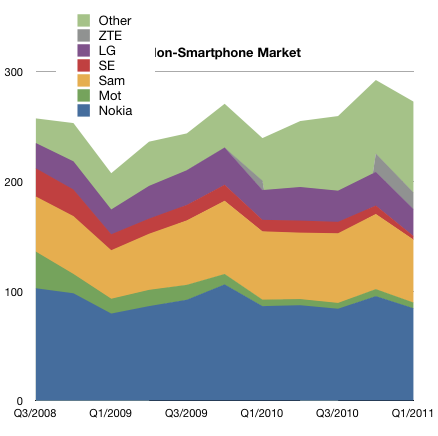

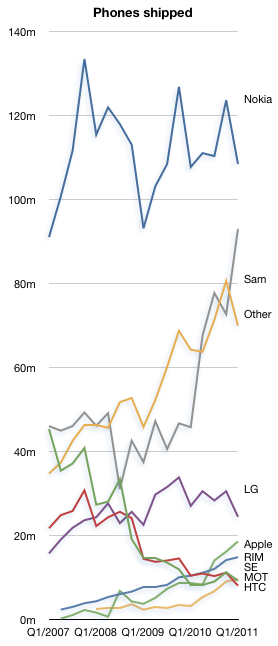

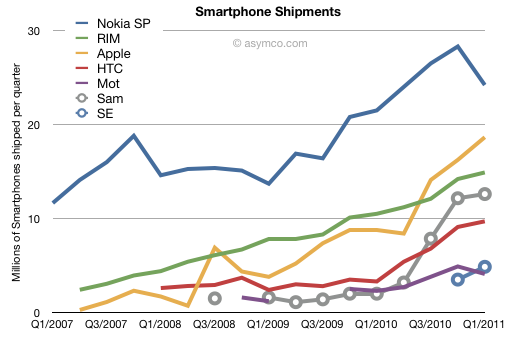

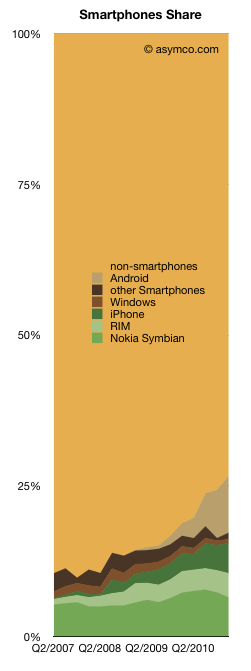

The smartphone market grew to about 100 million phones last quarter. The volumes grew sequentially and as a result reached a new record share of 27% of total phones shipped. The chart on the left shows how this market evolved over the last few years.

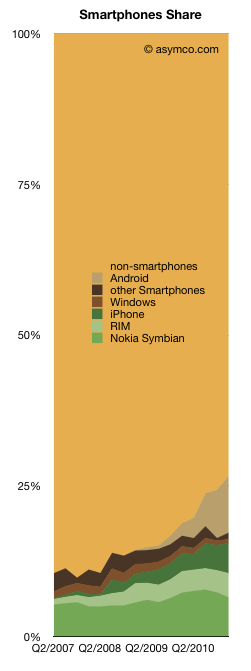

I’ve added each platform’s contribution.

While much of the focus will be on who had what share, the better question might be who has the better chance to beat smartphone non-consumption? Non-smart devices are still the dominant competitors. Though it’s getting easier to win against them, they still have some compelling competitive advantages.

What the chart shows is that Android (and phone versions of iOS) have taken share from direct competitors but have taken more from non-consumption. Rather than focusing on rivalry between platforms, minds should be focused on the shape of the smartphone adoption curve.

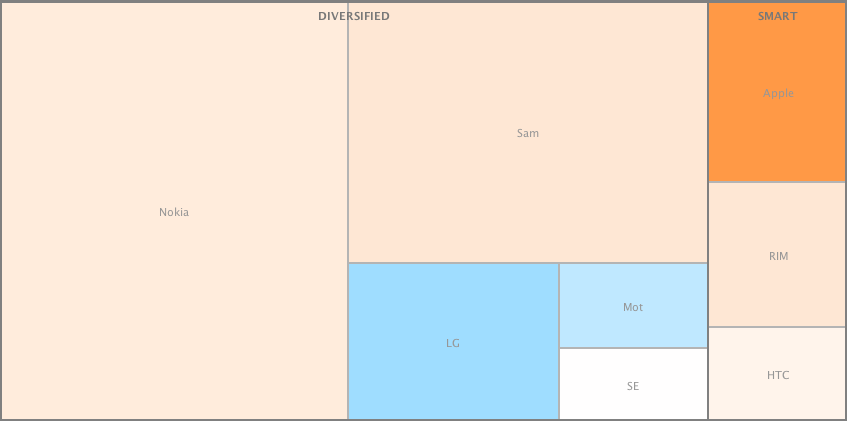

The market is largely un-penetrated and yet some argue that “it’s too late” to enter or that “the game is over” and winners have already been decided. This is an argument that we are at the beginning of the end. Once the market is predictable it’s discountable. Once it’s discountable it becomes economically uninteresting.

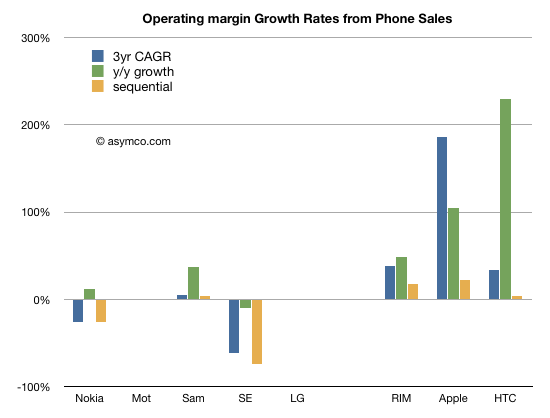

I’ve argued that this is far from certain. In a short span of a few years, a decades old business has been re-defined. But that was just the device side of a larger business. Smartphones have been, so far, sustaining to the telcos who capture the vast majority of revenues and are thus the true incumbents.

If and how they will be affected by further evolution of smart devices and new business models around them remains to be determined.