The Apple product line-up for 2023 is almost completely decided. This is not conjecture but simply an observation of the lead times for developing the types of products that Apple offers. The integration of hardware, software and services, often cited as the key to Apple’s sustainable competitive advantage, has a great cost: the time required to develop in an integrated fashion is far longer than the time required to develop in a modular fashion.

2.5 years is not a long time. The development process on truly new products could take 4 to 5 years. Apple Silicon, new Operating Systems and new services could all take longer than 2.5 years. The products we just saw launch this year were planned and engineered at least 2 years ago. The more integrated, the more time is needed. Wearables, AI/ML and process engineering are additional examples of long arcs of development needed to reach products.

This does not mean we can predict what these products will be. We don’t have visibility to the process but Apple management does and they will make decisions now on adjacent dependencies in the business. For example, visible efforts in planning the use of cash, the carbon offsetting, capital expenditures and R&D are all synchronized to the roadmap and hints may be read into this data.

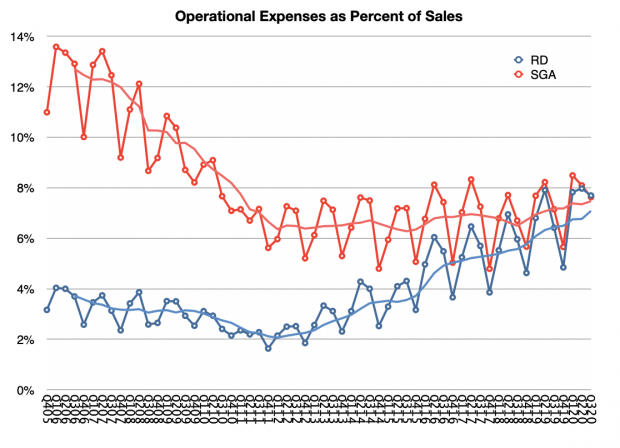

The biggest hints are the R&D spending and the company’s capital return program. Combined they show a confidence in the roadmap that is hard to overestimate. First, R&D is reaching new highs of about 7% of sales (on a trailing 12 months’ basis, see graph below). This is almost the same as the spending on SG&A which has declined as a percent of sales from above 12% pre-iPhone.

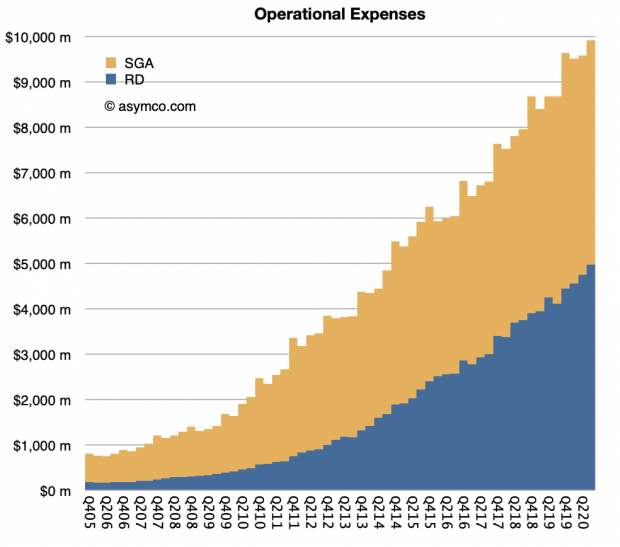

Of course sales have increased significantly over the time shown in the graph below and the absolute spending is shown the following graph. R&D spending is over $5 billion/quarter or about $20 billion/yr. Some of the results of this will be seen in 2023 or beyond.

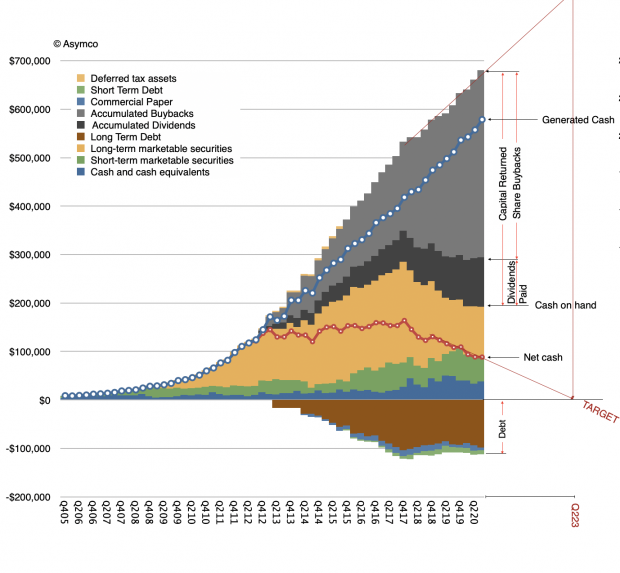

Next, capital returns. The company is returning almost all the cash it generates and is reducing its cash balance. It has returned about half a trillion dollars to date. Dividends paid has reached $100 billion and share buybacks about $400 billion. This is the largest capital return in US history.

The company has declared its intention to reduce net cash to zero. This means it will still have substantial cash due to loans in the form of bonds but no “excess” cash will be held by the company. This is in contrast to the strategy under Steve Jobs where he sought to keep as much cash on hand as possible due to the need to weather potential storms, Tim Cook’s Apple is being very “casual” about cash.

Steve Jobs had his reasons for hoarding cash. The company had been through periods of existential crisis. The absence of cash jeopardized its independence and it was something he vowed never to happen again.

However if that strategy would be maintained to this day, as the graph shows, the company would have cash of nearly $700 billion today. It would make Apple the world’s largest hedge fund, by far. Second only to a very few sovereign funds. Given a conservative cash preservation mandate it also means that that capital would largely go unrewarded because the return on it would have been minimal, negligible. Not to mention also the target it would paint on the company’s balance sheet.

So given the trajectory in net cash being so consistent, it’s probable that the goal of net zero will be reached mid 2023.

That leaves the question of what will happen at that time?

The answer is nothing. Nothing will happen. The capital return programs will probably be ended and additional cash generation will be paid as dividends going forward. That’s it.

Rather than suggesting a change, the capital return program (and the R&D program) suggest a lack of change, consistency. The company management is anticipating a steady capital generation rate, a steady product roadmap (with predictable growth) and a steady customer base (with predictable loyalty).

This future for Apple in 2023 may seem boring. But that’s exactly the plan. This is a plan that the company management has been making for a long time and has been executing for a long time. The plan is to be boring on the business side but exciting on the customer product side.

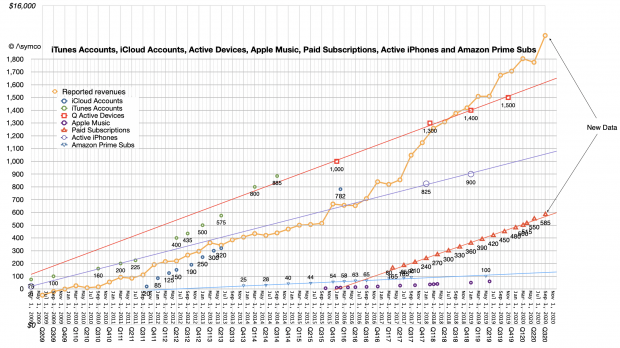

Consistency has been the characteristic trait of the Tim Cook era. It is a smoothing of seasonality with services. It is the clockwork delivery of product updates, regardless of macro and externalities. It is a growth in user base consistent for a decade.

It is perhaps because more people believe that consistency is the future that we have Apple’s P/E ratio now in-line with its peers. Paradoxically, being boring is what makes Apple shares so exciting today.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.