via AppleInsider | Apple’s iTunes lead increasing, now selling 26.7% of US music.

Market data & competition.

“Checks indicate that US iPad sales remain strong post-launch, driven by rising consumer visibility to iPad’s user experience, sustained PR/word-of-mouth marketing, 3G iPad launch, and broadening iPad apps/content,” Abramsky wrote in a note to clients this morning. “We believe Apple is now selling >200k iPads/week, greater than US Macs (est. 110k Macs/week) and just below US iPhone 3GS first quart (246k/week).”

Retail checks in mid-May showing widespread iPad stockouts at Apple stores and Best Buy. The 3G iPad is sold out at many Apple stores and about 25 percent of them now have only selected Wi-Fi iPads available. Waiting lists are not uncommon.

… Abramsky raised his global iPad outlook for 2010 from 5 million to 8 million.

via Apple Selling More iPads Than Macs | John Paczkowski | Digital Daily | AllThingsD.

iPad is not only outselling iPhone version 1, but, soon, iPhone version 3.

Five weeks ago Apple forecast 100 million iPhone OS devices will be sold by summer. This was fairly easy to predict but the question comes up: when will the next 100 million be sold? And what about after that?

The iPhone OS three-legged platform is now the fastest growing platform ever and enjoying network effects which naturally accrue to platforms under solid custodianship. However, I am observing signals from Apple that they intend this platform to become the global standard for mobile computing, which, in today’s world, means targeting 1 billion users. Here are the signals that I’m noting:

I would point out that all these are marketing, not technical challenges. They are thinly disguised questions about product placement, portfolio, pricing, production and distribution–classic Marketing 101. (Promotion, which is what most people equate with marketing is not particularly challenging, especially for Apple who mostly does it through PR).

It is comforting perhaps to know that Apple is the best marketing organization in the industry today. So to answer the question, 100 million is in the rear-view mirror, 200 million will come up in no more than 2 years and 1 billion will take 5 to 8 years.

In December I reported iPhone controls 46% of Japanese smartphone market | Asymco. Five months later Apple’s share has reached 72%.

According the MM Research, 1.7 million iPhone were sold in the fiscal year ended March 31. That’s not a huge number relative to the 110 million subscribers in the country. But Apple’s exclusive carrier Softbank has only 22 million subscribers so Apple may have penetrated over 10% of that user base.

Continuing from Will Apple rule the iPad market? | Asymco.

The first claim is that

it is unclear if [Apple] will end up dominating the market the way it has come to rule the digital music player market with the iPod.

After hearing a thousand voices cry out that the iPad is nothing more than a bigger iPod touch (which, plainly, it is) it’s amusing to read that its similarity with a sibling ends when it comes to market performance.

Let me make one claim up-front: the iPad is more of an iPod than the iPod.

The original iPod was successful because it had a significant integrated value chain bolted on. Apple disrupted music with a value chain, not a product. It changed the way music is bought, consumed and even how it is produced. It changed the economics from retail down to songwriting.

This is why it came to dominate its market. Every competitor that took a run at it did so with a partial solution to the value chain. Often it was nothing more than a music player, and in some cases (e.g. Zune) it was bundled with some other pieces of technology, but poorly executed and too late.

The iPad comes with an even bigger value chain bolted on: the App Store. Apple is flogging not just an “app player” but also a new way to develop and distribute software. If you cut “music” and paste “apps” you see the immediate parallel between iPod and iPad. The app ecosystem will quickly grow to be larger than the music ecosystem with the mobile software business already eclipsing the music business.

A competitor launching a tablet device will have to somehow overcome the momentum of billions of downloads fed by hundreds of thousands of apps built by tens of thousands of developers for hundreds of millions of users.

The iPod juggernaut pales in comparison to the iPad supernova. The iPod had no apps or dedicated developers. Its ecosystem consisted of a handful of music companies. The only thing that made it “sticky” was the tie-in with one type of content.

The iPad on the other hand has a thousand other jobs to do for its users. It has a rich tapestry of functionality and a multi-dimensional (literally) user experience. It’s a platform. It’s even powerful enough to impose new standards on the web itself and to suggest that search is a bygone activity.

So to suggest that Asus or Dell will somehow build “iPad killers” sounds asinine. These competitors don’t even grasp what the product is and what it’s for. Sony said they don’t see a market for it. Microsoft, trapped in the innovator’s dilemma and overshooting the market by miles, said they don’t understand what the point is because users want full PCs. Google asked what’s the value of a big iPod. I could go on, but there was not a single company in the industry who recognized what they were looking at in January. Apple keeps a tight lid on new products so that competitors don’t get a head-start on copying, but in the case of the iPad, advance knowledge would not have had any impact. Competitors look at the iPad and see nothing. They’ll only react once the market explodes and they start to feel belated pain.

If, and it’s a big if, they do recognize what an iPad is, their response cycle is going to be measured in years. On hardware, they were blown away with a product that had twice the power, half the bulk, twice the battery life with half the price of what they had on the shelf. They may catch up on hardware in a year or two and launch some sort of iPad-like assembly of components, but that is like making the first iPod killer in 2002.

Then there is software. Their software supplier (Microsoft of Google) will have to build a platform that works. That will take years. Years during which the iPad will penetrate every geography, demographic and vertical market.

Google might move more rapidly than Microsoft, but they will produce an open source poster child of a platform. Fragmented and rough around the edges to the point of looking like a hobby project. Their flea market store will also have the smell of fresh glue about it. Microsoft is so far behind the curve that I don’t even think they will try to move the tiller. Their view of the market was betrayed by the recently knifed Courier demoware. To suggest a challenge to the PC/Windows model inside Microsoft is a career-limiting move so don’t expect their brightest to be lining up to propose new platforms to management.

What about HP? Assuming they overcome the pitfall of NIH that kills 80% of integration efforts, they will still need to perform an enormous amount of heavy lifting to get WebOS to be a competitive experience on a tablet. Most opinions were that Palm came pretty close with a smartphone, but that was nowhere near enough to stay alive, never mind challenge iPhone.

Then there is the ecosystem. Building it is just not something I can even begin to roadmap. What about developer tools, SDKs, frameworks and evangelism? With a Palm division, HP is the best positioned of the PC vendors but it has a chance at being a player as much as Creative did vs. the iPod, or needless to say, Palm vs. the iPhone.

So the iPad challengers face five daunting obstacles:

That does not even touch the logistics, sourcing, margin and pricing challenges of world-wide distribution of the whole value chain. Nor does it cover the lock-in of advertisers to new tools for creatives or the billions of daily views from a platform that is blindingly dazzling.

To put it in the language of disruption, by the time the competitors launch symmetric attacks on the iPad, Apple will be the incumbent. And we all know that symmetric attacks never work against entrenched incumbents who have all the levers of power at hand to deploy in a withering counter-attack.

This question sounds like a tautology. It’s like asking “Will Apple rule the iPod market?” But redundancy has not stopped WSJ journalist Benjamin Pimentel from asking. His answer to the question is below:

But while Apple apparently has the edge in the emerging tablet war, it is unclear if the company will end up dominating the market the way it has come to rule the digital music player market with the iPod.

Gartner’s Fiering said the iPad has “raised the bar and suppliers are now scrambling to make sure they get it right.”

IDC now projects 6 million tablet devices to ship this year, including 4 million iPads, Shim said. But while Apple has taken the lead, he added, the company faces the “burden of lifting or defining this entire new market,” because there are no other competitive devices available.

“In the iPhone market, they learned from everybody else,” he added in a video interview. “In this new space, there’s nobody else to kind of bounce ideas of so to speak.”

But Apple may not have to feel so alone for long.

Fiering specifically pointed to H-P’s as the best positioned challenger, given its scale, reach and its upcoming merger with Palm.

“There are not too many suppliers that can pull all those pieces together,” she said. “H-P could if they integrate the Palm acquisition properly.”

Another IDC analyst, Crawford Del Prete, agreed saying, while the “buzz” from H-P had generally been defensive in relation to the iPad, “the longer term story is far more interesting.”

“Given H-P’s massive scale, I think they have the ability to drive new price points for this kind of product,” he said. “With a lower price point, the category becomes far more interesting.”

via PC Makers Look To Challenge Apple’s IPad – WSJ.com.

Before diving into the statements above it’s worth noting where the journalist went to get opinions to fill his column. He called Gartner and IDC. Quoting industry analysts is a standard operating procedure to fill column-inches with material that does not offend. But how good are they?

In my years of watching those who watch markets I formed a ranking of analyst types and their likely accuracy with respect to prognosticating a market shift. In order from most accurate to least accurate:

You might notice a pattern here: the closer you are to the market, the less likely you are to observe how that market is crumbling around you. You cannot see the forest for the trees.

How could this be? How can having more access give you a poorer picture? The answer lies in the asymmetry of a disruptive attack. The more you know about how things are the less you know about how things could be.

In practice, the analyst information value chain works like this:

Corporate analysts feed information to management that management is comfortable digesting. Those managers then hire industry analysts to validate their opinions. Industry analysts are keen to maintain a relationship with those firms and so they listen carefully to the prejudices of their clients. They then hold up a mirror to those myths and consolidate those opinions for wider distribution and quotation by journalists at respectable publications.

Stock analysts listen with one ear to the chatter but with the other to the way the wind blows with the stock market. Sometimes they actually sample the data in the value chain directly by calling acquaintances in the market and hire interns to watch what’s happening in the shops. They then build an opinion that has some level of surprise but that they hope will not stray too far into controversy so that they can keep their jobs in case they are wrong. The safe bet is always to say that things will stay mostly the way they are, but to say it in clever ways.

So that just leaves only one group of analysts with independence from a paycheck who can make an opinion on the basis of facts alone.

This post has become longer than I planned, so I’ll dive into the exact answer to the article claims in part II.

The app store crossed 200k apps in early may and is on its way to a quarter million apps approved by end of June.

On the way to this total, the rate of addition of apps has been increasing to around 630 apps added every day. What’s perhaps interesting is that this app add rate has not been increasing in a steady way.

The graph below shows how the add rate has been increasing (sourced from 148apps.biz). During the first year, the add rate was increasing steadily. Then it reached a plateau of about ~350 apps/day for six months in the later half of 2009. Then it jumped dramatically in December to over 800/day and then leveled off to an average of 680/day during the last 6 months.

The pattern could be due to the rate of applications being submitted changing or due to the rate apps are approved. Clearly there is a seasonal explanation for the December jump, but the rate has held pretty steady after that month and has remained far above the rate during the trailing six months.

My guess is that the app approval process and resourcing for the task has been improved during the last six months. On a monthly basis the new normal seems to be around 20k apps/mo.

Google gives up on Nexus One online store, moves to retail | Electronista.

So much for Google the Shopkeeper.

UPDATE: This also puts the idea of Android generating any revenue for Google at a logical dead end. As it stands tactically and strategically, Android is a financial black hole in perpetuity.

Android remains, in my opinion, Google’s biggest failure.

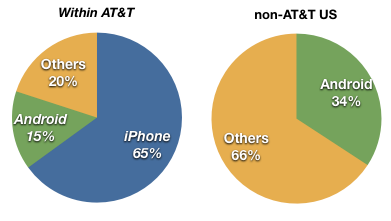

Following up on my last post on how misleading US-only share comparisons can be, I decided to draw charts to visualize the comparison.

As Android and iPhone compete in various ways, it’s hard to see which is the preferred choice given a direct comparison. In other words, iPhone and Android devices rarely are placed next to each other with similar terms.

Take the US market for example. The overall data from NPD suggests that last quarter Android reached 28% share vs. 21% for iPhone. Many of those Android devices were new to market or at least newer than the iPhone which in Q1 was coming to the end of its product cycle. Second, pricing for Android devices seems to have been quite aggressive with buy one get one free sales. But I won’t dwell on tactics now; what I do want to note are the differences in share between AT&T users and non-AT&T.

Note that within AT&T, iPhone outsells Android over 4 to 1. iPhone also outsells “others” (mainly RIM) more than 3 to 1. However, outside AT&T, where the iPhone is not available, Android does not outsell “others”.

Note that within AT&T, iPhone outsells Android over 4 to 1. iPhone also outsells “others” (mainly RIM) more than 3 to 1. However, outside AT&T, where the iPhone is not available, Android does not outsell “others”.

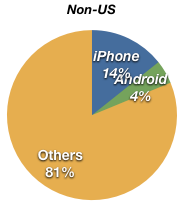

If we exclude the US altogether, we also see that Android does not have a great distribution.

Outside the US, the iPhone also outsells Android nearly 4 to 1, but it has a way to go before challenging Symbian which makes up the bulk of “Others”.

Outside the US, the iPhone also outsells Android nearly 4 to 1, but it has a way to go before challenging Symbian which makes up the bulk of “Others”.

So in markets where Android is head-to-head with the iPhone (AT&T and non-US markets), iPhone’s lead is quite high (still). The possibility still exists that Android will overtake iPhone given the broad licensing and distribution, but it’s not necessarily a given. And in any case, iPhone is not the market share leader today and that leadership does not seem to be their objective (note the pricing).

The bigger question is what will happen to RIM and Symbian as Android grows.

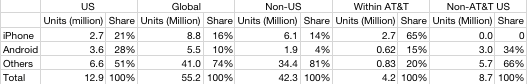

Much ink is being spilled over Android outselling the iPhone in the US in Q1. Here’s what NPD survey data shows:

The table below combines the NPD, AT&T, and Canalys data to show units for iPhone and Android in the US, Global and non-US regions.

One can only wonder what would happen if iPhone would be available non-exclusively. Would iPhone achieve greater than 60% share as it did on AT&T? Certainly that’s what happened in France.