The following interview took place by email on April 15th, 2013.

1. What are the truth and false about the ‘Apple shock’ currently? In what perspective should we see this?

First, I’d point out that during Steve Jobs’ time the company suffered many such shocks. The stock fell many times far further than it just did for trivial and irrational reasons. Recently Warren Buffett himself pointed out that his own company had 50% drops in value four times in the past. Share prices are not always good indicators of potential and markets are not always efficient. I catalogued the dramatic share price declines in Apple during the last decade here.

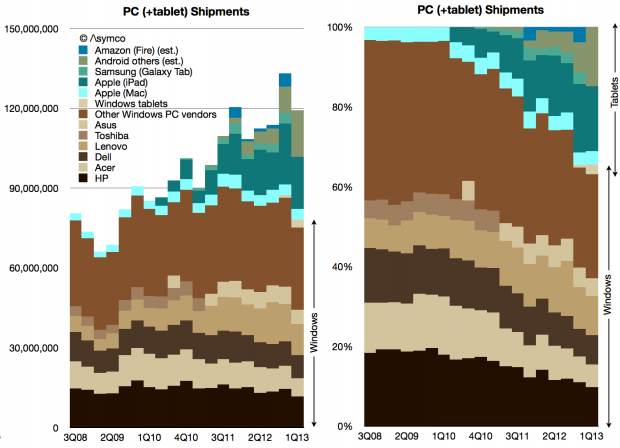

Second, I’d point out that the number of people watching and commenting on Apple has grown almost as fast as its sales and earnings. When Apple was small the people who studied Apple were few. (You could see this today for other, modest tech companies. There aren’t 50 analysts writing reports every day and 2000 bloggers tweeting about Lenovo even though it’s a successful and growing PC company.) Because of this growth, I would guess 80% of the observers have not observed Apple’s prior painful episodes first hand. For them this is the first time a “dominant” Apple has slowed. The amplification of so many voices raising alarm makes it seem truer, but it isn’t.

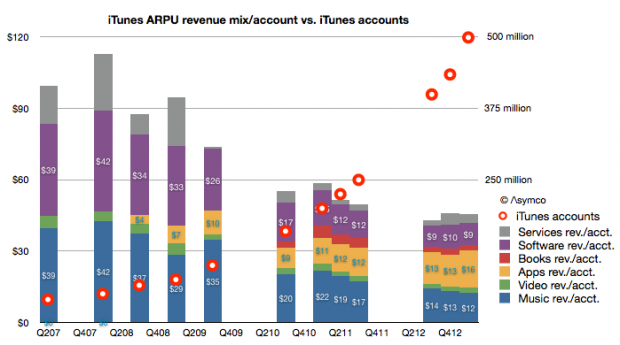

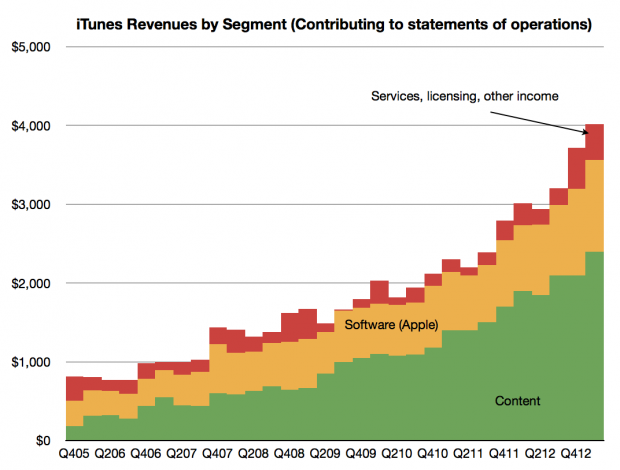

Third, the failures being cited are not significant. In terms of increased competition, before Samsung there was Nokia and Motorola and the mobile Operators and Microsoft and Dell and many others long forgotten. They were all about to “defeat” Apple. As a quick example when Apple was “the iPod company,” iTunes was considered vulnerable and fragile due to DRM concerns or the Beatles not being on it. Microsoft was launching “Plays for Sure” and Zune and Creative was suing Apple over patents. These battles are long forgotten. Before those there were concerns about the viability of the Mac that go back decades. At the time those were actually very valid concerns. At the time Apple did not have half a billion users. It depended on one product. But what saved them was a process of development of new products not the products themselves. iPod faded, Mac faded. What mattered is that they created new things to replace them.

Finally, what is not commonly understood is that the mechanism for creating things at Apple is unchanged. Its functional organization is inherently unstable and chaotic, sometimes looking like it will derail. But that’s the way it was designed to be. You just have to have faith that it’s a system that works. Those who did in the past were well rewarded.

2. What possibilities out of 1~10, do you think, Apple will suffer the same downfall as Steve jobs has left the company in the past in current?

Continue reading “Interview with Chosun Daily of Korea about Apple”