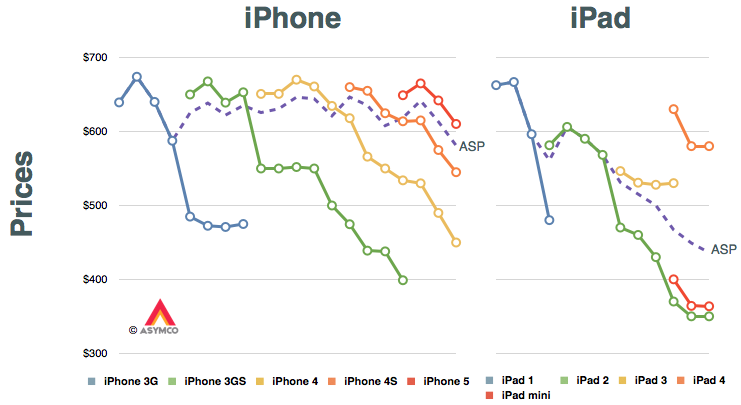

The answer may lie in the way the iPad mini has been marketed. The pattern for iPhone pricing is pretty regular but that for the iPad shows a marked difference. The reason is, of course, that the iPad has already gone through a portfolio broadening. The following graphs tell the story.

Category: Market

Market data & competition.

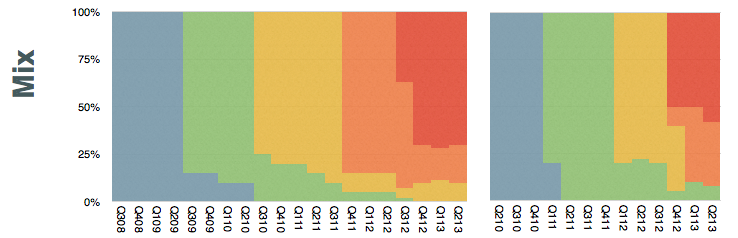

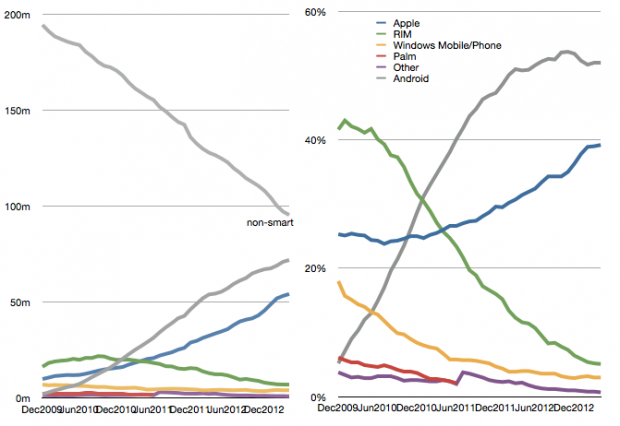

Signs of US Android net user decline

ComScore’s latest survey for US smartphone users showed that Android had 52% share of about 142 million users. That amounts to 73.84 million Android devices in use.

ComScore’s previous such survey showed that Android had 52.4% of about 141 million users. This amounts to 73.88 million Android devices in use. It also means that Android usage in the US went down for the first time.

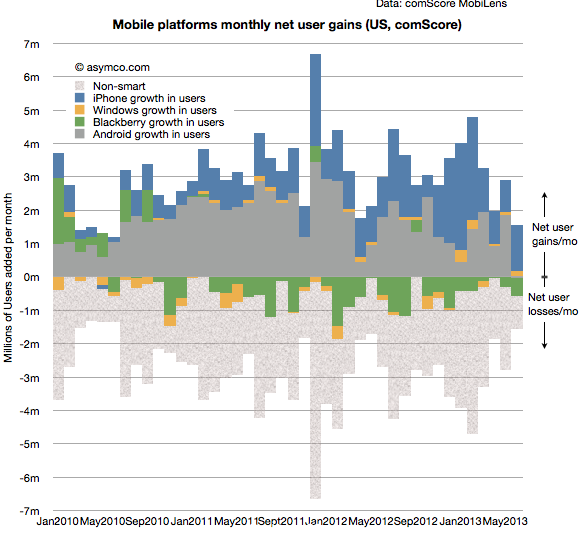

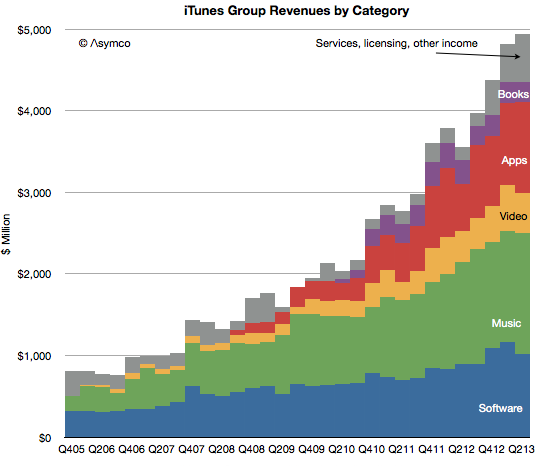

iTunes Update

In the latest quarter the iTunes group top line grew by 25%.

Additional newly reported items:

- Quarterly revenues dipped slightly to $4 billion (second highest after $4.1 billion last quarter).

- iTunes Stores billings (i.e. gross content revenues) were $4.3 billion

- Reached the best month and best week ever for App Store billings at the end of the quarter.

- iTunes billings translated to quarterly revenue of $2.4 billion, up 29% from the year ago but flat q/q. Company reports “strong growth in revenue in both content and apps.”

- New content added includes HBO GO and WatchESPN available on Apple TV. Apple TV catalog now includes over 60,000 movies and over 230,000 TV episodes.

- Users have downloaded more than 1 billion TV episodes and 390 million movies from iTunes to-date. They are purchasing over 800,000 TV episodes and over 350,000 movies per day.

- iOS developers have now created more than 900,000 iOS apps including 375,000 apps made for iPad. Apps created grew by 50,000 overall and 25,000 iPad apps.

- Cumulative app downloads have surpassed 50 billion.

- App developers are being paid at the rate of $1 billion per quarter.

- App developers have been paid over $11 billion for their sales through the App Store (half of which was earned in the last four quarters.)

- There are now over 320 million iCloud accounts

- There are 240 million Game Center accounts

- Almost 900 billion iMessages have been sent

- Over a 125 billion photos have been uploaded and over 8 trillion notifications were sent.

Some observations and estimates:

- Music revenue growth remains at around 15% while video revenue growth remains around 25%

- Apps continue to accelerate with a near doubling of revenues

- Book revenues are contracting as pricing pressure is being felt

- The software group grew moderately at 15% as Apple’s apps are reaching saturation within the iOS user base and as Mac sales stagnate.

As a reminder, you can order the iTunes Business Review from the Asymco Store.

The iPhone Stores

Here are the latest performance figures for the Apple stores:

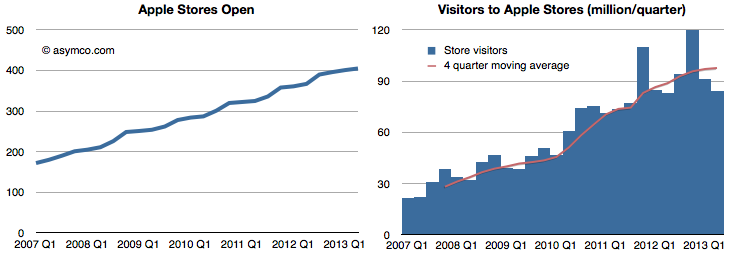

Stores Open and Visitors

Visitors per employee,Visitors per store, Revenues per store and Employees correlated with Visitors. Continue reading “The iPhone Stores”

What's an Android user worth?

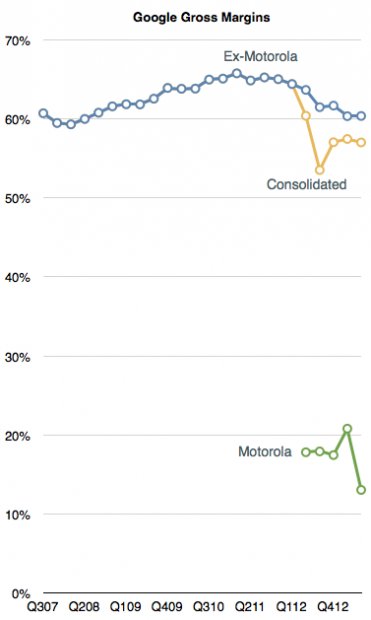

Excluding Motorola, Google’s gross margins have dropped for six out of the last nine quarters. They peaked at 65.8% in early 2011 but have now dropped to 60.4%. Including the drag from Motorola they are down to 57%.

Gross margins include the effect of price, volume and direct costs of sales. Although sales have grown (see graph below), the pricing Google has been able to obtain (CPC) has fallen. The cause is unknown but there is a strong correlation between the growth in their mobile channel. For their part, management cites mobile as having an effect in reducing CPC though they caution that it’s one of many factors. Continue reading “What's an Android user worth?”

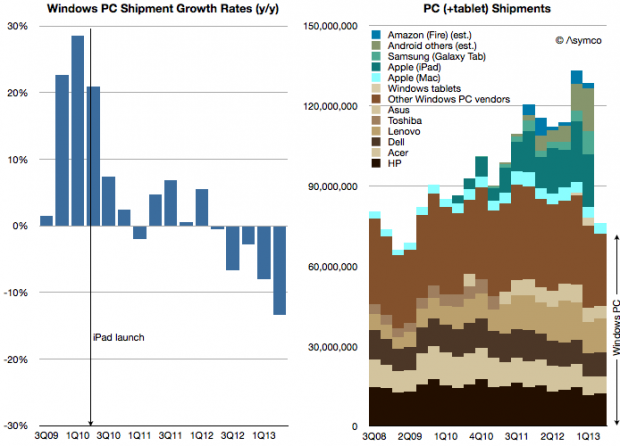

The PC Calamity

As Intel has improved its products, their demand has decreased. Enormous efforts put into improvements are neither valued nor absorbed. The problem is not with the processors themselves but with the systems within which they are built:

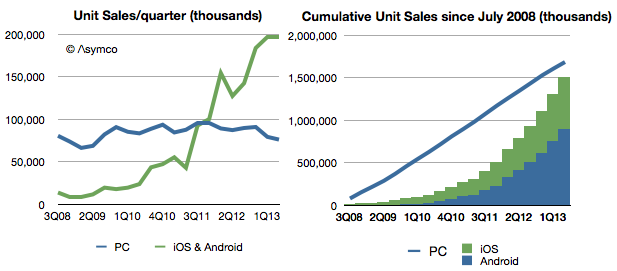

PC sales fell again last quarter and the contraction is likely to continue. We received affirmation of this as Intel cut sales and earnings forecasts and the crucial capital spending that creates supply in the longer term.[1]

At the same time, computing device sales have soared.

Even excluding Android devices which don’t register with Google’s Play Store (and excluding Windows Phone devices), mobile ARM devices are selling at 2.6 times the rate of Intel-powered devices. Put another way, since the birth of Android nearly as many iOS and Android devices have been sold as PCs.

In terms of install base, a computing category that did not exist six years ago has come to overtake one that has been around for 38 years.

The calamity for Intel has been that they have had no part to play in the new category. Perhaps that is because they had every part to play in the old category.

—

Notes:

- Intel said it was cutting 2013 capital spending to $11 billion. The cut follows a reduction from $13 billion to $12 billion in April. Apple’s budgeted capital spending for fiscal 2013 (ending September) was set at $10 billion.

"Everybody has got a smartphone"

… says UBS analyst John Hodulik, as quoted by the Wall Street Journal.

No they haven’t.

According to the latest comScore survey data, 98 million Americans above the age of 13 don’t use a smartphone as their primary phone. That’s 41% of US mobile phone users.

What’s more, 2.5 million more people first started using smartphones in the three month period ending May vs. the three month period ending in April.

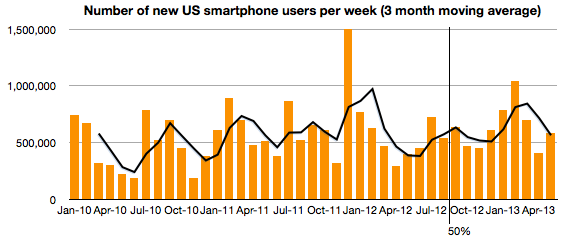

The switching rate to smartphones is shown below:

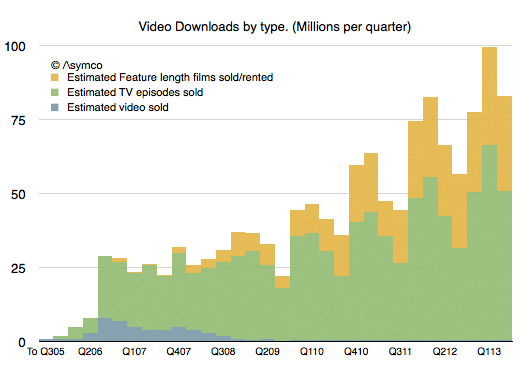

Measuring the iTunes video store

It’s been five years since we had an update on TV show downloads and six years since we’ve had an update on movie downloads from Apple. In Q3 2008 Apple announced 200 million TV show downloads and in Q2 2007 2 million movies. That’s a long period with no information making a tough extrapolation to the present.

Nevertheless, I tried. My estimates for these two quantities were 963 million TV Shows and 108.2 million movies to date.

So I was quite surprised to see that figures for both TV show downloads and Movie downloads were published today. The figures were 1 billion and 380 million respectively.

My TV show forecast has proven to be very accurate but I severely underestimated movie download rates. Apple states that the movie download rate is 350k/day. My estimate was only about 126k/day.

After adjusting for the new data, the picture of downloads that emerges looks like this:

The overall iTunes gross revenues by sub-component becomes: Continue reading “Measuring the iTunes video store”

Measuring the latest iOS accessory market

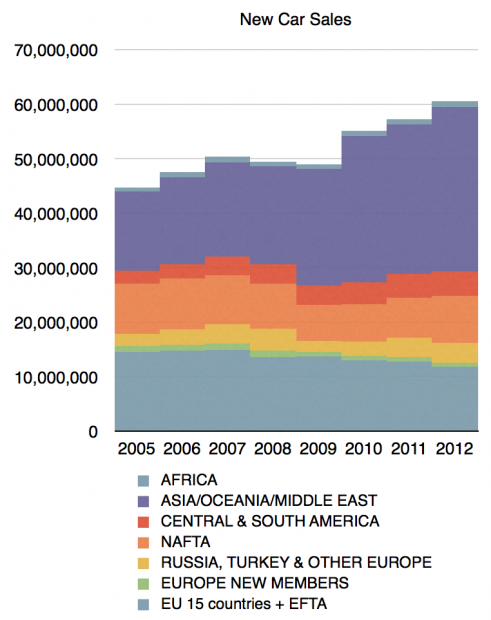

One of the most startling announcements during the WWDC 2013 was iOS in the car. The mockup that was shown seems to indicate the use of the car’s in-dash display as an “external monitor” for an iOS device while control would come from inputs using Siri.

The technical details were not released so it’s hard to know the protocol used to accommodate this interface. However it seems that it will be generic enough that a number of launch brands signed up for the launch. The list includes Honda, Mercedes-Benz, Nissan, Ferrari, Chevy, Infiniti, Kia, Hyundai, Volvo, Acura, Opel and Jaguar.

Is this a significant opportunity?

Before we get excited, it’s important to note that this will likely take a very long time. It won’t even begin until 2014 and the number of new models may trickle into showrooms quite slowly. Consider that the time it took for automakers to universally support external audio input (mostly the trivial line-in) was about a decade.

To also curb our enthusiasm we need to realize that the car industry does not produce many units. In 2012 there were over 60 million cars produced (with the following regional mix:)

In contrast, 60 million is about the number of phones sold every two weeks. In 2013 there will be more iPads sold than cars.

In particular the companies mentioned had the following production figures in 2011: Continue reading “Measuring the latest iOS accessory market”

Measuring US Mobile Platform Shares: Kantar vs. comScore

The latest comScore US smartphone install base data is in and there are few surprises. iPhone has reached a new record high penetration (39.2%) and user base (54.3 million). Android has reached a new high in user base (72 million) but share at 52% is below the peak reached in November 2012.

This pattern of gradual iPhone share gain in the US has been consistent for over two years even while Android has catapulted into an overall lead. The surprising thing is how Android seems to have peaked in share. There are still 95 million non-smartphone users and there seems to be headroom for growth even though the other platforms have been tapped out. But it does not seem that Android phones have any particular advantage over iPhone. My hypothesis remains that as price is taken out as a differentiation, the adoption of iOS is slightly higher than Android.

Another measure of market performance is the implied net platform user gains which is shown below: Continue reading “Measuring US Mobile Platform Shares: Kantar vs. comScore”