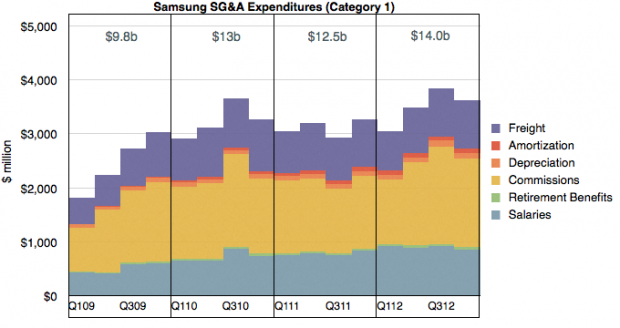

Thanks to @jtk0621 via twitter I was able to obtain a quarterly view into Samsung’s SG&A expenditures by cost category.

The value of this data is in being able to understand why Samsung SG&A as a percent of sales remains fairly constant. To recap, the discrepancy with Samsung’s SG&A is that it has grown in proportion to rapidly rising sales. Normally, when sales grow, SG&A grows but when sales grow very rapidly, SG&A grows a bit more slowly since it’s primarily a function of headcount and hiring is necessarily organic and hence slower as a process.

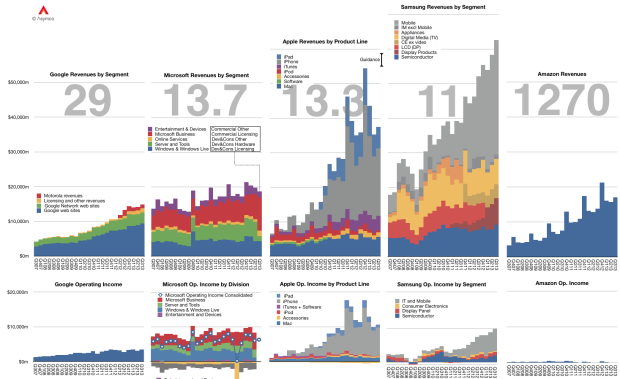

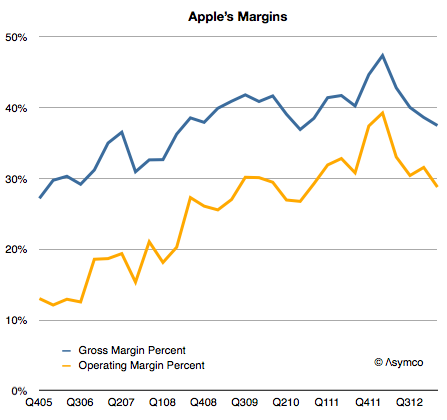

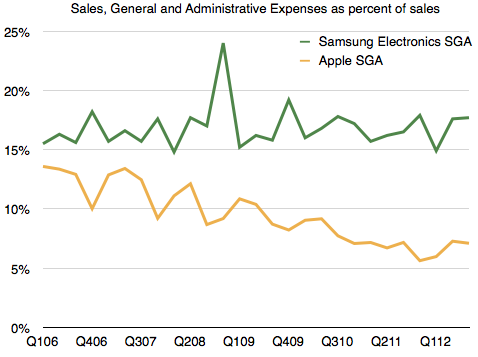

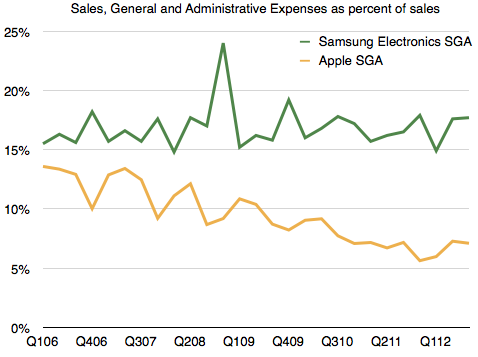

The contrast is shown in the following comparison between Apple’s SG&A and Samsung’s SG&A as a percent of sales. [For more detail on Samsung revenue composition see: The Cost of Selling Galaxies].

Apple’s SG&A has declined as a percent of sales, as one would expect, but Samsung’s hasn’t.

I have hypothesized that the reason for this might be in the practice of “outsourcing” many marketing functions. As Samsung expands promotional efforts, it does so partially by hiring people but even more so by farming out a lot more work. In this way, if and when sales subside, it can pare costs. This practice ensures that it’s not exposed to a huge cost structure that is hard to control. The downside to this approach might be obtaining “quality” marketing as oversight is still depending on inside teams who still have limited resources.

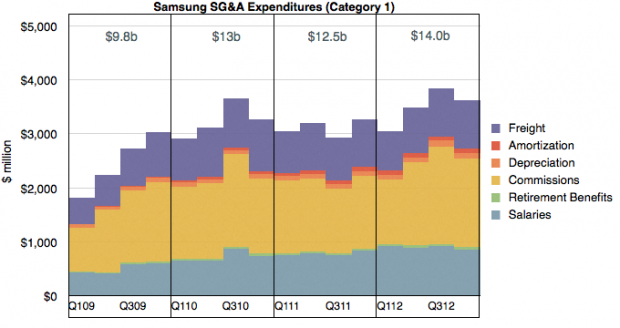

To test this hypothesis, I looked at the types of costs it reports and divided them into two categories:

Category 1 are what might be considered “internal” costs which are in function of employees or operations. These costs are:

- Salaries

- Retirement Benefits

- Commissions

- Depreciation

- Amortization

- Freight

I graphed these costs over time below:

Category 2 costs are those which can be “outsourced” and are in function of budget items. These are: Continue reading “The cost of selling Galaxies, updated”