During 2016 Apple services revenues were $25.6 billion. In January 2017, just after the end of that year, Tim Cook said “We feel great about this momentum, and our goal is to double the size of the services business in the next four years”.

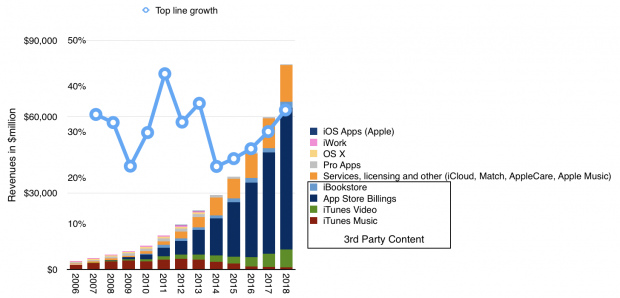

If Apple were to hit that target, during calendar year 2020, Apple’s services revenues should exceed $50 billion. In 2017 they were $32 billion, in 2018 they were 41.5 billion and so far this year they are 23 billion. If, as has been the case during 2017 and 2018 (see graphs below,) Apple were to maintain 30% growth in Services during the rest of this year they will have revenues of $51 billion in 2019; reaching the doubling tarted a year sooner than predicted.

Apple will have doubled Services in 3 years to a level equivalent to a Fortune 63 company (right behind Goldman Sachs).

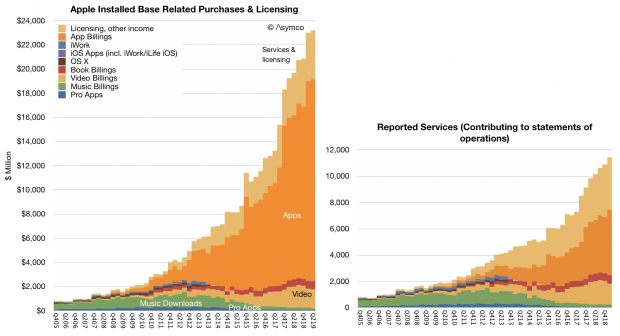

Keep in mind that the reported revenues are not billings or what consumers actually spend. That figure is at a run rate of over $71 billion. You can see the difference between billings and reported revenues in the graphs above.

So what made this possible and what is the source of growth in the future?

As my estimates above show, the growth came from apps and licensing and other revenues. Apps include many third-party subscriptions and licensing includes Google TAC and other income includes Apple’s own subscription services and a few additional items like Apple Pay, AppleCare and iCloud.

What Apple is launching this year will boost this even further with TV+, Card, Arcade and News+. These are a new set of specific services that, apart from Card, will require subscriptions and will deliver Apple-specific content. Unlike previous Music and TV offerings, what Apple has embarked on is a high degree of involvement in the content creation process. These will be Apple TV shows, Apple video games and Apple-directed News feeds.

This is quite the watershed moment. Apple, a company dedicated to providing tools to content makers and content consumers, choosing to be involved in the lottery-like game of choosing and backing winners in creative works.

Can a company with good taste about devices and software successfully extend that capability to content? That seems to be the question many are asking: How good is Apple at creating hits? The process of hit creation is difficult but it’s not completely random. There are many individuals who have skills or taste. And Apple’s approach seems to be to hire people with such skills. These “executives” then proceed to attach people with great track records in hits and who may have the star power to attract audiences. It’s not a matter of complete guesswork. It’s actually the approach most “streamers” have: They hire studio executives, attach talent to projects and spread bets.

This is why there has been a rush by streamers to secure programs and A-listers. There might be a variety of subscriptions users are likely to pay for but there is a fixed number of bankable names in the business.

But let’s pause here to think more deeply about what is happening. Without much notice, we are seeing a content world where distributors are locking up talent and creating a studio model where production, talent and distribution and display are under one roof. This is exactly where the movie industry was in the so-called golden age of Hollywood. The era of the studio system. An era that ended with divorcement—the complete separation of exhibition interests from producer-distributor operations or the forced divestiture of theaters by production/distribution.

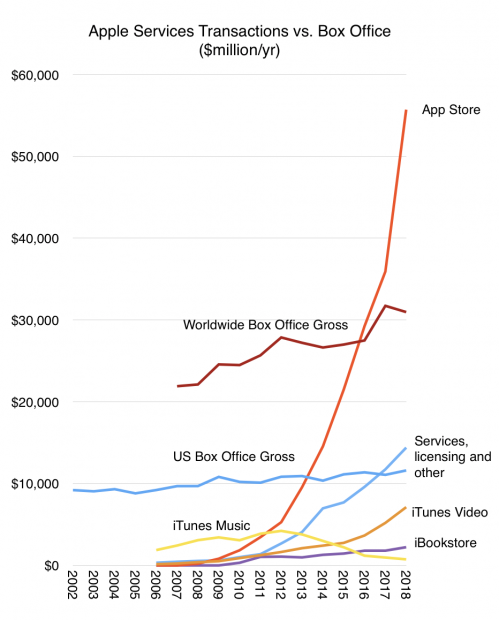

Another observation to be made is that the bundling and binding of content into specific distributors creates a walled garden effect. This extends beyond video content to games (a larger business than film, at least at the box office, see below) and to apps. Arcade games are Apple-exclusive. Many apps which depend on Watch, AR and other unique technologies become exclusive, and of course unique titles.

As far as consumers are concerned this might be just fine. There are very implicit lock-in effects of ecosystems, from UX muscle memory, switching costs for data, network effects from friends/family/co-workers in the same system. The extension of this to cultural content, news curation, music curation and privacy curation could be the comfortable default for many.

In this world-view the proposition Apple offers is very attractive. Look at the preference vacationers have toward packaged experiences. Look at the popularity of cruises. Look at the way features are packaged in cars. Look at meal delivery and the packaging of ingredients into something you can cook at home. Look at fitness and the packaging of instruction with the exercise venue. The examples are plentiful.

A garden is lovely after all. The walls are there to keep danger and chaos away as much as to keep you in it. The constraints simplify as much as they restrict. Though it may be contrary to some modular and interoperable utopias which paralyze with choice, we might well be experiencing a triumph of the walled garden.

Discover more from Asymco

Subscribe to get the latest posts sent to your email.