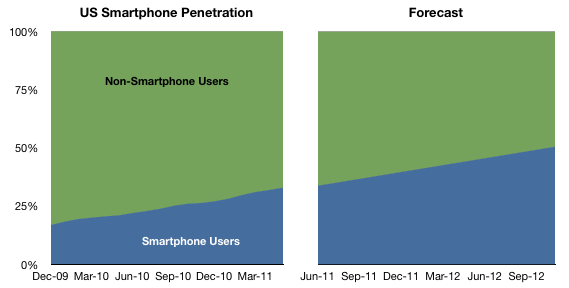

The latest comScore MobiLens is out and it allows an update to the picture of the US phone using population. Through the three month period ending May 2011, smartphones were in use by 76.8 million or about one in three US phone users. Here are some other highlights:

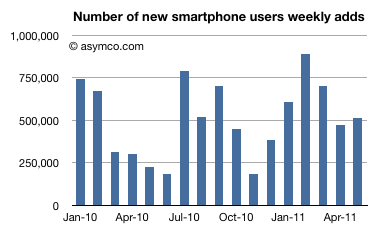

- A total of 513k users switched into using a smartphone every week during the period, a rate of switching consistent with the last 17 periods (average of 510k/wk).

- Penetration of smartphones increased by 940 basis points, slightly higher than the 900 bp increase in the last period but consistent with average.

- Using a four-period trailing average and linear extrapolation, 50% penetration will be reached by August 2012. “Summer 2012” seems a safe bet as that target has not changed much.

I’ve updated the countdown counter (Phone Tipping point at top of right column on this page) to reflect the new date.

The following charts show the penetration and switching rates.