There are 80 million Mac users. The last 12 months saw sales of 18 million Macs.

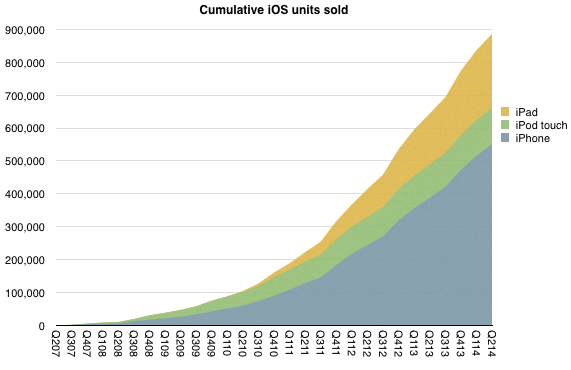

As of the end of June there were 886,580,000 iOS devices sold. As of today the total is well over 900 million. One billion sold will happen well before this year is out. Estimates of current iOS users vary but they are probably at least 500 million and could be 600 million.

Apple claims 800 million iTunes accounts.

Therefore, in terms of revenues:

- Mac User = $289/yr

- iOS User = $262/yr

- iTunes User = $25/yr1

Adding iTunes usage to either Mac or iOS yields

- One Mac owner = $323/yr or 89c/day

- One iOS device owner = $287/yr or 79c/day2

This should make valuing Apple easy.

80 million Mac Users and 500 million iOS users add up to about $169.3 billion in sales per year. If we assume that the number of Mac users grows to 90 million and 600 million for iOS then next year Apple should get another $200 billion from its population of users.

So over the next 30 months Apple sales should easily be higher than its current enterprise value.3

This would be the forward price to sales ratio of about 2.5. Each sale yields a certain net profit, which for Apple is on average 21%. Multiplying 2.5 by (1/.21) gives 12 which is about the P/E ex cash.

This exercise summarizes Apple’s valuation nicely: Apple is expected to keep its current customers for about a decade and then disappear.

- Measured from billings [↩]

- This conforms well to the rule of thumb that, after taxes and accessories/services, one Apple device is worth about $1/day [↩]

- Enterprise Value = Market Capitalization – Cash + Debt = $585 billion – $164.5 billion + $29 billion = $449.5 billion [↩]

Discover more from Asymco

Subscribe to get the latest posts sent to your email.