On the eve of iPad 2.0, it’s time to think again about this curious new computer. My intuition tells me that this product category will behave very differently from the iPhone and will not be subject to the same sales ramp.

The iPad has been on the market for less than a year but it’s still a puzzle for many. It’s a product that’s often seen as an iPhone product line extension. From a hardware point of view, it certainly seems to be. It has an almost identical internal architecture and uses almost the same software. An engineer would look at it and reasonably say it’s the same thing.

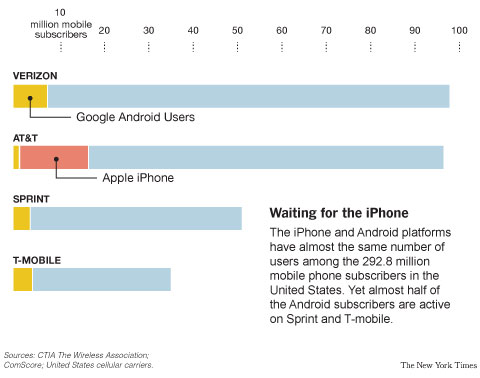

However, from the way it’s used and the way it’s sold, it has very little in common with its smaller cousin. There are plenty of experts who can detail how the products are used differently, but I would highlight the portability of the iPhone makes it suitable for a completely different set of tasks than the less portable but more immersive iPad.

But what I want to dwell on here is how differently the products are sold. Continue reading “Why operators will find it hard to sell tablets”