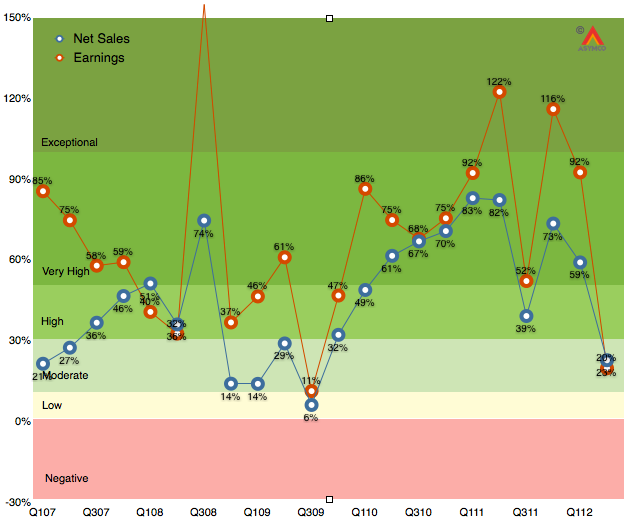

As the chart below shows, the last quarter (second calendar 2012, third fiscal 2012) was disappointingly moderate with 20% earnings growth and 23% net sales growth.

It was the first quarter since the iPhone launched that earnings growth has fallen into moderate (below 30%) territory. Much of that disappointment (to me) was the relatively low performance of the iPad following a launch quarter. The iPhone was weak as well, though that was expected. As I said last quarter, the iPhone is still the most important component but the iPad is becoming increasingly decisive in overall performance. In fact, I’m projecting that the iPad will have the same revenues as the iPhone had one year earlier.

The iPhone is going to be extremely difficult to project. On one hand we have the launch of the i5 which will account for about 10 million units in the quarter, on the other, chances are that sales were very weak prior to the launch as purchases were being deferred even more than during the last quarter.

So with these very meager clues, here are my estimates for the quarter (with y/y growth in parentheses):

- iPhone units: 27.8 million (62%)

- Macs: 5.6 million (15%)

- iPads: 18.8 million (69%)

- iPods: 5.6 million (-15%)

- Music (incl. app) rev. growth: 40%

- Peripherals rev. growth: 10%

- Software rev. growth: 15%

- Total revenues: $39.5 billion (40%)

- GM: 42%

- EPS: $9.75 (38%)

This earnings value would imply a trailing twelve months’ EPS of about $45.2. At the current price of $697/share the P/E would be 15.4. Cash and equivalents will probably increase to $125 billion or $131/share. Excluding cash, the P/E would be 12.5.

[Update. The EPS figure above includes a tax rate estimate of 30%. Company guidance was 25.5%. Using the company’s guidance yields an EPS of 10.43. TTM EPS becomes $45.9/share and at $697 the PE is 15.2. At time of this update the share price has fallen to $665 and thus the pro-forma trailing P/E ratio is 14.5).]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.