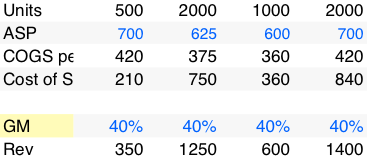

My ASP estimate is about $600 with COGS around $300. Additional costs of distribution of $60 will make 40% GM look reasonable over time.

Quarterly 2010 forecast in table above.

Quarterly 2010 forecast in table above.

HTC is the world’s fourth largest smartphone company. It ships 80% of all Windows Mobile and probably a similar proportion of Android devices. Like Microsoft in 2003, Google turned to HTC for its first smartphone, the G1 and its latest, the co-branded Nexus One. The company shipped a total of 11.7 million mobile phones in 2009.

HTC is the world’s fourth largest smartphone company. It ships 80% of all Windows Mobile and probably a similar proportion of Android devices. Like Microsoft in 2003, Google turned to HTC for its first smartphone, the G1 and its latest, the co-branded Nexus One. The company shipped a total of 11.7 million mobile phones in 2009.

It would appear that HTC is very well positioned in what amounts to be the best industry in technology.

However, not all is well. A few days ago HTC issued revenue guidance below analyst estimates and its stock price is at 2005 levels, 70% off its peak (see graph–source: Google finance).

Part of this could be explained by its continuing reliance on Windows Mobile which is fading fast, but also it’s because, as management acknowledged, there is significant price pressure.

HTC prides itself with having a “premier” product with typically high-end feature sets and positioning. HTC invested in its own UI to differentiate its products and has mounted a branding campaign to move away from being a white-label ODM.

It seems all for nought. The rules of the smartphone market do not favor modular component players. As HTC does not front its own OS, it still struggles to stand out in the eyes of the consumer.

Looking at the list of top 3 vendors: Nokia, RIM and Apple, we see hardware companies that field an integrated OS/service bundle.

It’s hard to compete against this.

It’s time to re-evaluate the categorization of smartphones. The term has always been problematic. It loosely means a phone that runs an advanced operating system and has third party SDKs. There is no industry standard definition and some call it a converged device or a multimedia device. One analyst famously said that the iPhone did not count as a smartphone on launch because it was not open to developers.

I’d propose a different definition, not based on the attributes of the device, but the jobs that the device is hired to do. This is in a way, the same distinction between Facebook and MySpace. They are clearly hired to do different things by their users and as a result don’t directly compete. When you do this job-based segmentation, you realize that iPhones, Android devices and Windows Mobile and Palm are fairly similarly used. Blackberry, however, does not match the profile. (Neither do most recent Symbian devices, though for different reasons.)

The most common jobs I can see in use with the first cohort of devices is (Comscore data exists to back this up)

The Blackberry has relatively poor utilization of any function except for email and perhaps social networking (though the latter is not likely in company-sourced devices). The focus on a large number of jobs to be done is what distinguishes smartphones from the more limited “feature phones”. By this logic Blackberry is hired as a “feature phone”.

It’s also instructive to follow commentary among enthusiasts. It’s fairly clear that this segmentation exists implicitly: Android, iPhone, Palm and WinMo are comparable while Blackberries are for a different demographic, different user, different usage.

Finally, there is the gut check. It’s become clear to me that what users do with Blackberries is similar to what they do with voice phones: voice and messaging. Although additional functionality is available, it hardly gets used because it’s hard to use.

But you may ask: so what? The reason this is significant is that smartphones are embryonic mobile computers with a clear trajectory for improvement. Feature phones are overshot voice phones which are likely to be disrupted by data-centric entrants.

On a different level, it also means that growth stats for the two product types are not comparable. Saying that the Blackberry is outgrowing the iPhone (or vice versa) is meaningless.

It also means that Blackberries, being an evolution of voice products, still have a huge growth potential with those customers which are looking for messaging as an improvement for their good enough voice products and for whom smartphones are over-serving.

A lot of thoughtful people, many of whom are bloggers, look at this history and say, “Look at this march of progress! Surely the desktop + windows + mouse interface can’t be the end of the road? What’s next?”

Then “next” arrived and it was so unrecognizable to most of them (myself included) that we looked at it said, “What in the shit is this?”

Highly recommended reading:

http://stevenf.tumblr.com/post/359224392/i-need-to-talk-to-you-about-computers-ive-been

What you’re seeing in the industry’s reaction to the iPad is nothing less than future shock.

Very good reading.

Fraser Speirs – Blog – Future Shock

Windows Mobile 7: we so dropped the ball in our early phone OS presence that now it seems like it’s a losing battle to have a dog in this fight. But WinMo7 is out there. To me, I can imagine this becoming like the Zune HD: well praised and all, but not making a dent in the market because everyone has already moved on to the iPhone platform.

David Worthington interviews Brandon Watson, “director of product management in the developer platform at Microsoft”:

Watson claimed that many developers of applications for the iPhone OS–which the iPad uses–are not making money. Developing applications for the iPhone and iPad is expensive, he said, because iPhone OS uses the Objective-C language rather than Microsoft’s more pervasive .NET platform. And Apple’s control over the platform has alienated some people that make software for its products, he said.

Now if we can get the Grand Poobah of Ovi to chime in, we’ll be all set.