Apple’s valuation has been discussed several times on Asymco. Apple’s relative valuation in terms of P/E ratio has not improved since the recession despite an acceleration in financial performance. As Apple seems to be getting punished for growth, we have to also ask if it is the only one.

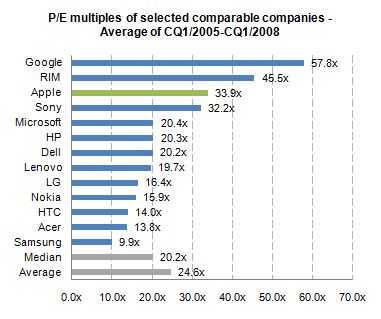

When looking at valuation from an institutional investor or financial analyst point of view, the most common methodologies are discounted cash flow (DCF) as well as comparable company multiples. Most often, a DCF valuation is performed and cross-checked with comparable multiples. The justification for using comparable companies is the exposure to the same market dynamics including, for instance, market growth and profitability. So to understand this perspective, let us focus on a peer group valuation by looking at the average P/E multiples[1] for the calendar quarters 1/2005 to 1/2008[2].

We can see that before the financial crisis Apple has been valued above the peer group average with a P/E ratio of 33.9x.

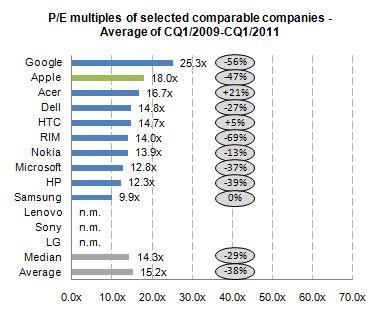

During the financial crisis stock prices declined across industries. For the selected companies share prices declined on average more than 80%. One would assume that with the improved industry outlook and worldwide recovery since 2009, peer group multiples should return to pre-crisis levels. By looking at the average P/E multiples for the calendar quarters 1/2009 to 1/2011, we can derive the change in relative valuation levels.

The data shows that, on average, all companies are continuously trading almost 40% lower for a two year period after the financial crisis. Despite Apple’s higher-than-average discount of 47% to pre-crisis valuation level, Apple is valued above the peer group average and on top of the mobile phone and PC vendor group.

By using the comparable company valuation approach, we are able to see how institutional investors analyze and value Apple. The analysis points to a valuation paradigm shift affecting not only Apple, but many comparable companies post financial crisis. In addition, there was a premium on Apple’s valuation before crisis and there is a premium after the crisis.

The notion that Apple has been single-handedly punished by the market does not hold in the context of comparable companies.

The next step will be to determine if the P/E premium for Apple is consistent with its growth premium.

—

Notes:

- Share prices as of end of quarter, earnings include last twelve months

- Charts excluding negative multiples and outliers (turn-around multiples)

Discover more from Asymco

Subscribe to get the latest posts sent to your email.