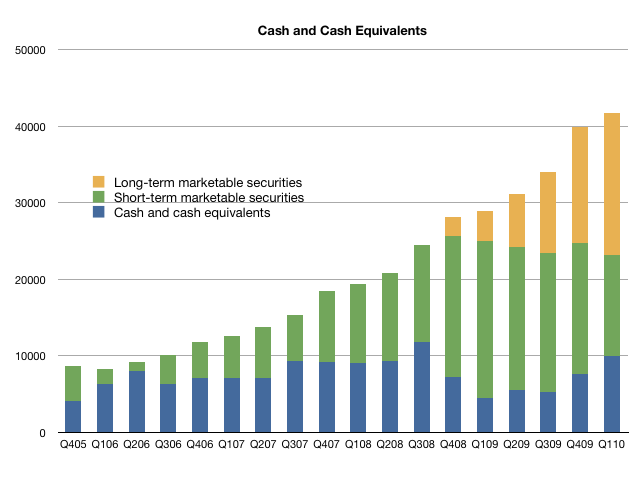

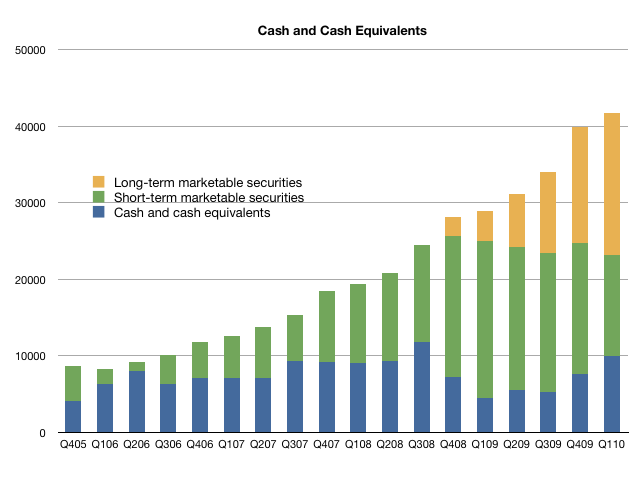

Apple’s cash continues to grow. This quarter it reached $41.7 billion, a sequential increase of $1.9 billion. This time last year, the cash was about $29 billion with a y/y increase of nearly $13 billion. This is equivalent to $45.19 per share.

Many financial sites report this figure incorrectly (e.g Yahoo finance with $24.8 billion) and are often cited by journalists. This error is because Apple holds much of its cash in “Long-term marketable securities” and some choose to report only “short-term” holdings as cash. Apple’s “Long-term” securities are the same as their “short-term” securities, namely US Treasury bonds. The distinction is in the maturation date, not their liquidity. Apple makes a clear statement of their cash position every quarter and highlights the composition of their holdings.

Note that more than one third of cash is currently in Long-term securities and exclusion of that item would indicate a decrease in Apple’s cash.

Note also that cash grows in a seasonal pattern. Q1 is typically the lowest growth, and Q4 the fastest.

The graph below shows Apple’s cash by security.