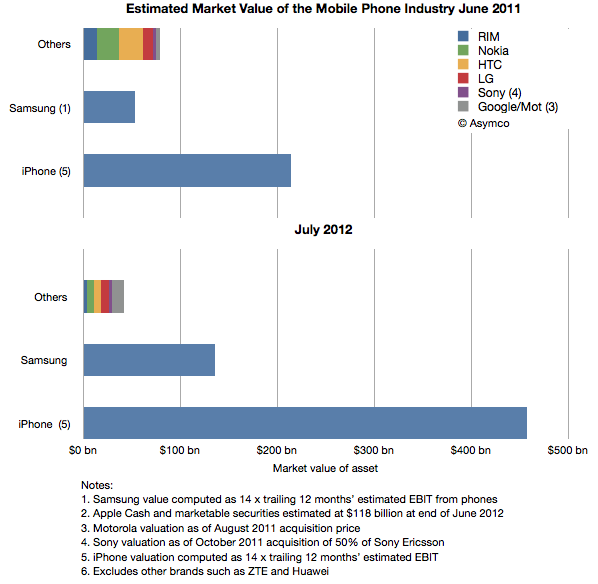

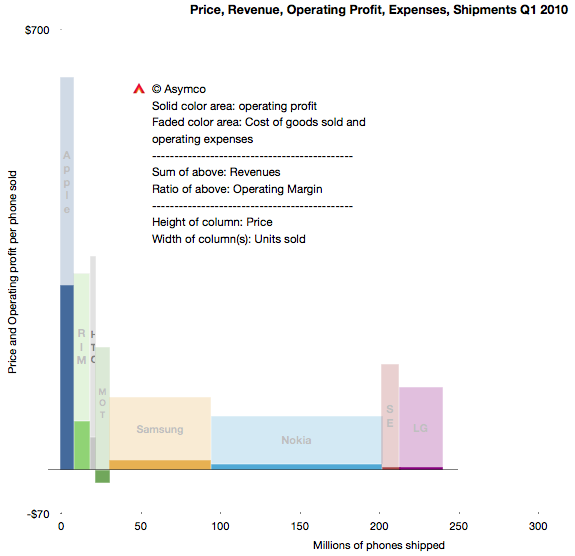

A year ago I noted that Apple could buy most of the mobile phone industry with cash on hand (excluding Samsung’s operations).

Since then Apple’s cash has grown significantly and the value of all phone vendors except Samsung has gone down significantly. The following chart shows the year ago and present day estimated market value of the industry participants.

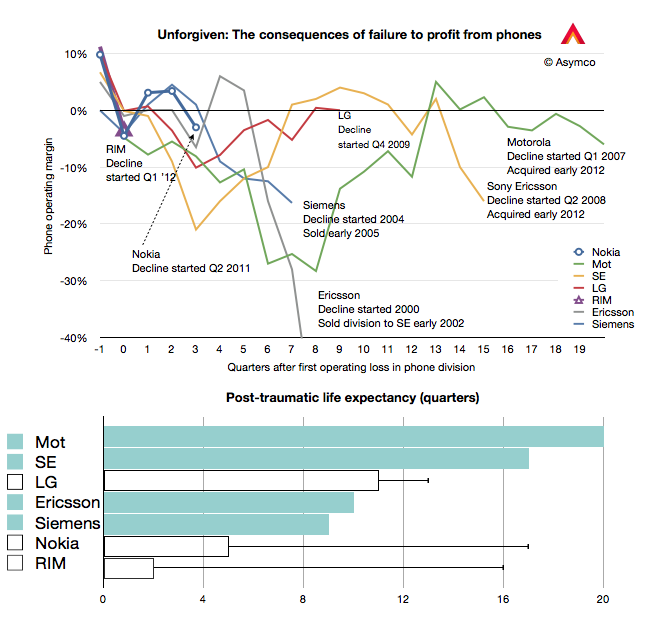

Phone brands other than Samsung and iPhone have seen a reduction in market value of a combined 47%. That’s actually being quite generous since I’m valuing Motorola and Sony’s businesses at their acquisition prices. The operations of both those companies have continued to stagnate.

Based on the same multiple of estimated earnings Samsung grew its value by Continue reading “From bad to worse and from good to great”