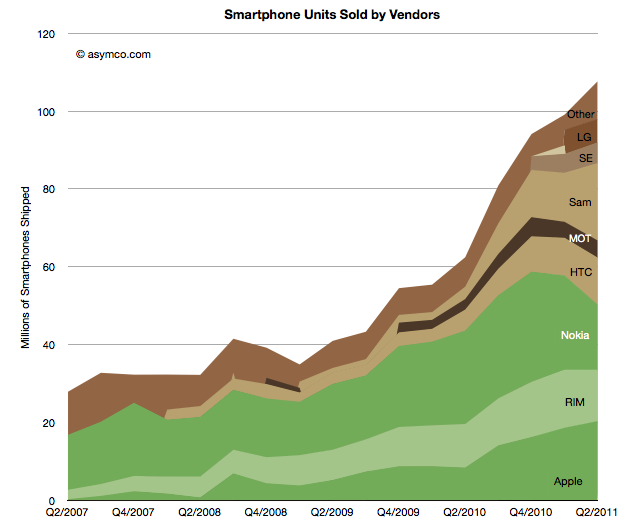

Smartphones made up about 30% of global phone sales last quarter. That is a significant increase from 10% in Q4 of 2007.

Smartphones made up about 30% of global phone sales last quarter. That is a significant increase from 10% in Q4 of 2007.

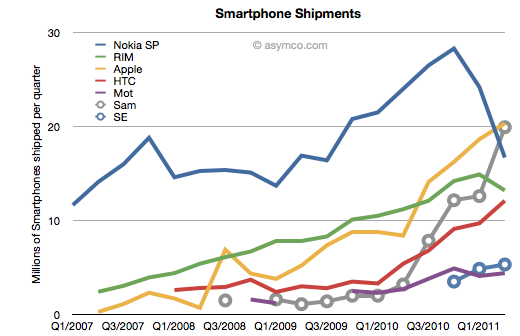

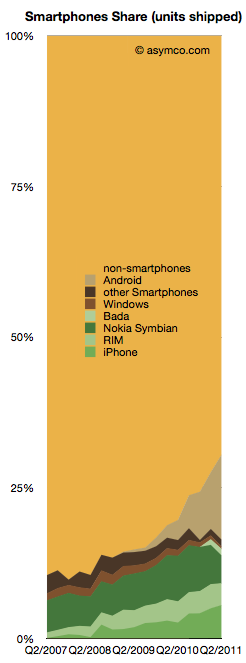

From this perspective, iPhone obtained 5.6% share, Android 14.2%, Nokia Symbian 4.6%, RIM 3.6%, Bada 1.1% and Windows 0.4%.

The competition however still has 70.5%.

The chart to the right shows the challenge remaining and the progress being made.

The good news is that the non-smartphone market is not growing while the smartphone market is. In fact, the non-smart market has had a three year CAGR of 0% and a y/y growth of 1.0% and a sequential decline of 6%.

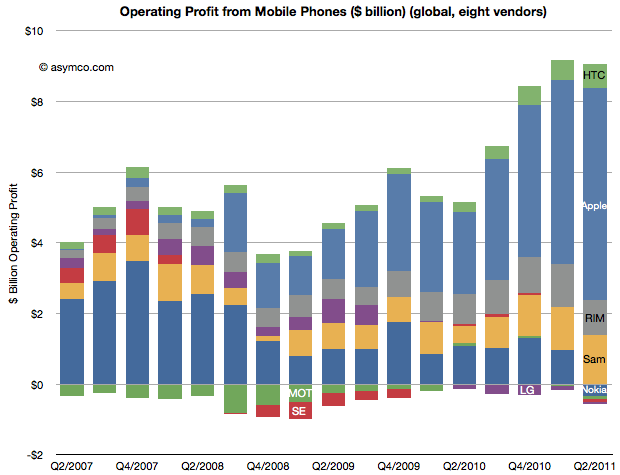

The non-smart portion of each branded vendor’s business is pretty dismal:

- Nokia saw 17.57% decline y/y

- Samsung’s non-smart business declined by 8.14%

- Sony Ericsson’s dropped by a dramatic 80%

- LG’s fell by 38.56%

- Motorola is the only one that grew y/y, by 17.86.

The reason all these brands fell is because the unbranded vendors took their place. “Other” non-smartphones grew by 43%. They have been sustaining growth at the rate of 57% compounded over three years.

The following chart shows the increasing share taken by the “other” vendors in non-smartphone units: Continue reading “The Competition”