Apple’s CFO guidance statement:

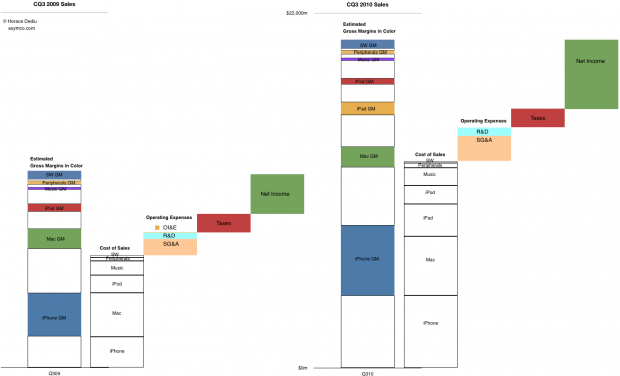

We expect revenue to be about $22 billion, compared to $13.5 billion in the March quarter last year. We expect gross margins to be about 38.5%, reflecting approximately $50 million related to stock-based compensation expense. We expect OpEx to be about $2.35 billion, including about $250 million related to stock-based compensation. We expect OI&E to be about $50 million, and we expect the tax rate to be about 25.5%. We are targeting EPS of about $4.90.

via Apple Management Discusses F1Q11 Results – Earnings Call Transcript – Seeking Alpha.

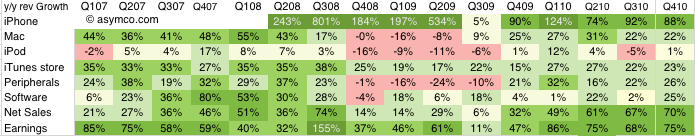

This is a particularly aggressive revenue growth forecast of 63% (note again that Apple’s P/E has dropped to 18 and 14 ex cash and 10 on a forward basis) . Since Apple always guides very conservatively, the likely figures for the top and bottom lines are likely to be higher.

How much higher? Here are my estimates (growth in parentheses is year over year).

- iPhone units: 18.4 million (110%)

- Macs: 3.62 million (23%)

- iPads: 6 million

- iPods: 10.1 million (-7%)

- Music (incl. app) rev. growth: 25%

- Peripherals rev. growth: 23%

- Software rev. growth: 23%

- Total sales: $24.5 billion (82%)

- GM: 38.8%

- EPS: $5.89 (77%)

Looking a bit further ahead, earnings suggest the company is now trading at a forward P/E of about 9.5.