On Christmas Eve 2007 to be precise. That’s when the Enterprise Value/share was $181.5. These days it’s around $150. The Enterprise Value (EV) measures the value of future cash flows excluding current assets and is a better indicator of the potential of a company than its current overall value.

On Christmas Eve 2007 to be precise. That’s when the Enterprise Value/share was $181.5. These days it’s around $150. The Enterprise Value (EV) measures the value of future cash flows excluding current assets and is a better indicator of the potential of a company than its current overall value.

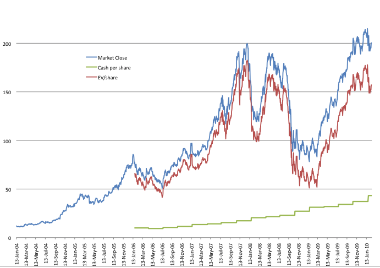

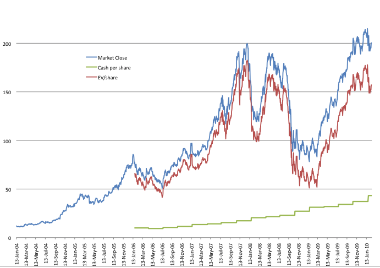

As you can see in the graph above, the cash per share (in green) has grown to $43 while back in late 2007 it was less than half that. As a result, although the market value for Apple peaked at $215 on 19th January this year (the blue line), the EV/share was only about $178 (the red line), below the all-time-high in 2007.

As Apple’s cash continues to grow, the gap between EV and MV will also grow. If the MV remains low (as the P/E is indicating) then the Enterprise Value, i.e. the net present value value of future cash flows, drops.

Did Apple’s prospects peak in 2007–six months after the iPhone was first launched–or is the current valuation still a function of sentiment of the overall economy, independent of the company’s fundamentals?