Tear of joy, that is.

Georg Friedrich Händel – Oratorio – Messiah, HWV 56 Part 2, No. 44 Chorus

Performed by The English Concert & Choir

Tear of joy, that is.

Georg Friedrich Händel – Oratorio – Messiah, HWV 56 Part 2, No. 44 Chorus

Performed by The English Concert & Choir

This site is fairly new. It has been around for only about 6 months. In that time there have been 393 postings and 586 comments. It has been read 100k times and I’ve moved it three times to accommodate this growth. Lately, thanks to links from John Gruber’s Daring Fireball, views have increased dramatically (to over 10k/day). This has been a blessing but also a dilemma because the traffic is overwhelming for the humble hosting setup I have. So much so that the site was down due to overload much of yesterday.

I apologize for this downtime.

I am trying to find a solution and have implemented a few optimizations (thanks to my lovely wife’s suggestions). I also turned on full text RSS feeds so readers don’t need to hit the site for full articles. In the mean time I hope readers will be forgiving and return even if the site is overwhelmed.

Additional suggestions on how to maintain a high quality of service are welcome.

After piecing together the global smartphone shares, it’s time to take a look at global mobile phone shares. That’s all phones from all vendors that matter.

Unfortunately, just like there are only fragments available from Canalys about smartphones, there are only partial lists from IDC (IDC – Press Release – prUS22441510). Missing are numbers from Apple, Motorola and HTC. But fear not, those can be obtained from company earnings reports.

So here is the full picture for 2Q10 vs. 2Q09

The year-on-year growth for the vendors above is:

Observations:

The saga of Nokia’s challenges has been well documented in this weblog.

For this quarter, we take a look at the sequential deterioration in Nokia’s bottom line and draw causal inferences to its lack of competitiveness in mobile operating systems.

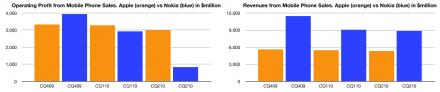

First, the bottom and top lines are shown below (in blue) and compared with Apple (in orange):

The charts show how Nokia’s bottom line (left) collapsed while the top line (right) remained relatively solid. By comparison, Apple remained consistent in revenue with slight dip in profit as it transitioned to a new model.

The charts show how Nokia’s bottom line (left) collapsed while the top line (right) remained relatively solid. By comparison, Apple remained consistent in revenue with slight dip in profit as it transitioned to a new model.

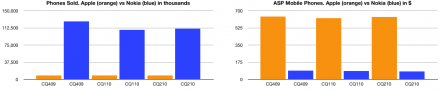

The top line (sales) is the product of units sold and their average selling price (ASP). Here are these two quantities side-by-side:

Note how Apple’s units are hard to discern relative to Nokia’s volume and how the opposite is true for the selling price. These values include all phones sold by the companies.

Note how Apple’s units are hard to discern relative to Nokia’s volume and how the opposite is true for the selling price. These values include all phones sold by the companies.

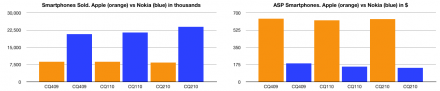

The story is a bit more clear when comparing the smartphone part of Nokia’s business, again with units and ASP:

The story here is telling: even in smartphones, Apple’s ASP is dramatically higher and much more resilient.

The story here is telling: even in smartphones, Apple’s ASP is dramatically higher and much more resilient.

The question has to be why: Why can Apple retain not only higher prices (and hence margins)? The answer is competitiveness. Margin is an indication of value created and value differential is competitive differentiation. All the user satisfaction surveys, the reviews and tests boil down to these hard numbers above. The deterioration of Nokia’s business is directly traceable to its historic failure to embrace mobile software as a disruptive force and instead using it to sustain a hardware business.

According to Canalys:

Usual disclaimers apply:

Data used to build charts: Continue reading “Canalys: Android global share rises to 16% of smartphones in Q1 [Updated]”

The following chart shows the value of sales per quarter (in $million) since the beginning of 2005. What’s interesting to note is that more than half of sales is contributed by products which did not exist three years ago (iPhone and iPad). Music and iPod did not exist 10 years ago. It’s entirely appropriate that Apple removed “Computer” from its name, though they still sell mostly computers of a different kind.

asymco | Apple’s Valuation Struggle.

As despondency over Apple’s 75% earnings growth rate continues, it’s time to revisit the historic P/E in contrast to growth for the company’s earnings.

The latest chart (below) shows the company’s P/E ratio (in blue, left scale) vs. the trailing twelve months rolling growth rate (in brown, right scale) and the ratio between these two (in red, right scale).

The red line can be considered a form of PEG (Price over Earnings over Growth) with the caveat the the Growth is trailing not forward and hence is based on actual data not fictional analyst “consensus”. I call this PETG (Price over earnings over trailing growth).

The actuals show that Apple’s price to trailing growth ratio is dropping to lows unseen since last year when the recession was still in effect. At PETG below 20 the predominant sentiment displayed is extreme pessimism. 100 could be considered an even balance between pessimism and optimism. It now stands at 35.

Following up on last quarter’s “asymco | Apple’s Growth Scorecard.”

June quarter showed a significant increase in sales growth (due to the iPad) while the iPhone growth moderated to 74%. Overall earnings growth is a solid green.