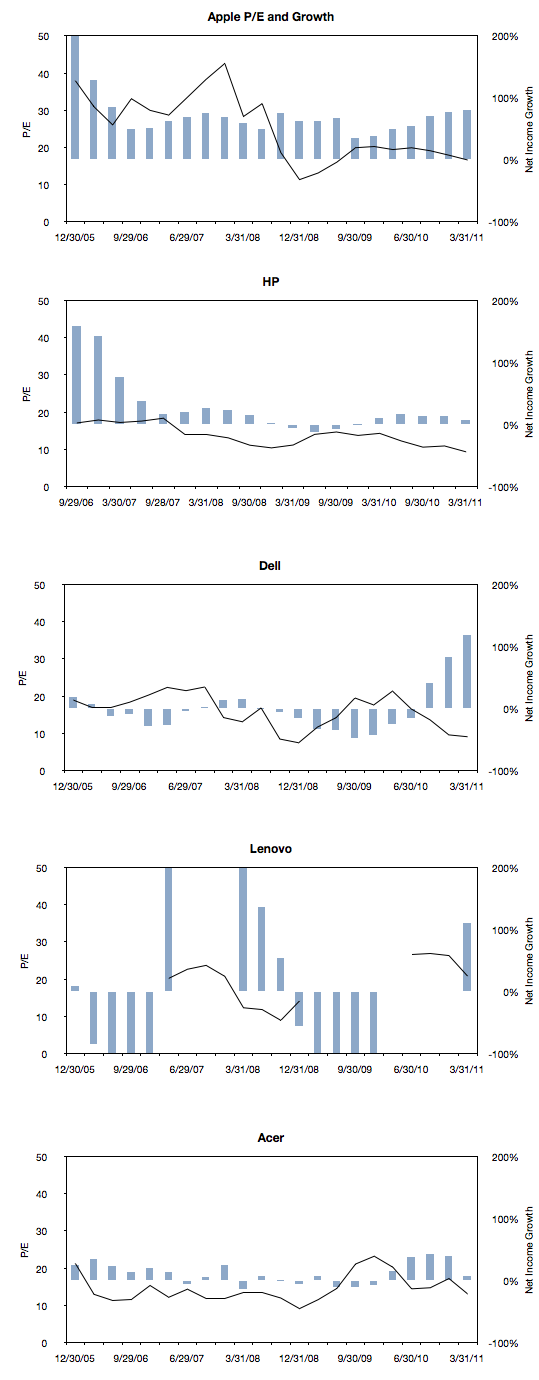

The previous article showing the profile of Apple’s growth vs. its P/E prompted a similar review of a set of comparable companies. The cohort is composed of:

Apple

HP

Dell

Lenovo

Acer

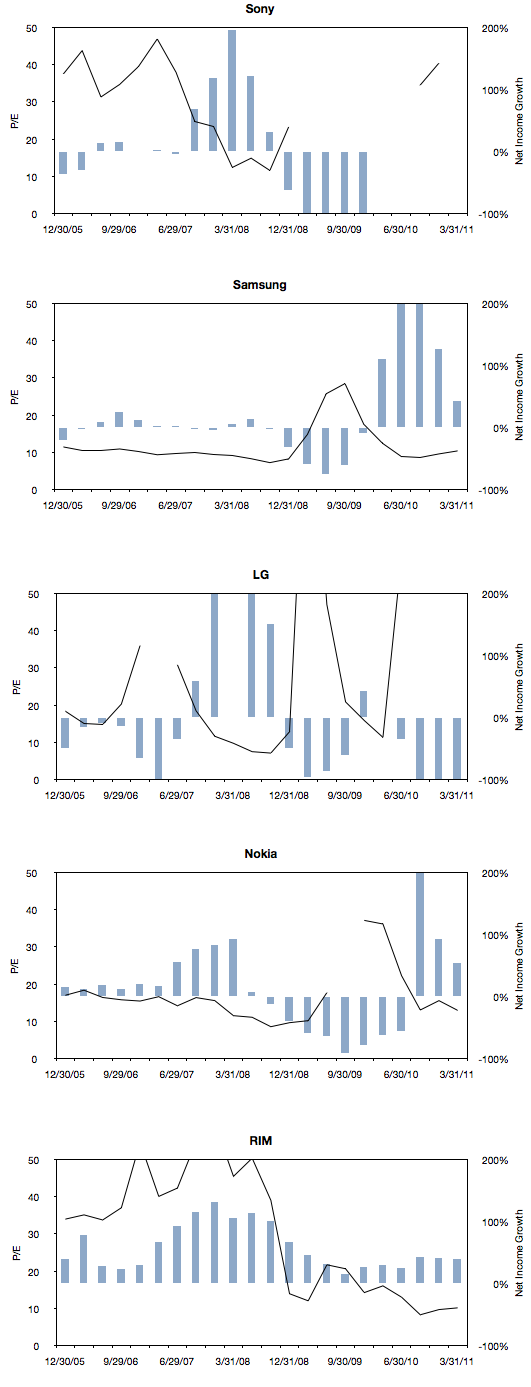

Sony

Samsung

LG

Nokia

RIM

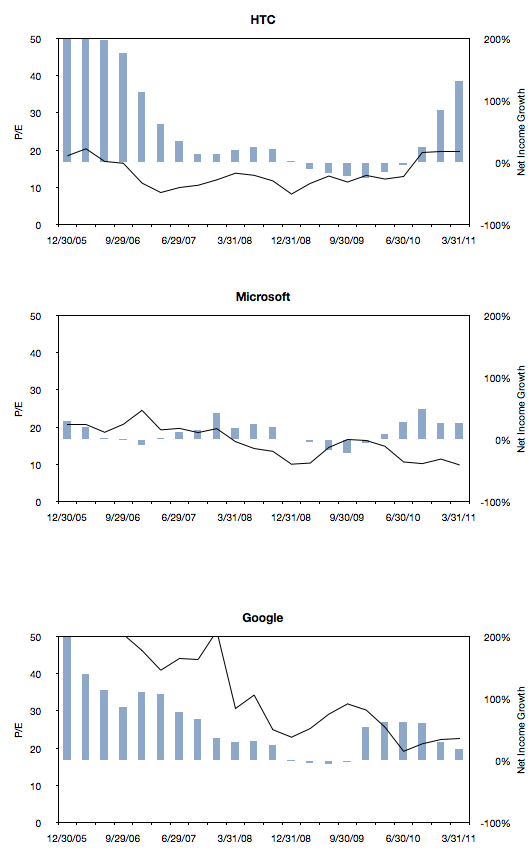

HTC

Microsoft

Google

The following charts are a simple representation of P/E (line chart with left scale) with Net Income growth super-imposed (bar chart with right scale.) The time period is 22 quarters; 11 quarters after the crisis (i.e. quarters after the one ending in Sept. 2008) and 11 quarters before the crisis (quarter ending 12/20/05 through the one ending 6/30/08).

We made one change to the growth data from the previous post where the Net Income growth is not quarterly year-on-year but average of four quarters year-on-year. This reflects the fact that P/E is also a trailing twelve months’ earnings. It also has the benefit of smoothing the growth data making it easier to discern.

Here are the charts:

Note that all charts are to the same scale (P/E from zero to 50 and Net Income growth from -100% to 200%). Some clipping of the values is possible. Growth from unprofitable periods are undefined (i.e. when measuring growth from a to b, if a is negative, the data is omitted.) Growth from a positive period to a negative period is defined as -100% (i.e. when measuring growth from a to b, if b is negative, the value is defined as -1).

There are some anomalies, for example growth due to an acquisition or loss of profitability due to re-organizations, however the patterns are probably what matter most.

Next post will discuss the relationship between P/E and growth in the pre- and post-crisis time windows for all these companies.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.