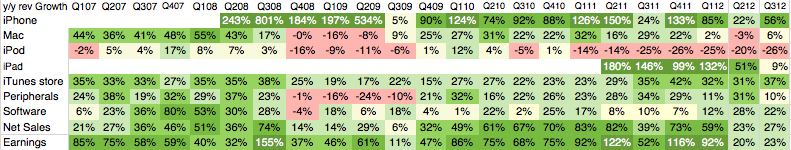

In the parlance of developers Apple keeps “throwing exceptions.” This quarter the iPad surprised with a significant decline in sales growth. I placed a table showing the sales growth for this quarter as well as the previous 22 quarters at the bottom of this post.

Here is a quick review of each line:

- The iPhone returned to a more customary growth rate (which I rate as Very Good–above 50%). The quarter was bound to be quirky due to it being both a transition quarter and a launch quarter. The launch of the iPhone 5 came quite late but not too late to make a contribution. It was also widely rumored and anticipated so there was slowing of the previous generation product. I expect growth to accelerate further in the last quarter of the year.

- The Mac turned in a commendable 6% revenue growth (1% unit growth) on the back of the new 15″ Retina screen MacBook. The average sales price increased sequentially and the mix of portables to desktops reached a new high of above 80%. More about the Mac will be written in a future post.

- The iPod continued its decline. The 26% sales decline was in-line with other non-launch quarters. The company tipped its hand and let us know that iPod touch now makes up 60% of iPod volumes. At 3.2 million iPod touch units, it’s a significant iOS contributor but still a declining number.

- The iPad was painfully underperforming. With only 9% revenue growth, it was a complete reversal of the torrid growth of the last two years. Management blamed both anticipation of a new product and a reduction of inventory ahead of refresh of the larger screen retina. The only silver lining was that the average price decline was moderate (down about $3/unit). Overall, I’m very disappointed with the pause in the product but the new mini could change the character of the product dramatically in a way similar to how the iPod mini turbo-charged the iPod line.

- iTunes had a very good quarter. It’s the perennial growth engine with the most consistent performance throughout the time period shown. It was the second fastest growing line item firmly in the “High” growth bracket.

- Peripherals, including Apple TV had a moderate quarter. Management revealed that about 5 million Apple TV units shipped in the fiscal year. That adds up to a half-billion dollar revenue business. Peripherals had $2.8 billion over the same time frame so Apple TV was about 18% on a yearly basis. This does not include content revenues.

- Software had a modest growth of 22% but has come to be the high end of the range. Since changing the way it prices OS X updates, the era of Apple software windfalls is over. Still, at nearly $1 billion per quarter it’s nice pocket change, especially as it’s nearly all margin.

- The overall top line (net sales) was a bit improved sequentially (+4 points of percent) but still in the “transition quarter” range of moderate growth. The company may be shifting its launch cycles and as a result we’re seeing a break in pattern. As pricing for iPhone and iPad did not change very much the slowing of top line growth is entirely due to a unit shipment reduction. Again, the primary cause is transitions in multiple lines simultaneously.

- The bottom line (earnings) followed the same pattern as top line (slight sequential increase in growth). There was a slight attenuation of margins (gross margins are down to 40%).

Overall, the quarter was not up to the recent level of performance for Apple. Growth was overall “moderate”.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.