“It’s costly and has unpredictable consequences. That makes it a very bad business model. I suppose both companies have agendas that are not visible in court and perhaps Apple is signaling to other parties, and perhaps Samsung is using it to raise its profile. It still seems that unintended consequences may arise and the result could be very bad for everybody,’’ said Horace Dediu, founder of equity-research firm Asymco, in an e-mail interview with The Korea Times.

The above was a quote from the article Samsung can’t afford to lose Apple fight by Yoo-chul Kim from The Korea Times. Yoo-chul contacted me via email with a series of questions. I want to share all his questions and my answers as well:

Samsung wides market gap with Apple, according to research firms.

You think the gap will further be widen and please tell me why

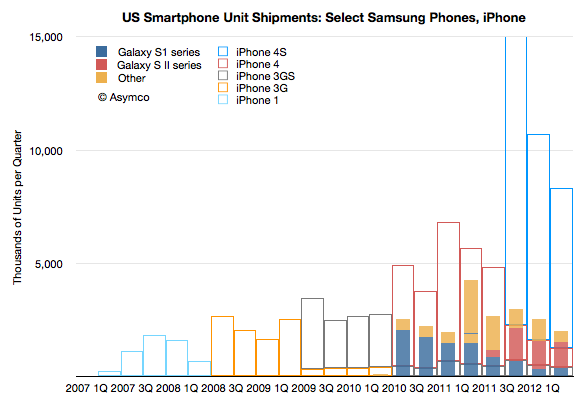

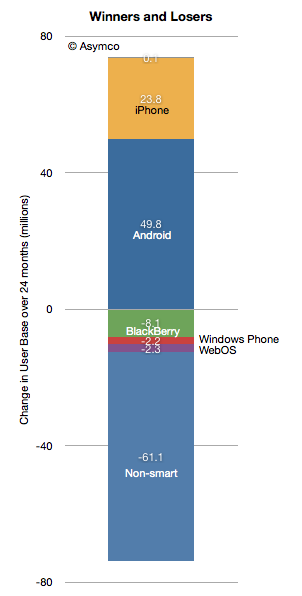

As Samsung converts its phone portfolio to be all smartphones, it is very likely to reach much higher smartphone volumes. One year ago Samsung sold about 56 million feature phones. Last quarter it sold about 43 million. The smartphone portion increased from 20 million to 50 million. At the same time, Apple has maintained a growth in its smartphone business of about 100% on a yearly basis. I expect that to continue into 2013 as well. Therefore it’s possible that Samsung could sell 290 million smartphones in the next 12 months and Apple could sell about 200 million in the same time frame.

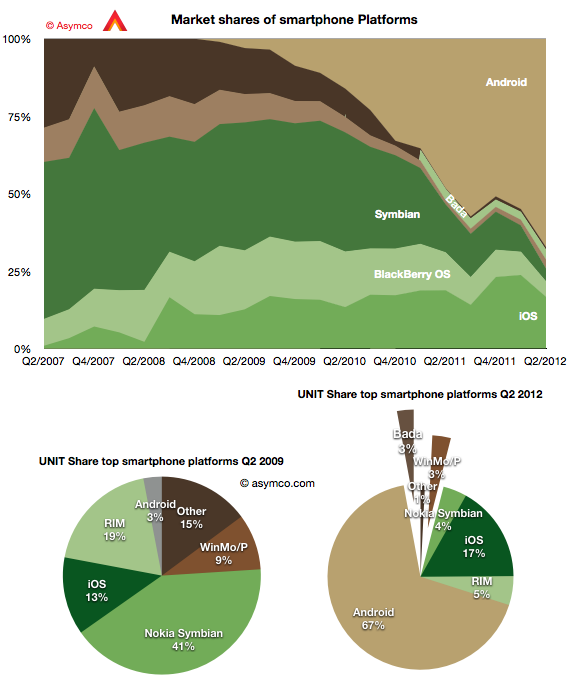

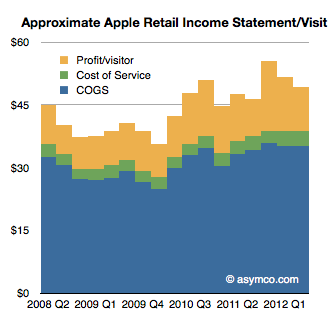

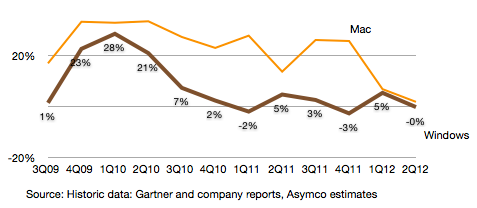

However, it’s important to understand that the companies compete on different bases. What I mean is that what generates a profit (i.e. payment by the consumer above what a product costs) is different for each company. Apple is a platform company that sells access to the iOS ecosystem across many other device types. Samsung sells consumer electronics with limited “network effects” but desirable features. In this view, the gap in device sales is “asymmetric” and not reflective of the actual competition which is between Google’s Android and Apple’s iOS as forms of access. Continue reading “It’s costly and has unpredictable consequences”