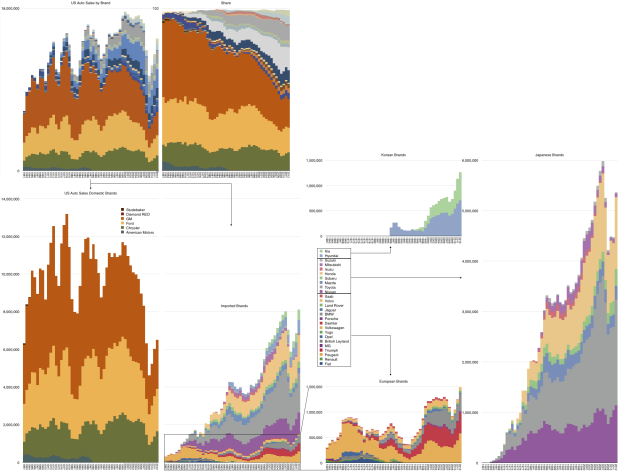

As automobiles become smartphone accessories, they become an interesting industry to study. Here is a recent (since 1961) history of the US market.

Category: Nostalgia

Mostly claim chowder.

Dark Matter

Benedict Evans explains well the problem with measuring Android tablets. There are no reliable data collected because many of the devices are invisible through the regular, measurable channels:

- There are no firms which report their shipments

- They are not sold through retail chains which normally are sampled in the US and Europe (NPD and GfK respectively.)

- They don’t show up in browsing or ad transaction data

- Google Play statistics are missing most of the activations since they are not sold as bona fide Google-sanctioned Android.

The only measured statistic happens to be component shipments. Items such as screens, CPUs or perhaps memory might be visible to market analysts. It’s therefore tempting to add up tires manufactured to determine what’s getting sold in auto dealerships.

But it’s also hugely problematic.

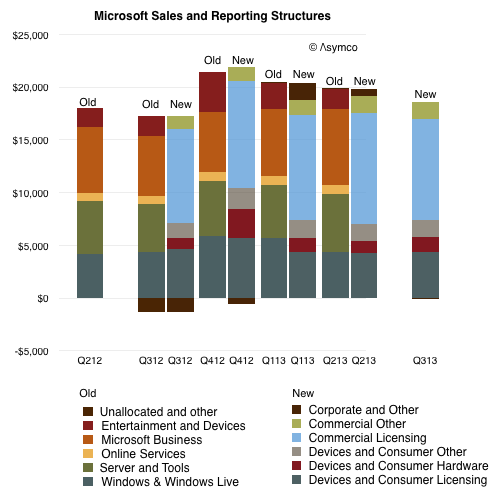

The newly integrated company

During the first quarter of fiscal year 2014, we changed our organizational structure as part of our transformation to a devices and services company. As a result of these changes, information that our chief operating decision maker regularly reviews for purposes of allocating resources and assessing performance changed. Therefore, beginning in fiscal year 2014, we are reporting our financial performance based on our new segments; Devices and Consumer (“D&C”) Licensing, D&C Hardware, D&C Other, Commercial Licensing, and Commercial Other.

The previous reporting segments were:

- Windows & Windows Live

- Server and Tools

- Online Services

- Microsoft Business

- Entertainment and Devices

- Unallocated and other

The new are:

- D&C Licensing: Windows OEM licensing, Consumer Windows, Consumer Office, Windows Phone (including related patent licensing)

- D&C Hardware: Xbox 360, second-party and third-party video games, and Xbox LIVE subscriptions; Surface; PC accessories

- D&C Other: Resale, including Windows Store, Xbox LIVE transactions, Windows Phone Marketplace; search advertising; display advertising; Subscriptions including Office 365 Home Premium; Studios including first-party video games; retail stores.

- Commercial Licensing: Windows Server, Microsoft SQL Server, Visual Studio, System Center; Windows Embedded; volume licensing of Windows; Microsoft Office for business (Office, Exchange, SharePoint, and Lync); Client Access Licenses; Dynamics, Skype.

- Commercial Other: Enterprise Services, including Premier product support services and Microsoft Consulting Services; Cloud Services, comprising O365, other Microsoft Office online offerings, Dynamics CRM Online, and Windows Azure.

From Microsoft’s FY14 Q1 10Q via Microsoft Investor Relations – Press Releases

The mapping between the old and new is not straight forward. There is overlap between D&C Licensing and the old Windows and perhaps between Entertainment and Devices and D&C Hardware but there are many gaps. There is also some overlap between the old “Business”/”Server” segments and the new “Commercial” but, again, they cannot be matched.

I show the difference between the two structures in the way revenues are allocated below, using color to try to show similarities.

Given the re-stated quarters it’s possible to compare one year’s historic performance at a segment level. For example, Continue reading “The newly integrated company”

The Meanings of Appleiness

I’ve never worked at Apple and know very few people who did. Nevertheless, I read Adam Lashinsky’s book and enough Folklore.org that I think I can get away with replying to the Meaning of Googliness with the following:

| Googliness means | Appleiness means |

| Doing the right thing | Doing the best thing |

| Striving for excellence | Striving for greatness |

| Keeping an eye on the goals | Keeping both eyes on your task |

| Being proactive | Being obsessive |

| Going the extra mile | Going to the moon |

| Doing something nice for others, with no strings attached | Doing everything for the user |

| Being friendly and approachable | Keeping your mouth shut |

| Valuing users and colleagues | Valuing functions other than your own |

| Rewarding great performance | Punishing failure |

| Being humble, and letting go of the ego | Keeping your mouth shut |

| Being transparent, honest, and fair | Keeping your mouth shut |

| Having a sense of humor | Never writing a post on what Appleiness means |

Happy Birthdays

Today is the iPad’s third birthday. It’s also the mobile (cellular) phone’s 40th birthday.

Whereas the launch of the mobile phone was probably an obscure event, the launch of the iPad was greeted with derision.

It is perhaps with irony that we should greet this auspicious confluence of anniversaries.

The last feature phone

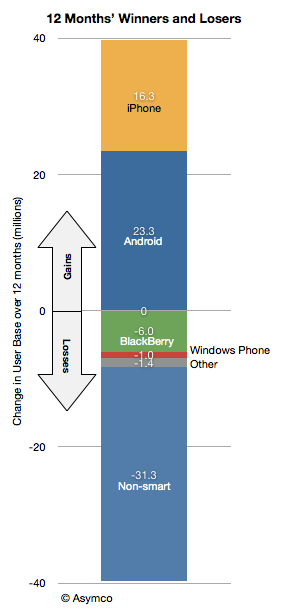

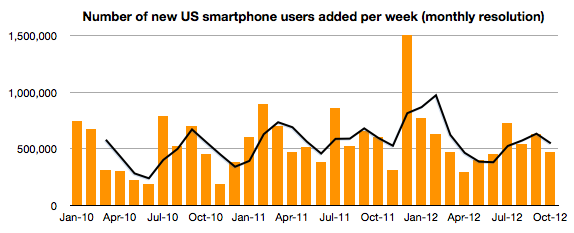

During the last 12 months 31 million American phone users abandoned the use of feature phones. During the last 24 months over 60 million switched. Over 550k users are switching every week and this rate of switching has not changed much since late 2009.

On not being boring: A dramatic reading of Apple's share price

Apple’s renaissance began with the iPod. This was not evident right away however. The product was unveiled on October 23, 2001 at a time when Apple’s share price had just fallen 70% from year-earlier levels. It was perhaps a good point from which one could expect a recovery to begin.

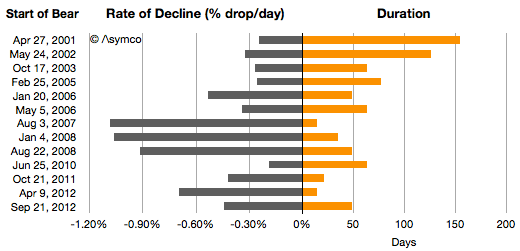

It was not to be. One year after the iPod’s launch the stock price had fallen another 20%. Indeed during 2001 the company was in the throes of a “bear market” in its shares. If we measure a time of persistent share price reduction as a bear market, then the one in 2001 was significant. For 154 days, between April 27 and September 28, 2001 the shares fell 38%. This represents the first bar in the following graph showing all the Apple bear markets since then.

I also illustrated these bear markets in terms of their duration and the average %drop/day.

Chronicling these periods: Continue reading “On not being boring: A dramatic reading of Apple's share price”

Nokia's price for exclusivity

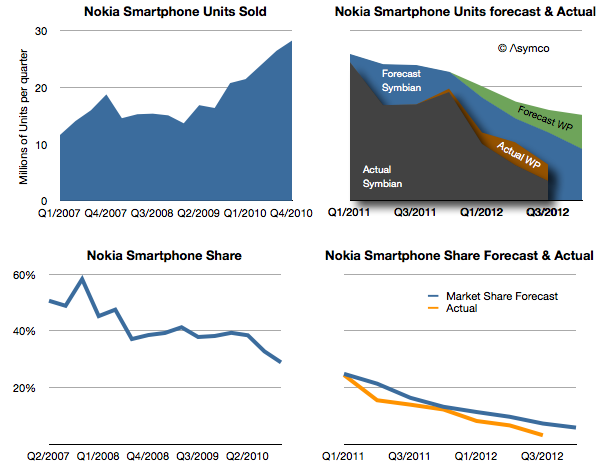

Days after Nokia announced the end of life for the Symbian platform I wrote a post titled Who will buy the next 150 million Symbian smartphones? The reference was to claim by management that before there would be a complete transition to Windows Phone, 150 million legacy Symbian phones would be sold, keeping the company financially stable before the new ecosystem took root.

I reproduce the original forecast I made below with the addition of what actually happened.

The omnivorous app

Marc Andreessen famously coined the phrase “software is eating the world.” It’s an apt observation. If you look back on the history of computing you’re likely to measure computers sold or devices sold or users harvested or productivity gained. These things are measured because they can be measured. But the greatest cause of value created and captured has been the development of software. An ephemeral product whose value is often ignored in analytical discourse.

Software is not easily measured and it’s not easily valued due to its intractable nature. Firstly, because businesses that make software tend to have weird cost structures–absurdly high fixed costs and operating margins: They operate without income for years and then suddenly are massively profitable with a minimal set of resources. They have a non-linear, “big bang” trajectory.

Secondly, software companies tend to capture revenues from something other than the direct sale of the good. Software is rarely sold. Services sometimes are sold on the basis of software but more likely audiences for services are sold to a set of bidders, or revenue is obtained in even more circuitous ways.

Thirdly, because there are curious multi-sided markets for software platforms. Charlie Kindel hints strongly at how difficult it is to understand the dynamics of software platforms. There is the prospect of lock-in of users and data. There are relationships to nurture with developers and there’s the principle of an ecosystem that creates network effects. The virtuous/vicious cycles are non-linear and unpredictable even for the experts who have been at it for decades (e.g. Microsoft).

5

It looks like the next iPhone will be called the iPhone 5. What’s in a name? As it turns out, quite a lot.

Every hardware product that Apple has released has had a brand and a sub-brand. Macs for example use the Mac brand and a sub-brand as follows:

- iMac

- Mac Pro

- Mac mini

- MacBook

Thus each sub-brand imparts certain meaning to the buyer. i, Pro, mini, book are all evocative. MacBook even has its own sub-brands:

- MacBook Pro

- MacBook Air

These Mac sub-sub-brands of Pro and Air are specifically designed to also distinguish and convey meaning.

iPods as well use the iPod brand followed by a sub-brand.

- iPod Classic

- iPod touch

- iPod mini

- iPod shuffle

- iPod nano

Note how the mini sub-brand was retired from the iPod line to be used exclusively in the Mac product line. That may not be specifically necessary or desirable but it is an interesting coincidence. (The Pro sub-brand is shared between different Mac lines)

However, when we look at the iPhone and the iPad, the nomenclature has been distinctly different. Both products have been using generational naming conventions. This implies no sub-branding as the iPhone and iPad are the only identifiers of brand and hence the only meaning being imparted to the buyer. You either get an iPhone or and old iPhone.

That changed with the iPad however. The third generation iPad became just iPad. This was deliberate (why would they want to confuse buyers?) I think there is some logic to this.

Note the parallel to the convention of the original iPod. When the iPod launched it was just the iPod. Subsequent versions were identified by a generation, but not a specific sub-brand. After the third generation iPod (still called iPod), the mini version was launched, creating the sub-brand convention that remains in use to this day. The iPod therefore was born generational but switched to sub-branding in adolescence.

The possibility exists, therefore, that there will be a sub-brand for the iPad. Perhaps “mini” is being reserved for a new iPad, to distinguish it from the regular iPad (no sub-brand) that is likely to remain in production. The logic is to make room for sub-brands when the core brand begins to cover a wider array of form factors, themselves proxies for separate use cases or jobs to be done.

So what about the iPhone?