When tallying up the race to a billion users, I noted that both iOS and Android seem to have the potential to reach that size of user base. However, that raises the question of where those users will come from. We have to note the fact that there aren’t a billion users to be captured today.

When tallying up the race to a billion users, I noted that both iOS and Android seem to have the potential to reach that size of user base. However, that raises the question of where those users will come from. We have to note the fact that there aren’t a billion users to be captured today.

If not today, then how soon, and where are they?

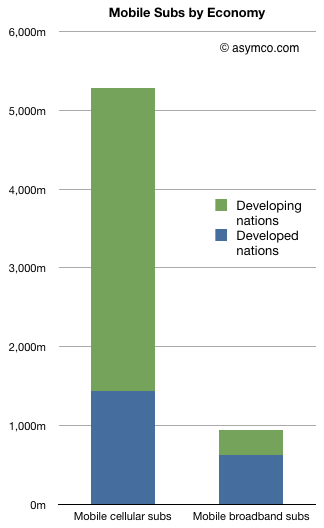

The first question is who is addressable. If we stick with mobile cellular subscribers, there seem to be plenty of users (at least 5.3 billion as of October 2010 according to the ITU). However, the number of “mobile broadband” (i.e. 3+G network subs) is about 940 million. The chart to the left shows the difference and adds the subdivision between developed and developing economies.

Over half (51.1%) of developed nations’ populations have signed up for mobile broadband while only 5.4% of developing country populations are on 3G. And whereas developing countries have added 2.6 billion mobile subs in 5 years, they added only 293 million mobile broadband (MB) subs. Developed nations added 574 million MBs in the same time frame.

As a result, two thirds of mobile broadband subscribers reside in developed nations as of 2010. This number will decrease rapidly as MB penetration reaches saturation in developed countries, however the race to a billion is being run in these markets first.

Continue reading “Which mobile users will platforms harvest first?”