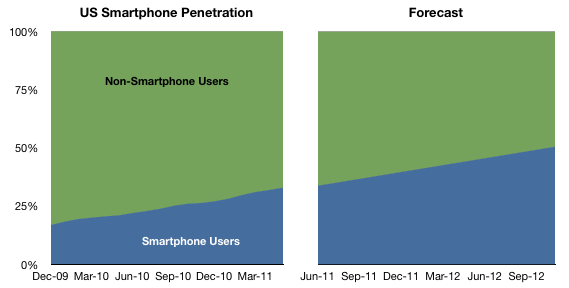

Windows Phone Marketplace has reached 25,000 apps. That’s an impressive figure given that so few devices have actually been sold. Compared with Android which is activating half a million devices per day, Windows Phone seems like a rounding error. According to Gartner, 3.6 million smartphones using a Microsoft mobile OS were sold in the first quarter of 2011, of which 1.6 million were Windows Phone 7. That implies a daily activation rate of 17,500 per day or one WP device for every 28 Android devices.

And yet the number of apps on Windows Phone is more than 10% of the number of Android apps and Android Apps are about half of iPhone apps. As far as Windows Phone is concerned, apps are being added faster than users. Why is this?

If we take the point of view that mobile platforms behave like the computing platforms of years gone by (i.e. Windows vs. Mac) then this is inexplicable. Developers should not be bothering with a distant third. This would be like betting on the Amiga in the era of Windows.

But we’re not in the PC era any more. That era had very high software development costs. It had very difficult software distribution channels (retail box sales typically) and very few categories of software with high price points. It was also dominated by institutional buyers which did not give quarter to small vendors. It was also a time when there were orders of magnitude fewer users and even fewer buyers.

The post-PC era is characterized by an explosion of ideas and application of new talent to software. It’s an era of immediate gratification and painless, one click distribution. App production is a cottage industry not something entrusted to only a few experts or those who can raise venture capital. It allows the small to distribute widely and get a shot at stardom. It has been (thankfully) avoided by enterprise buyers. The result is an explosion of apps: well over half a million new apps have been built in three years on three platforms that did not exist three years ago.

So the very reasons which are driving developers to spread their bets across all and any new platforms should indicate the potential for new platforms and the sustainability of small platforms. The thesis that one dominant platform wins the mobile “war” is naive. The post-PC era will be a multi-platform era. Developers already understand this. Platform vendors know this. It’s time to unlearn the lessons of the PC era.