The Earth’s axis is tilted relative to the orbital plane it follows around the Sun. The angle is about 23.44 degrees. Because of this axial tilt, the intensity of sunlight incident on the northern and southern hemispheres varies alternatively throughout the orbit, which, by its duration, is called a “year”. This change in sunlight intensity causes weather changes. Colder when there is less light, warmer when there is more light. Life on Earth became used to this cycle and humans came to call these changes in weather “seasons”.

The warm seasons became the easier seasons for people, especially when agriculture was introduced, since that was when food grew. Because of the geography of landmasses on Earth, humans became more concentrated in the northern hemisphere. As the northern hemisphere turned away from the Sun darkness and cold returned every year. When that darkness was at its worst people decided it was time to celebrate the return of warmth and sunshine, and thus plentiful food.

So it became very common in northern lands to celebrate the winter solstice or the darkest and coldest time of the year. The amazing thing was that all peoples did this regardless of culture or geographic location. In fact, it became common to mark the end of year at around the same time as the solstice. A new year was said to begin when the Sun began to move higher in the sky every day. The Europeans celebrated the solstice with a festival which eventually came to be called Christmas and the Chinese celebrated it as a Winter Festival which came to be called Chinese New Year.

As part of these celebrations, gift giving also became the default practice. And so, around what came to be called “December” and “January” most of the people in the Northern Hemisphere gave gifts to each other. Interestingly, as people migrated to the southern hemisphere they kept the same festival schedule so that gifting was done in what was the height of summer!

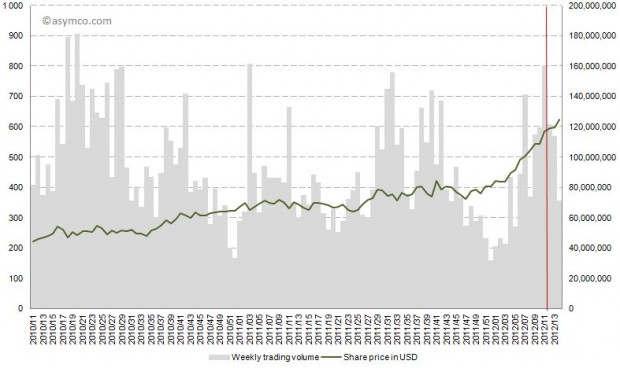

What Wall Street seems to have missed is that the gifting season is a global event spanning into January. In other words, buyers of iPhones aren’t concentrated in one part of the planet and they don’t all celebrate one single gifting festival.

The reason lies in the way the Earth is tilted and the way the continents are arranged upon it. So perhaps a better understanding of astronomy and geography would have helped investors make decisions during the past few weeks. I suggest remedial lessons for those who missed this.