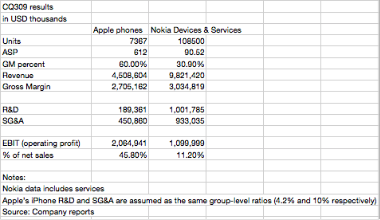

Peter Oppenheimer, Apple’s Chief Financial Officer, said that the Average Selling Price of iPhones in the quarter “was just over $600. This reflects both high mix of 3GS sellthrough and benefits of rebalancing the ending channel inventory toward the 3GS.”

An astonishing admission from Apple who has never revealed their iPhone ASP. Previous analyst estimates had the iPhone ASP at $550. If this is true, then Apple has violated one of the cardinal mobile industry rules: “Thy ASP shall always erode”. Given what is known about the components, iPhone gross margin is likely to be above 50%. The gross margin, or what you are able to capture in value above the bill of materials, isthe primary indicator of value creation in the device business. Apple’s number is astronomical vis-a-vis the competition. Stay tuned as this gets scrutiny.