Building a successful business is hard. Many try, few succeed and those that do tend not to thrive for long. So success in business it should be respected. Especially in highly competitive industries like technology. The fragility of success however should also give one pause to think about how delicate a business model is.

The presumption that companies can shift business models at will is usually false. Businesses are balanced on a knife’s edge of dependency on multiple variables. Almost all resources are expended on preserving this balance.

This being my observation, I take issue with assumptions that large companies can “pivot” on a dime or that they can change their business models “when conditions are right”. Consider Microsoft’s dilemma. They have all the resources in the world and yet they could not pivot to take advantage of a change so mundane as a low power microprocessor (which enabled a mobile computer and hence a new ecosystem and profit model for software.)

Or consider the dilemma of Apple which after building a successful computer business which included system software, could not pivot to license that system software so others could build computers with it.

Or consider the dilemma of Nokia which had an early and large leadership in smartphones including having its own OS and platform and large volumes and users bases. It could not pivot to allow into an ecosystem and had all its advantages disappear.

Each company thought they could manage change but none of them actually did.

It’s with this thinking about inertial navigation that came to consider the idea that Amazon has a flexible business model which, though unprofitable today, will be profitable some day.

The premise that Amazon can, on a whim, change its business model from selling other people’s products at a razor thin margin while investing in capital-intensive distribution to selling other people’s products at a large margin while not investing in capital-intesive distribution is not credible.

I would argue that Amazon’s existing business model is a direct consequence of the market it’s in: that it could not be anything else given the circumstances it finds itself in. Enlightenment may be an illusion.[*]

That’s not to say that there is no wisdom in the management of Amazon. Quite the contrary; recall the respect that’s called for in creating a great business. Managing the business to this point was a work of decades of vision and creativity.

What I take issue with is the premise that Amazon is the “anti-Apple” in its hunger for growth and patience for profits. Apple has its own “Amazon-like-business”: iTunes has been growing at a steady 25% or more and it also has its ancillary zero-profit hardware analogue to the Kindle called Apple TV. iTunes is a great business in the Amazon vein, harvesting hundreds of millions of users (and their credit cards.) Presumably iTunes could also some day “flip the switch” and become profitable, but something magical needs to happen. Something like becoming a payments processor or retailer of other things. Analyst beware however. There might be conditions that make such switch flipping extremely difficult.

At an even deeper level, Apple and Amazon are much more alike than they are different. They are both hired for similar jobs (convenience, ease of use and a controlled, predictable environment for average users interacting with technology). They both focus on delighting customers and controlling all the variables which come into contact with that delight. They both have long-term views and are driven by vision rather than competition.

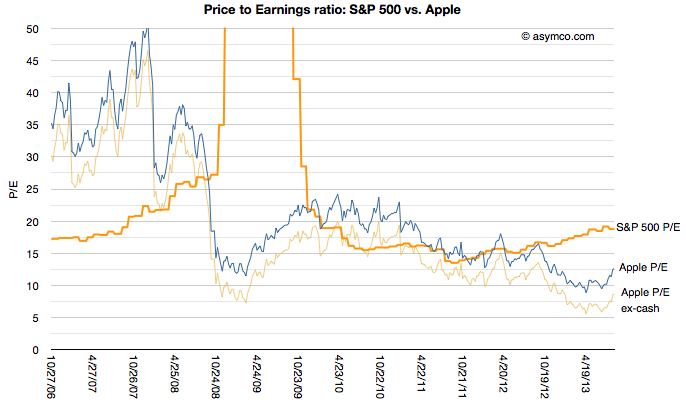

Where they differ is in others’ perception of sustainability. Whereas Apple is perpetually given an expected lifespan of less than a decade, Amazon is expected to have an indefinite lifespan. This is because Amazon is seen as having no competition and Apple is seen as having infinite competition. In other words, Amazon is perceived as a monopoly and Apple is perceived as the innovator that is in a permanent state of being disrupted by the low end.

I disagree with both assumptions. I’ve always thought Apple fragile but dedicated to moving into new markets as older markets are disrupted. It’s a tough strategy and one which (literally) nobody believes possible. But I’ve also thought Amazon’s monopoly status fragile. This too is not a popular idea but the company depends on many variables.

Retail is hard and it is being disrupted by technology wielded well by Amazon. But it’s also subject to further disruption. Amazon’s job to be done can be done by alternatives. Buyers are typically hiring Amazon for convenience, not just price and ease of use is where the value is. But again, new information technology which makes shopping, discovery and delivery of products directly from the vendor, bypassing the aggregator (i.e. retailer) could shift value along the value chain yet again.

By the time Amazon reaches some point of monopoly in distribution it could be too late to make the switch to profit generation.

I don’t want to suggest that failure is inevitable, but I want to point out that success is not certain by any means. Disruption happens.

—

* It’s possible that Enlightenment is also an illusion at Apple. Even if they once had it, there are forces which act on companies that make them lose their wisdom.