Catalin Stelian Andrei, Editor of The Day, INTERNET PROTV asked me twenty questions:

1. What phone do you have in your pocket right now? Why that model?

I carry the iPhone 5. The last iPhone I bought was an iPhone 5C which I gave to a family member.

2. Apple is going to launch, form all we know, an iPhone with a bigger screen, long after their market rivals. Is Apple one step behind, being forced to take this road in the fight with Android and Windows Phone devices? Because many smartphone users were hoping that an big screen iPhone, a redesigned model, will be lauched long time ago, and that didn’t happen.

Making bigger phones is easier than making smaller phones. First because miniaturization has always been the most difficult engineering challenge, and second, because a smaller phone has a smaller battery making efficiency much more important. The larger the phone, the simpler it is. The third reason smaller is more valuable is that it’s easier to carry and use. The largest phones cannot be put in pockets and cannot be used with one hand. In the history of consumer, electronics size reduction has been the most consistent measure of performance, and the most rewarding. Usually the most exceptional reductions in dimensions create the highest price and profit bands. There have been niches for larger portable devices but they are consistently a small part of the overall market. If Apple were to introduce a larger device I hope they will be able to solve usability problems and make the category attractive to a larger audience.

3. What do you expect from the new iPhone 6?

I expect it to run the latest version of iOS and, with the new apps developers will ship, that should make the most impact in people’s lives. I imagine health maintenance and home automation will become valuable new franchises. Of course iOS 8 will also run on older iPhones, but I suspect the newest iPhone will somehow run the new software better and have smoother integration with services.

4. What’s the “not to do” lesson that Apple needs to learn for the now iPhone from it’s own past experience or their competitors?

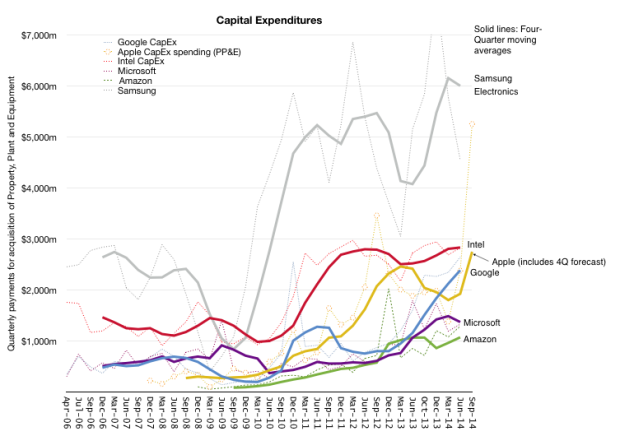

The biggest challenge is to move rapidly with scale. The company has managed to grow from zero phones a year to hundreds of millions. That’s great but it’s still frustrating to wait one year for major improvements. The “cycle time” of innovation for Apple remains one year. I wish it could be faster but perhaps this is also too fast for some. In some services like maps and iCloud and iWork, which are independent of hardware (mostly,) speed is of the essence.

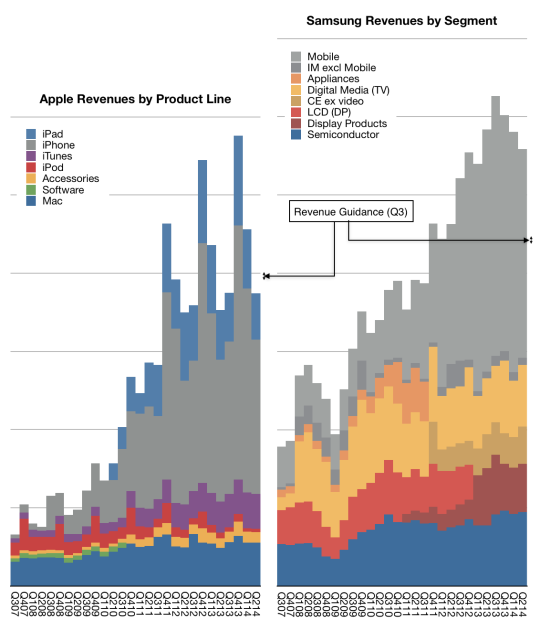

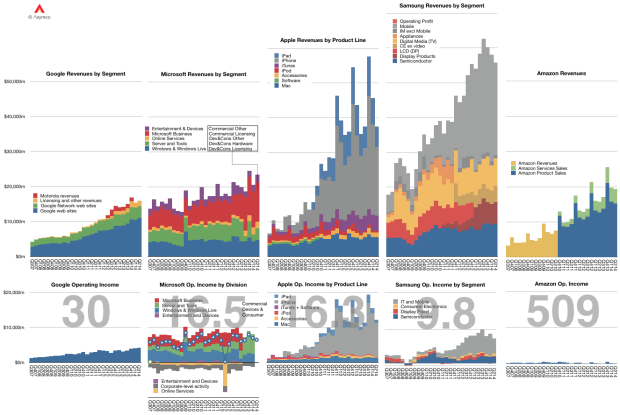

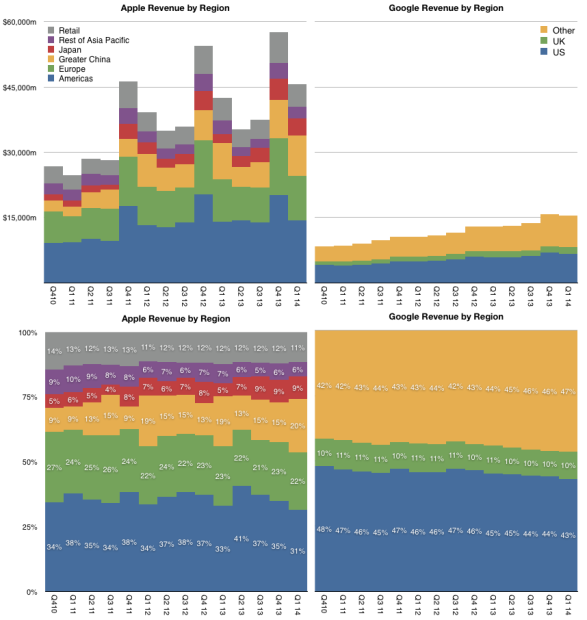

5. The iPhone is the most expensive smartphone on the market right now. In Romania, it certainly is. But where does Apple gains it’s most money from, selling products to users or selling services, like iTunes, App Store? And having that in mind, what will be their next step: better – breakthrough products or bigger, more complete services?

The answer to where a company “gets its profits” is best answered by asking where a buyer “gets his value” from the product. For instance you might answer the question of where a car company gets its value by saying that it’s from making people be in more than one place in a day. So the “differentiation” of a car is in answering the question slightly differently. If it’s hard to see a difference to this answer between cars then it’s hard for any one company to make a profit. For a company like Apple, we need to ask what its users value about the experience and why they are willing to pay for that. My hypothesis is that the brand’s value is in making life a little bit easier. That’s what Apple competes on. Of course, some people are not willing to pay to have an easier life and some even want to make their lives more complicated so Apple’s proposal to make life easier, for a price, is not accepted by everybody—which is ok by them. But for many, paying for comfort, productivity and ease of mind is worth quite a bit. The reason Apple is able to gain a premium over the competition is that this value proposal (of paying for simplification) is either weak or non-existent for competitors. Indeed, many competitors compete on the basis of making life more complicated.

6. What does innovation means for Apple right now? What are their options for assuring a next decade of success? A new Steve Jobs person or a Steve Jobs tipe of group thinking. How hard is that to achieve?

Innovation is meaningful invention—bringing useful creations to a large number of people who then make use of that creation. The interesting aspect of making money from innovation is that it’s a rare phenomenon, requiring many disciplines to work together. It’s like a big movie that somehow works and becomes widely popular but costs little to make. Many movies are made, few are successful and very few of those which are successful are built at low cost. What we know about technology innovation is that it’s a combination that comes together under strong leadership but that leadership alone is not sufficient. The myth of Steve Jobs is that he was both necessary and sufficient to success. The truth is that he was necessary but not sufficient. To make successful innovations requires strong leadership and teamwork and a process of incentives and passion that is hard to create a formula for. How this works at Apple is its biggest secret.

7. Who are the key Apple employees right now? Do they need another Jobs or do they already have him?

All Apple employees are key. I would say that’s the magic formula. There is no chief magical officer (and there never was.)

8. What will be the next best thing for Apple? […]

I don’t know. It’s probably not knowable. Continue reading “Twenty Questions from Catalin Stelian Andrei”