My thanks to Dan Benjamin for taking the time to chat and for preparing this program:

The Apple Growth Scorecard

Apple’s revenue for the first quarter was $24.7 billion, which at 83% was the largest quarterly revenue growth they ever experienced. Operating margin was an all-time high of almost $7.9 billion, representing 31.9% of revenue and yielding 95% EPS growth.

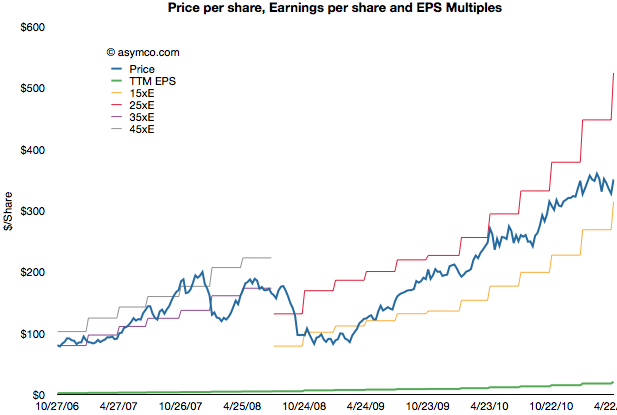

After earnings were announced the share price reached $350.7. This includes $70 in cash. Trailing twelve months’ earnings were $20.97. That makes the Price/Earnings ratio 16.7. Excluding cash, P/E is 13.4. The average growth over the past four quarters was 77%.

The following chart shows the share price vs. earnings. The green line is price and the blue line is share price. I also added multiples of the earnings to show how the stock traded in certain multiple bands.

During the period of 2006 to 2008 the company shares traded Continue reading “The Apple Growth Scorecard”

If Cash is King, Apple's is an Emperor [Updated]

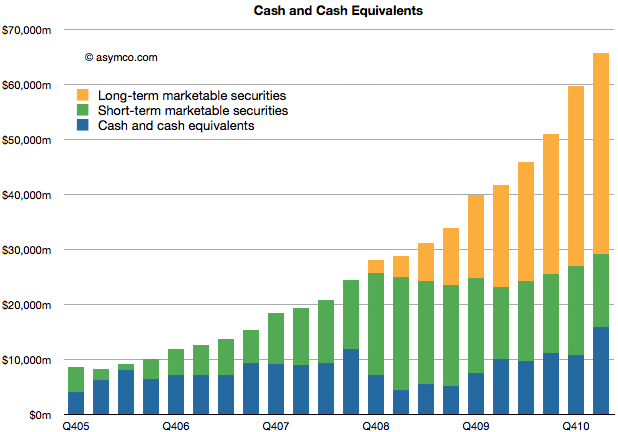

Apple’s cash for short-term and long-term marketable securities totaled $65.8 billion at the end of the March quarter. Cash increased by $6.1 billion.

The increase in cash is net of approximately $900 million for prepayments and capital expenditures related to the strategic supply agreements that Apple announced last quarter.

The following chart shows the historic cash, short-term and long-term liquid assets Apple holds.

As in previous quarters, the securities Apple holds are: Continue reading “If Cash is King, Apple's is an Emperor [Updated]”

The iPad slowdown and impact from the Japanese disaster

Tim Cook explains that there was no material impact from the Japanese disaster:

“Regarding our global supply chain, as a result of outstanding teamwork and unprecedented resilience of our partners, we did not have any supply or cost impact in our fiscal Q2 as a result of the tragedy, Continue reading “The iPad slowdown and impact from the Japanese disaster”

Estimates for Apple's third fiscal quarter (ending June)

Apple’s CFO guidance statement:

We expect revenue to be about $23 billion compared to $15.7 billion in the June quarter last year. We expect gross margin to be about 38%, reflecting approximately $55 million related to stock-based compensation expense. We expect OpEx to be about $2.5 billion, including about $255 million related to stock-based compensation expense. We expect OI&E to be about $70 million and we expect the tax rate to be about 25%. We are targeting EPS of about $5.03.

Apple Management Discusses Q2 2011 Results – Earnings Call Transcript – Seeking Alpha

Last quarter Apple guided revenue growth at an aggressive 63% with an EPS growth of 47%. They delivered 83% and 93% respectively.

They are now guiding about 47% revenue growth and 43% EPS growth and my current estimates are 65% and 72% respectively based on the following:

- iPhone units: 14.7 million (75%)

- Macs: 4.3 million (25%)

- iPads: 9.8 million (200%)

- iPods: 8.0 million (-15%)

- Music (incl. app) rev. growth: 25%

- Peripherals rev. growth: 25%

- Software rev. growth: 25%

- Total sales: $25.8 billion (65%)

- GM: 38.5%

- EPS: $6.02 (72%)

The biggest uncertainty remains iPad growth. This will be the first quarter where we can dial in a y/y growth rate. I’m being bullish with 200% because I believe the ramp for the iPad 2 may get sorted out. There are also more countries being opened up this quarter (13 this week).

Apple’s stock price to earnings ratio has dropped to 16.72. Ex-cash it’s 13.5. On a forward basis (my estimates) it’s 8.3. Apple’s valuation is now a case for business historians to discuss because I don’t think there are modern precedents.

A new era is only a new state of mind

The following interview was conducted by Bruno Ferrari a writer about technology for EPOCA, the weekly magazine of Organizações GLOBO, the largest Brazilian media company on March 30 2011. The article (published in Portuguese here) is an edited subset of the following exchange.

Q: In your analyses, you mention tablets as part of a new era, the “Post PC era”. Why do you think the PCs will be replaced by tablets?

This is not quite correct. Post PC does not mean the end of the microcomputer. The way to think about it is this: The stone age did not end because we stopped using stones. Same with the iron age and the industrial era. The era of jet travel did not end automobile or even ship travel (though that changed to recreation rather than transportation for passengers.) Each phase of technology does not fully replace its predecessor. It offers a new set of solutions and perhaps a slightly different way of solving old problems. We’ll still have PCs but we will use a new type of computer, an even more personal computer. The world still uses the microcomputer’s technological ancestors.

In terms of what new jobs will we hire the tablets to solve, they will vary greatly from what we used PCs for. Just like we used microcomputers for different things than we used time-shared minicomputers and mainframe computers. I expect social interaction, media consumption and entertainment will move from a PC to a tablet. New uses will emerge from the vast experiment that is the app phenomenon.

Q: What are the new ways to interact with machines? With gestures? How will this change the market? Continue reading “A new era is only a new state of mind”

Is Android responsible for Apple's deep market discount?

At last night’s closing price Apple was trading at a P/E of 16.3. Excluding cash that ratio was at 13. On a conservative forward basis (my estimates) the stock is priced at less than 10 times next twelve months’ earnings.

These figures show a remarkable pessimism that has persisted around Apple for years. It was slightly, but not much, worse during the great recession. It persisted whether the company was growing at 30% of, as now, 95%.

There are many hypotheses about why Apple’s earnings and growth are considered worthless. They come and go with the whims of the age: recession, elitist, luxury branding, health issues, macro “headwinds”, earthquakes, phantom competition.

Lately it’s become fashionable to blame Android. That’s a curious thing to me, because Android has been discussed at length here and it has been shown to be, for the time being, benign. Apple has not “lost sales” to Android as it has been selling all it can produce. In some ways it’s been a boon as a co-belligerent against non-consumption.

Continue reading “Is Android responsible for Apple's deep market discount?”

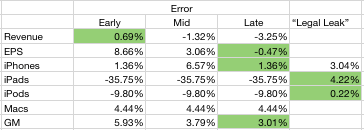

Apple Earnings: Evaluating my performance

As chronicled here, this quarter I went through three sets of estimates. This is a departure from my standard practice of sticking with one forecast made three months in advance. I felt last quarter was filled with materially important developments which deserved updating.

So how did I do?

I wanted to see if the additional information helped or hindered predictability so I put my three predictions side-by-side and measured the errors. I also added the “legal leak” from April 15th (published April 19th) to see whether it was an accurate predictor. The table below shows the error rates with the lowest error highlighted.

Continue reading “Apple Earnings: Evaluating my performance”

Review of Apple's unit numbers released in legal filing prior to earnings

Thanks to Nilay Patel at This is My Next for posting the complaint filed on April 15th against Samsung by Apple which revealed some potentially material data about its performance in the last quarter (which won’t be public until the 20th).

On page 4:

“As of March 2011, more than 108 million iPhones had been sold worldwide”

“By March 2011, Apple had sold over 60 million (iPod touch) units.”

On page 5:

“By March 2011, Apple sold over 19 million iPads”.

These numbers are material because we know units sold prior to CQ1 and can derive the minimum units sold for these three product lines during Q1. Continue reading “Review of Apple's unit numbers released in legal filing prior to earnings”

iOS vs. Android: the tale as told by Wall Street

Yesterday I wrote about the growth in Android vs. iOS. The two platforms’ can be said to be enjoying healthy growth, though in markedly different patterns.

The consequences of this growth are being felt across the telecom and computing industries. There are almost 300 million platform devices in use today that were not even dreamed of three years ago. Operators are transporting petabytes more data and dozens of phone vendors are scrambling to meet demand. There are tens of billions of app downloads and hundreds of thousands of apps being sold by tens of thousands of new app publishers. There is a lot of hay being made while the sun shines.

But what about the poor saps that are funding the development? What about the shareholders of the companies behind these platforms. Are they being rewarded or punished?

The following charts tell the story: Continue reading “iOS vs. Android: the tale as told by Wall Street”