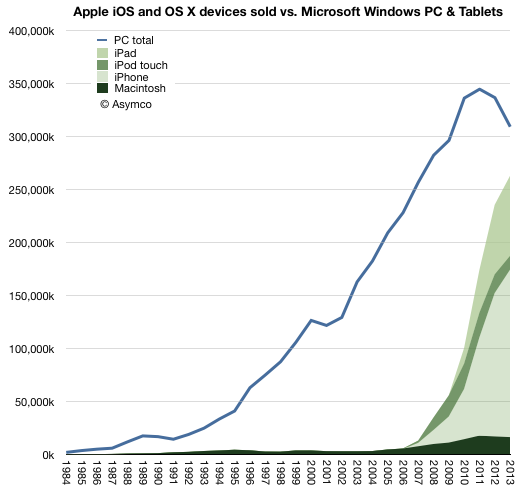

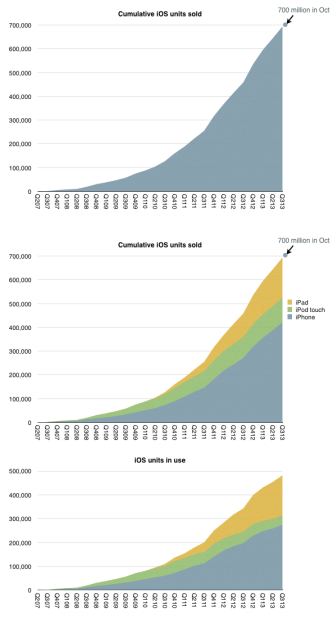

In 2013 there were 18.8 times more Windows PCs sold than Macs. This is a reduction in the Windows advantage from about 19.8x in 2012. This decline is mostly due to the more rapid decline in Windows PC shipments relative to the more modest decline in Mac unit shipments. Gartner estimates that about 309 million Windows PCs were shipped,1 down from 337 million in 2012 (which was down from 344 million in 2011, the year PCs peaked.) I estimate about 16.4 million Macs were shipped in 2013 down from 17 million in 2012.

The history of PC shipments relative to Mac shipments is shown in the following graph:

I chose to graph the Mac data as an area with additional areas for iOS devices layered on top.

Continue reading “When Apple reached parity with Windows”

- This figure is not published publicly but can be derived from subtracting Mac shipments from the total PC shipments which are published [↩]