Apple Reports Third Quarter Results.

I was surprised by the poor predictions of Mac units by the analyst community with estimates ranging from 2.86 million to 3.51. It was fairly clear to me early in the quarter that the product would get 30%+ growth. There was little news except overall Mac momentum to shape the forecast and it seemed logical that the growth would stay inline with the last quarter which was 32.8%. I dialed in 33% after the first month and stuck with this so my forecast came out to 3.46 million.

In the event, 3.472 million were sold for a growth of 33.4%. The ASP came in at $1,267, slightly down from $1,278 last quarter and $1,289 the year before. ASPs are eroding but Apple are holding the rate down with product updates. Looking forward, I’m forecast $1,300 ASP.

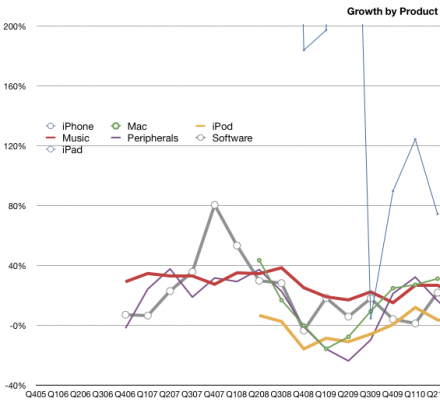

I estimate gross margin for the Mac at 27%. This is down from 31% a year ago. Revenue growth year-on-year was 31%. The Mac franchise is still doing better than most PC vendors and is gaining share. The graph below shows the growth by product revenues. The Mac is now the second fastest grower after the iPhone (the iPad is not included yet as these are y/y growth rates.)

Discover more from Asymco

Subscribe to get the latest posts sent to your email.