Recent commentary in financial press (e.g. FT Alphaville » Lost in correlation fatigue and The Herd Instinct Takes Over, Amber Waves of Pain) points out how the markets have become insensitive to fundamentals or valuation itself.

Symptoms of this are:

- Global markets trading in lock-step. In an apparent blindness to any local differences, markets from emerging economies to Japan and to London trade in perfect correlation.

- Crude oil and other commodities are mis-priced due to HFT or algorithmic trading which ignores underlying supply and demand fundamentals.

- Value investors find that there is lack of dispersion among stocks.

- Component stocks’ correlation to the S&P 500 is at highest level since ’87 crash, reaching a high of 83% vs. average of 44% since 1980.

- ETFs (exchange traded funds) maintain (or freeze) over- and under-valuations.

Structural changes such as the proliferation of exchange-traded funds and super-rapid computer-based bloc trading, activities that are totally unconcerned with valuation metrics and/or long-term trends, are still taking place and there is little or no prospect of this development coming to an early end.

- Adam Smith’s invisible hand has for the time being, been handcuffed.

It means you can’t trust any valuation. I could have valued a subprime CDO better on May 6 than any equity. And it’s almost the same thing all day long. Valuations and prices have been divorced for a while. Just look at the volatility. It’s not like traditional trading. No wonder there are such increased correlations.

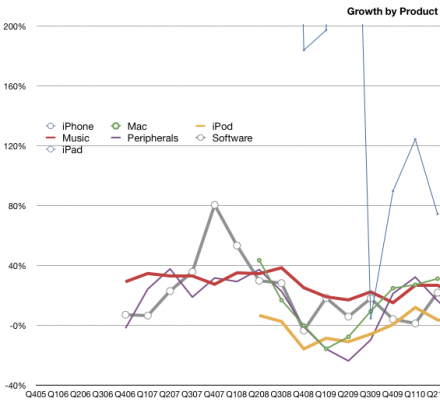

What this has to do with mobile computing? Interestingly, I find that Apple is not just a victim of this de-coupling of fundamentals from valuation. I hold out hope that the stark facts of its performance might actually pop this correlation bubble.

The hope comes from the fact that trading strategies have finite lives. As soon as a strategy develops to a point of being widely used, it makes sense for a contrarian to “short” or bet on the reverse of that trend, taking advantage of the tendency to overshoot. I don’t have a strong handle on this phenomenon, but the chances are that value/fundamental investment will be back with a vengeance and Apple might just be the leader, by sheer weight of numbers.