I’m registered as a member of the Press and will be attending the MWC 2011 in Barcelona February 14 through 15th. Please email me if you would like to schedule a meeting.

Category: Uncategorized

Hyvä Suomi! O Canada!

When looking at unique visitors as a proportion of population, this site is more popular in Finland and Canada than in the United States.

When looking at unique visitors as a proportion of population, this site is more popular in Finland and Canada than in the United States.

Very impressed with Singapore and New Zealand who punch above their weight. UK is second in overall volume. Honorable mention to Australia, Sweden, Norway and Switzerland.

It’s interesting to compare this list with Newsweek’s ranking of the world’s best countries.

- Finland

- Switzerland

- Sweden

- Australia

- Luxembourg

- Norway

- Canada

- Netherlands

- Japan

- Denmark

- United States

- Germany

- New Zealand

- United Kingtom

The correlation is uncanny.

Why Eric Schmidt had to go: Google's innovation dilemma

Charles Arthur provides a convincing back-story to the Google exec re-shuffle.

Google shuffle: why Eric Schmidt had to be pushed from the top | Technology | guardian.co.uk.

There is evidence of execution failure and indecision or muddled messages to stakeholders. Shared leadership arrangements never end well.

But in this forum I’ve been critical of their strategy. Though I’ll be the first to admit that such criticism is not founded on data but on intuition, strategy is always made in a vacuum of data. It is just an unfortunate fact of life that we don’t have data about the future.

But what data we do have is about the past and it shows the contrast between Apple and Google.

As a sample, let’s look at the performance in the last quarter: Continue reading “Why Eric Schmidt had to go: Google's innovation dilemma”

Reminder: @asymco on Twitter

There are many thoughts which are not substantial enough to be posted as blog entries. There are also questions that need to be asked or answered which are not yet ‘baked’ enough to be cast into a permanently linked posting.

For these reasons and for the simple fact that it’s fun, I am using Twitter more frequently. Since I know not everyone has or wants an account, my twitter feed is now shown in the second (right-most) sidebar. It’s limited to the last eight tweets.

For those who would like to keep the discussion going in this new medium, my Twitter app (from the Mac apps store) is always running.

Knowing me, knowing you

Among the current (~1800) followers of Asymco on Twitter, about 1000 have published “Bios”. In the interest of me getting to know you (and you one-another), here is a list of the most common words present in reader bios: Continue reading “Knowing me, knowing you”

Poll: How would you like to get Asymco data?

I am preparing a productization of the data underlying the models I use. I am working with Timetric.com to build the product and we are considering several options for packaging and pricing/access.

The first question I have is about how readers would like to see the data. I put up a poll to the right.

More questions will follow.

Android is accelerating smartphone adoption

According to Morgan Keegan analyst Tavis McCourt Chinese consumers purchased 8 to 10 million smartphones last quarter–implying 400% growth from the 2 to 3 million last year.

How quickly things change. According to McCourt, Android now represents nearly 50 percent of smartphone volume in the country, up from zero last year. And Apple’s iOS, while a niche player with less than 500,000 iPhones sold last quarter, is ramping up quickly, thanks to the successful launch of the iPhone 4 in the country last month.

The growth of Android is far beyond what a single company can engineer. It represents the effect of uncoordinated and uncontrolled distribution. Google does not have to market, license or write contracts for Android. It also does not necessarily benefit from this work. It enables excess device manufacturing and distribution capacity to embrace browser-enabled devices. Continue reading “Android is accelerating smartphone adoption”

Stats update: Asymco reaches one million pageviews

I began writing in February of 2010 but I moved to my own domain in June. More than 95% of my traffic came after June 1st (during which time 284 articles were written.)

Since then 270,036 visitors came to visit 592,351 times and saw 1,063,355 pages. 65,331 stopped by more than once. 337,270 of the visits came because someone told them about Asymco. 27,113 visits came because a search engine sent them. 1,548 of those who came had something to say and they said 5,273 things. Over 2,500 asked to keep in touch.

Here is the less lyrical breakdown of that traffic as reported by Google Analytics:

1,063,355 Pageviews

270,036 Unique Visitors

- 269,167 New Visitors

- 65,331 Returning Visitor

592,351 visits

- 337,270 from referring Sites (56.94%)

- 227,277 direct traffic (38.37%)

- 27,113 from search Engines (4.58%)

Views by operating system (top ten of 25):

- Macintosh 433,624

- Windows 271,938

- iPhone 201,940

- iPad 102,870

- Linux 19,898

- iPod 14,033

- Android 12,191

- (not set) 3,954

- SymbianOS 1,399

- BlackBerry 1,196

5,273 comments from 1,548 readers

1042 Twitter followers

248 Facebook “Like”

Approximately 1000 active RSS feeds

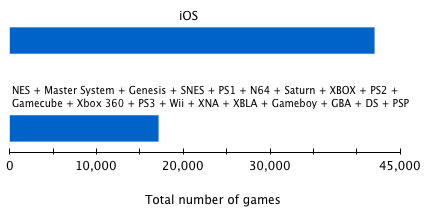

The staggering size of iOS's game collection

iOS has nearly three times more games than the previous twenty-five years of gaming combined.

via The staggering size of iOS’s game collection.

Most of the comments in the linked article complain that there is no filter for “quality” in the App Store. Contrasts nicely with the persistent criticism that Apple curates the App Store.

Is the smartphone a commodity?

People throw around the idea of things being or becoming “commodities” but there is little clarity about what “commodity” status implies.

If you look up the word, it has nothing to do with technology or innovation. In economics, a commodity is something that is substitutable (fungible) and roughly equal to competing versions of the same thing. A mineral good (oil) or agricultural product (pork bellies) is roughly of equal value regardless of where it comes from or who produces it. Commodities also have very liquid markets and are therefore easily priced according to demand.

Commodities have a “fixed” quality which cannot be and most likely never was improved. It’s a product that is essentially frozen in terms of innovation.

But in technology and especially in terms of complex, rapidly improving and evolving products with uneven distribution a commodity is not easy to identify and there can be a lot of arguing about what is and isn’t. Continue reading “Is the smartphone a commodity?”