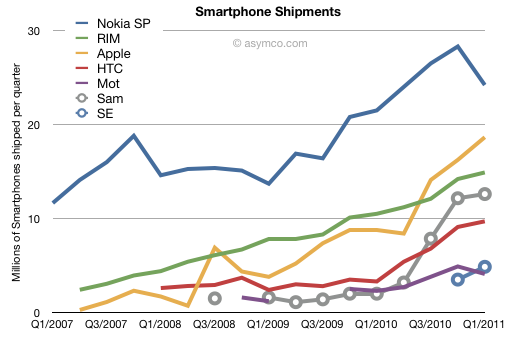

I’ve often said that the smartphone rising tide has lifted many boats. If you were selling smartphones during the last three years, your business was growing, no matter what phones you made.

In fact, measuring success and failure was a matter of deciding what growth rate was “not good enough”. Growing at 30% was nearly enough to shame some vendors into re-evaluating their strategies.

But that sort of tidal growth can’t last. At some point ships with holes begin to sink no matter what the tide brings.

When we look at the data from the last quarter, we should be asking again whether some ships have developed some leaks.

Continue reading “A rising tide does not lift leaking ships”