Data on Q4 performance is starting to trickle in. Last week Motorola, as part of a profit warning, revealed their Q4 smartphone shipments were 5.3 million. RIM had reported 14.1 million units (quarter ending November). HTC has also warned that their shipments of smartphones (and tablets) totaled 10 million. Samsung provided guidance on overall sales but since they don’t report data on smartphone (or phone) sales, the estimates are ranging between 32 and 35 million.

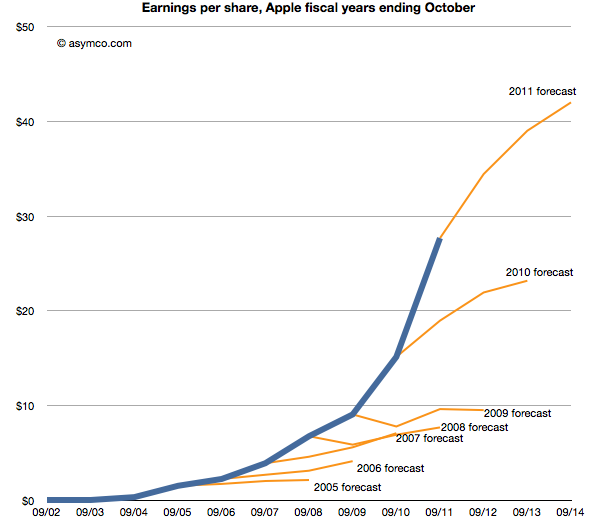

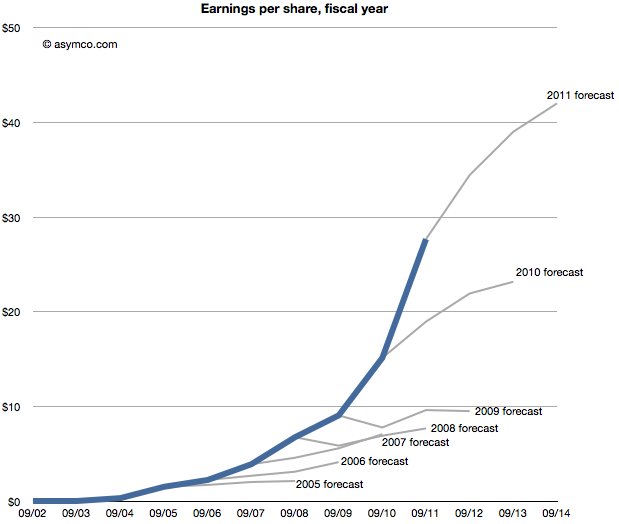

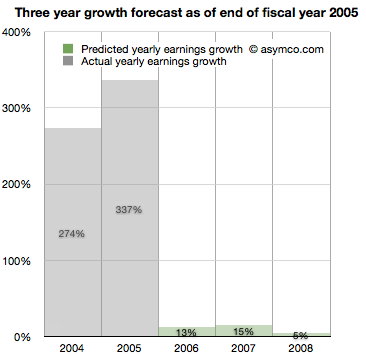

Many have forecast Apple’s performance but there are many other companies which are not easily estimated (Sony Ericsson, LG, Nokia, ZTE, Others.) But rather than dwelling on the specific quarter, we can make some long-range estimates of performance based on the historic data.

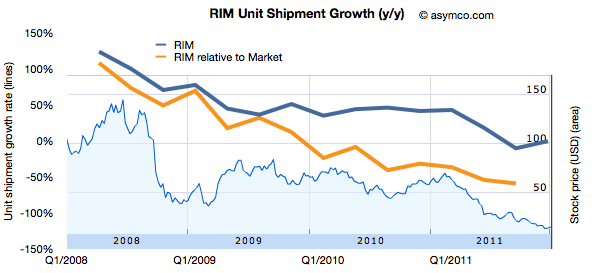

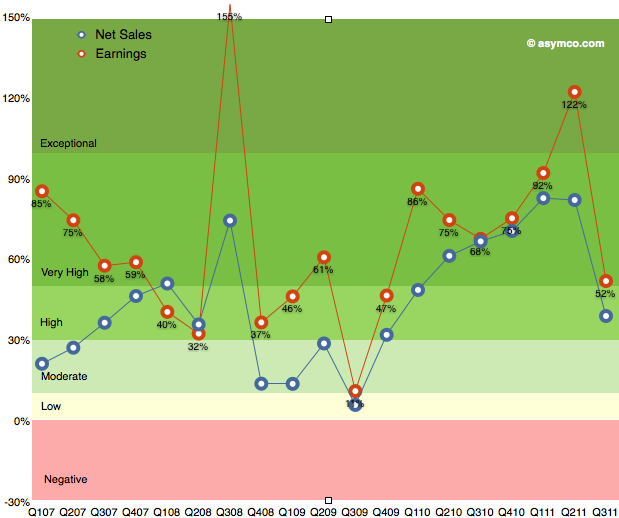

One method I use is to look at patterns of growth. Growth is the first derivative of market performance and it sometimes shows patterns which the performance itself does not. Consider the following chart showing the growth pattern for RIM.

The blue line shows the absolute year-on-year quarterly growth based on reported numbers of smartphones shipped. I’ve also shown the growth “relative to market” which is unit growth with market growth subtracted. This orange line represents how much faster (or slower) the company is growing relative to the market. If the orange line is above zero, the company gained share. If it’s below zero, it lost share.

I also overlaid the performance of the share price (right scale).

Now compare that with another long-term incumbent in the smartphone market, Nokia. Continue reading “The effect of smartphone growth on share prices”