns lean production. Those times were measured in decades.

[UPDATE]

In the week that followed this post new claims have been made on Tesla’s production system by other publications.

- Wards Auto published a story on problems with automating the Model 3 production line.

- Wall Street Journal published a story on claims that Model 3 production was constrained by hand-building on parts of the line.

- Edward Niedermeyer wrote in the Daily Kanban about regulatory documents that show limitations in production of the Model 3.

The most relevant quote to this post is the Wards claim that:

Its current production line in Fremont, CA, can’t build vehicles at [5,000 weekly] rate unless it runs two 10-hour shifts seven days a week, which is not likely for an all-new vehicle, even if everything goes smoothly. The plant presently runs two 8-hour shifts five days a week.

If this is true then the current Model S/X line is limited to about 50% of capacity or about 25 cars/working hour. This is equivalent to a takt time of 2.4 min/station. This is certainly much better than the estimated 5.5 and within a range of reasonableness, but one has to ask why is the line not operating more than half the time?

When I wrote about there being “infinite demand” for the X/S, the logic was that the X/S was still a niche product at 100k/yr and the category into which is sells is assumed to have a lot more headroom for their entry.

The observation that production is topping at 50% capacity for 18 months in a market that is quickly being targeted by competitors remains interesting to me.

- 100,000 to 200,000 for the second half of 2017 suggests an average of 150,000 for the six months or 75,000 per quarter [↩]

- This is an estimate based on another point of guidance: 100,000 models X and S for the 2017 year. [↩]

- This assumes one line. The chassis/engine marriage step is clocked at 3 minutes so the worst case is that there are three lines running at 3 min. cycle time each. [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.