RIMM shares dropped more than 5% after hours after company reported “light” units and a 20% rise in profit with a 24% rise in revenue.

RIMM sold 11.2 million units (of which 4.9 million were new subscribers and the rest replacement units–a deterioration in replacement rate). This represents 43% growth. The unit growth is nearly double the revenue rise implying a lower ASP ($300–half the iPhone) and margin (45.4%).

RIM passed another milestone: 100 millionth BlackBerry was sold during the quarter. We’ve noted before that Apple will also pass its 100 millionth iOS device this month. RIM sold 20 million units as of October 2007, right on the heels of the iPhone launch. That means that iOS grew 100 million to BlackBerry OS growing 80 million in the same time frame.

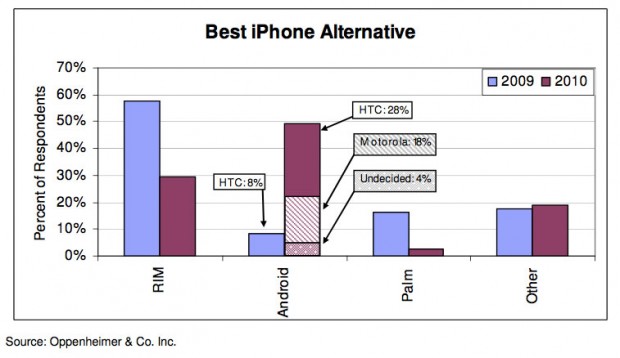

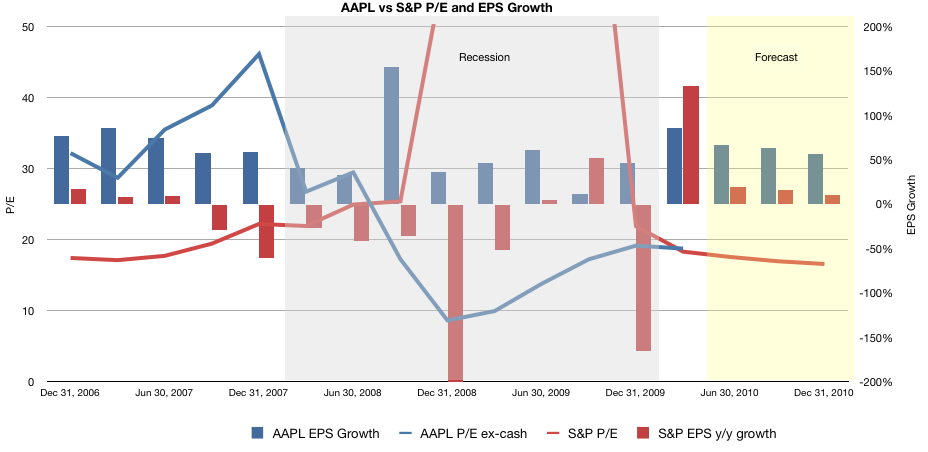

So why are shares at a P/E of 13? 20% EPS growth would be respectable numbers, but the smartphone market is growing faster than that. The implication is that RIMM is losing share and everyone is expecting that loss to accelerate.

Simona Jankowski from Goldman Sachs repeats her Sell rating. “RIM has now missed top-line expectations for three of the last four quarters, in our view demonstrating the building competitive pressures on its business from the iPhone and more recently from Android,” she writes. “We estimate that net subscriber additions in North America declined on a sequential basis, which we attribute primarily to the success of Android-based phones, such as the Motorola Droid and the HTC Incredible at Verizon.”

Research In Motion Limited (USA): NASDAQ:RIMM quotes & news – Google Finance.